European stocks are back with a vengeance after years of stagnation. They are outperforming their American peers, as you can see in the chart below. The German DAX index has soared by 8% in the past 30 days while in the UK, the FTSE 100 has soared by 5% and moved to its all-time high. This trend is also seen in other European countries like Spain and France, where the IBEX and CAC 40 indices have soared. At the same time, the EUR/USD exchange rate has surged by over 12% from its lowest point in 2022.

Why are German stocks soaring?

German and European stocks have surged for three main reasons. First, the European economy has emerged from the Russia-Ukraine crisis at a better shape than expected. For the most part of 2022, the consensus was that the region would struggle because of the energy sector. Instead, data published recently showed that the economy avoided a recession in the third quarter, as it was supported by the services sector.

Second, the relatively warmer winter has invalidated concerns that Europe would freeze to death. European natural gas prices have continued dropping in the past few months. According to Bloomberg, gas prices have had the strongest weekly losses since 2020. Most analysts were expecting that prices would surge to record highs after Russia decided to cut supplies. Instead, the United States and other Middle East producers have shipped loads of LNG to the region.

Third, the DAX index has soared because of the rising possibility that the European Central Bank (ECB) and the Federal Reserve will start their pivot soon with inflation easing. Data published last week showed that the European inflation dropped slightly to 9.2% in December of 2022. While inflation remains high, there is a likelihood that it has peaked. As such, while more ECB rate cuts are expected, I suspect that the pace of hikes will be much lower this year.

Finally, European stocks, including the DAX index have jumped as investors buy the dip. For a long time, the view was that European equities were exceptionally undervalued. The German DAX has a PE ratio of 12.1x, which is significantly lower than the S&P 500 average of 17. Nasdaq 100 index has a PE multiple of 23.24.

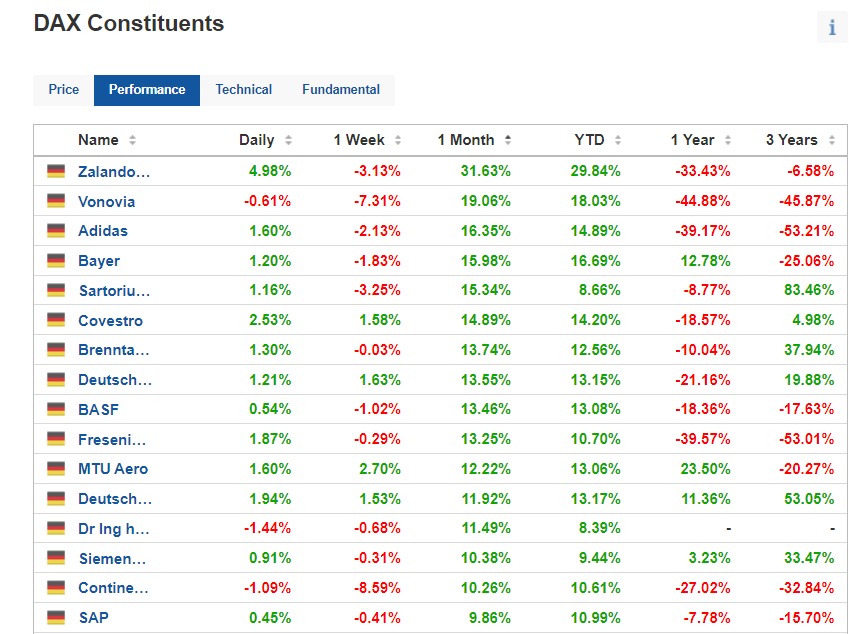

DAX index constituents’ risers and fallers

A closer look at DAX index companies shows that more than 90% of them have been in the green in the past 30 days. Zalando, the loss-making e-commerce company, has seen its stock surge by 31% in the past 30 days and 29% year-to-date. The shares have jumped following years of underperformance having fallen by 33% in the past 12 months.

Vonovia, the giant real estate company, has had its stock surge by 19% in the past 1 month and by 18% this year. The firm has an attractive 8% dividend yield as it manages over 550k residential units. Adidas stock has surged by 14% this year helped by China’s reopening while Bayer has jumped by 16% due to an activist investor, as I wrote in this article.

So, will the DAX index continue rising? Based on the concept of trend-following, as I noted here, the index could continue rising in the coming months. If this happens, the next key level to watch will be at 16,000 euros.