The USD/CHF pair tilted lower on Thursday morning as investors reflected on the upcoming interest rate decision by the Swiss National Bank (SNB). The decision comes a few hours after the Federal Reserve delivered a relatively hawkish decision. The USDCHF is trading at 0.9242, which is slightly below this week’s high of 0.9295 while the EUR/CHF is trading at 1.0432.

The SNB will conclude its two-day meeting on Thursday. This decision comes at a time when the country’s economy is doing relatively well. Inflation has risen slightly while the unemployment rate has slipped to about 2.5%.

Therefore, in theory, the SNB has reasons to sound hawkish. However, in reality, there is a likelihood that the bank will hold steady. For one, the government (SECO) has already downgraded its economic forecast for the year because of Omicron and supply chain disruptions.

At the same time, the SNB believes that the Swiss franc is overvalued. For one, it has risen close to a five-year high against the euro. Therefore, sounding a bit hawkish could push the EUR/CHF pair lower.

EUR/CHF forecast

The four-hour chart shows that the EUR/CHF pair has been in a bearish trend in the past few weeks. It has formed a descending channel that is shown in black. Recently, however, the pair has risen and moved slightly above the upper side of the channel. The pair has also moved slightly above the 25-day and 50-day moving averages while the MACD indicator has moved slightly above the neutral level. It also seems to be forming a double-top pattern.

Therefore, the EURCHF pair will likely retreat after the ECB and SNB decision. If this happens, the pair will likely retest the chin of this double-top at 1.03.

USD/CHF forecast

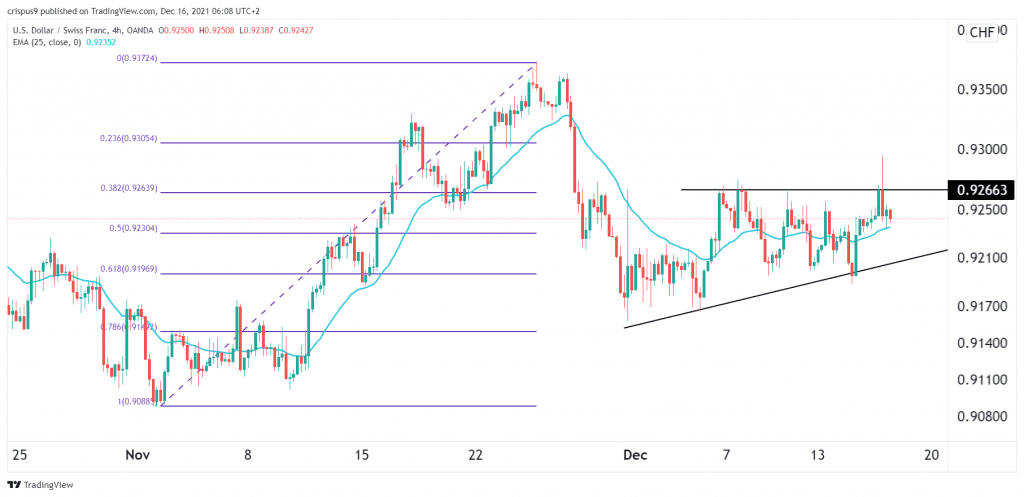

The four-hour chart shows that the USD/CHF pair has moved sideways in the past few days. The pair is trading at 0.9243, which is slightly below Wednesday’s high of 0.9295. The pair has moved slightly above the 25-day moving average and is between the 50% and 38.2% Fibonacci retracement level.

Therefore, the USDCHF price will likely resume the downward trend as bears target the lower side of the ascending trendline. This could see it drop to about 0.9200.