The GBP/USD has soared this Thursday after the Bank of England (BoE) responded to Wednesday’s steep jump in inflation by raising the interest rates for the first time in three years.

The BoE acted to raise interest rates in the UK from 0.1% to 0.25% after annualized inflation (headline and core) rose to 10-year highs of 5.1% and 4.0%, respectively. The market had predicted an inflation rise by 4.7% (headline) and 3.7% (core).

The decision was a market surprise, as the onset and rapid spread of the Omicron COVID-19 variant and subsequent restrictions were expected to stay the apex bank’s hand. But with inflation rising to multi-year highs ahead of the Christmas shopping season, the BoE decided to take action.

The GBP/USD is up 0.57% on the day, after leaping 62 pips in response to the news.

Technical Outlook for GBP/USD

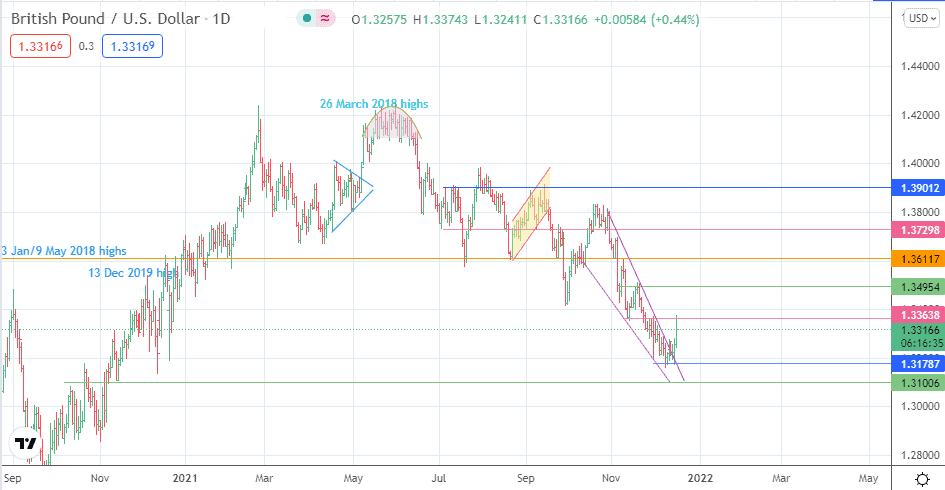

The day’s advance confirms the breakout from the falling wedge on the daily chart. This move is now testing resistance at the 1.33638 mark (12 November low and 29 November high). If the bulls uncap this level, 1.34954 becomes the new target, with 1.36117 and 1.37298 lining up as additional price targets to the north.

On the flip side, rejection at 1.33638 puts the pair under pressure, with 1.31787 lining up as the immediate target to the south. The 13 November 2020 low at 1.31006 serves as an extra downside target for the bears.

GBP/USD: Daily Chart

Follow Eno on Twitter.