This Monday, geopolitical worries are driving up gold prices on the XAU/USD. Spot gold is trading around $1840, up 0.29% on the day as tensions between Russia and Ukraine escalate. UK and US embassy staff in Ukraine have been told to leave the country, spurring a flight to safety.

Gold prices are also being monitored to see the response towards the Fed’s Wednesday meeting. Goldman Sachs is warning that the Fed may raise interest rates in all its remaining meetings sparked some market attention. However, the accompanying rise in US bond yields did not produce lower demand for the non-yielding metal.

Other triggers that could spark movements in gold prices are the US GDP report (advanced) and the Fed’s inflation metric, the Core PCE Price Index number.

Gold Price Outlook

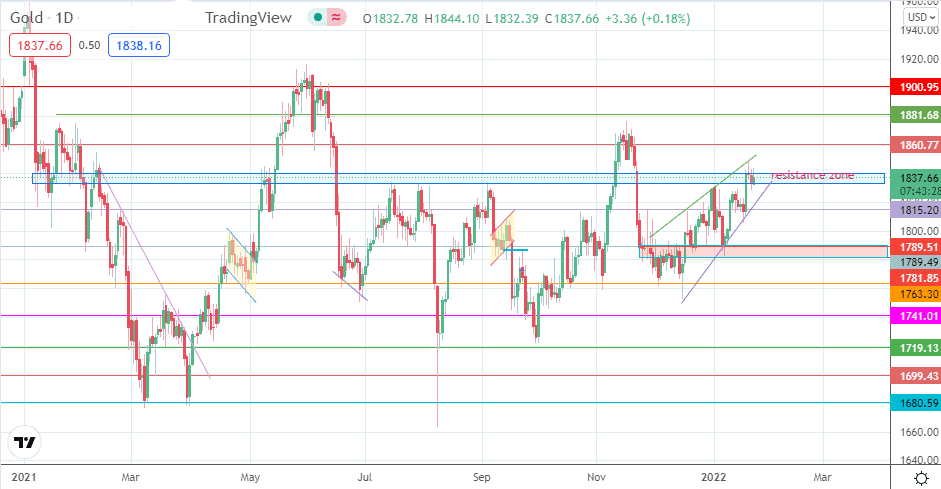

Gold price is trading in the 1828/1840 resistance zone. It is also approaching the upper edge of the rising wedge. A decline from this area targets the 1815.20 support level, where the lower border of the wedge is located. The breakdown of this support completes the wedge pattern’s expected move, targeting 1789.49 in the first instance. 1763.30 and 1741.01 are additional price targets to the south.

On the flip side, a break above the 1828/1840 resistance zone opens the door towards the 1860.77 resistance. 1881.68 and 1900.95 are additional targets to the north.

XAU/USD: Daily Chart