Silver price activity showcased additional selling on Wednesday and headed dangerously towards new YTD lows below $22 as a stronger greenback and rising bond yields put pressure on non-yielding metals.

Also putting pressure on the white metal ahead of China’s manufacturing PMI data for September are reports of a power supply crisis presently enveloping China, the world’s largest industrial metals consumer.

Goldman Sachs and Nomura bank have revised their China economic growth projections lower. With the markets also expecting a marginal drop in the CFLP’s manufacturing PMI data early Thursday, industrial metals such as silver are struggling.

Silver price on the XAG/USD chart is down 1.4% as of writing.

Silver Price Outlook

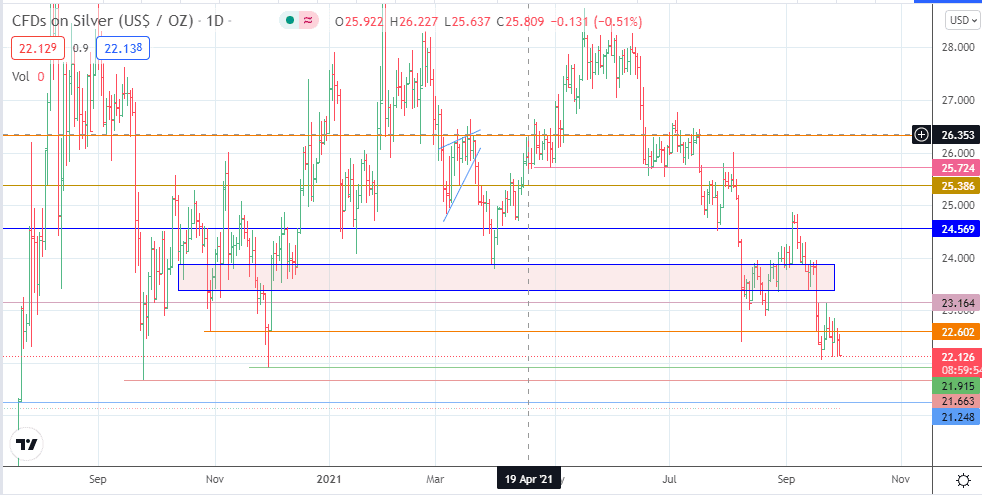

The decline in silver price looks set to test the lows of 30 November 2020 at the 21.915 price mark. If this support is taken out, the next downside target comes in at 21.663 (24 September 2020 low). The bears have to push prices below this support level before 21.248 comes into the picture.

On the flip side, bulls must overcome the resistance barriers at 22.602 and 23.164 before taking on the resistance zone at 23.367/23.872. Only when the bulls overcome the obstacles at this zone and the 24.569 can the price activity have a chance of retaking 25.386 or 25.724.

Silver Price Chart (Daily)

Follow Eno on Twitter.