The USD/TRY exchange rate has gone nowhere in the past few months. It has been stuck at a narrow range as it sits near its all-time high. The pair is trading at 18.61, which is a few pips below its all-time high of 18.80. In 2022, the Turkish lira has plunged by over 80% against the US dollar. Similarly, the GBP/TRY and EUR/TRY have also maintained their bullish view.

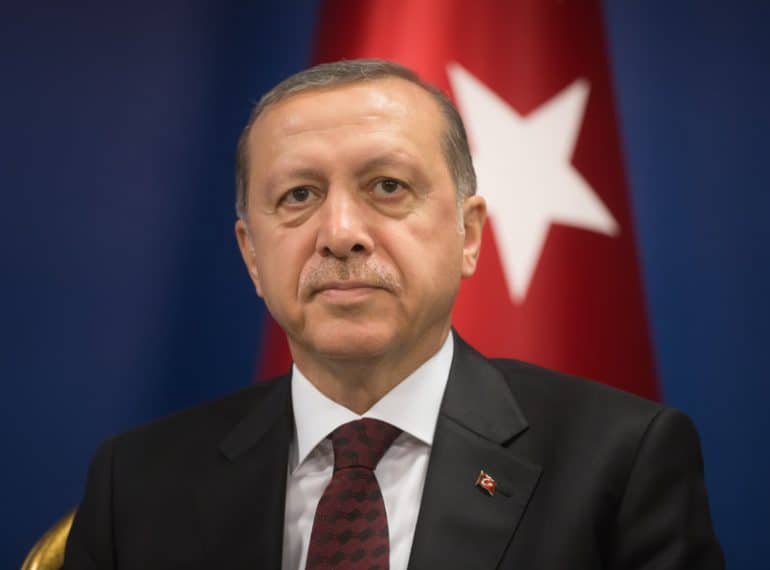

Turkish lira performance amid hyperinflation

The USD/TRY price has been in a consolidation phase as investors react to the ongoing divergence between the Federal Reserve and the CBRT. In the United States, the Federal Reserve has led the way in tightening. It has hiked interest rates by 400 basis points this year and embarked on a quantitative tightening process. It has reduced its balance sheet by over $375 billion in the past few months.

The CBRT has taken a diverging path even as consumer and producer inflation jumps. It has slashed rates by 300 basis points this year. And analysts expect that rates will keep coming down as Turkey prepares for an election in June next year. The impact of these rate cuts has been felt in Turkey, where hyperinflation has set in. Official numbers show that Turkey’s inflation has surged to over 86%.

On a positive side, some sectors of the Turkish economy are doing well. The deteriorating lira has made it cheaper for exporters. Similarly, the crucial tourism sector has staged a strong recovery since it is now cheaper for foreigners with USD in Turkey.

The next key catalyst for the USD/TRY price will be the upcoming American retail sales data scheduled for Wednesday. Still, the impact of these numbers on the US dollar will be limited since most analysts expect that the Fed will start slowing its rate hikes in December.

USD/TRY chart prediction

The daily chart shows that the USD to TRY exchange rate has been in a tight range in the past few months. It has remained slightly below the important resistance level at 18.80. As a result, it is consolidating at the 25-day and 50-day moving averages while the Relative Strength Index (RSI) has moved to the neutral point.

Therefore, the USD/TRY price will likely remain in this range this week unless something material happens.