The Reliance Industries share price has held steady in the past few weeks as investors cheer the company’s performance. The RELIANCE stock is trading at 2,595, about 20% above the highest level since March 8th this year. It has risen by over 36% in the past 12 months and 300% in the past five years, making Mukesh Ambani the second-richest person in India with a net worth of over $97 billion. He is second to Gautam Adani, the founder of Adani Group.

Reliance Industries is a large conglomerate with stakes in some of the leading industries in India. It is an energy giant that explores and produces oil, gas, and coal. It is also a leading refiner and marketer of products. The company has made entries into the clean energy industry by acquiring lithium battery assets in the past few months. It plans to invest $10 billion in clean energy in the coming years.

Reliance Industries is also a leading company in the textiles, retail, and telecommunication industries. Its retail division has become incredibly popular as it aims to defeat giant American companies like Amazon and Walmart. It operates about 12,711 stores and employs thousands of people. But, most importantly, Jio has become its crown jewel, valued at about $110 billion after receiving $24.8 billion in investments from the likes of Google, Facebook, and Qualcomm, among others.

The Reliance Industries stock price has jumped as investors cheer the recent prices of energy products. Coal, crude oil, and natural gas have all jumped because of the ongoing crisis in Ukraine and the fact that India has embraced a neutral stance. Also, it has rallied as the Indian central bank has embraced a more dovish tone.

Reliance Industries share price forecast.

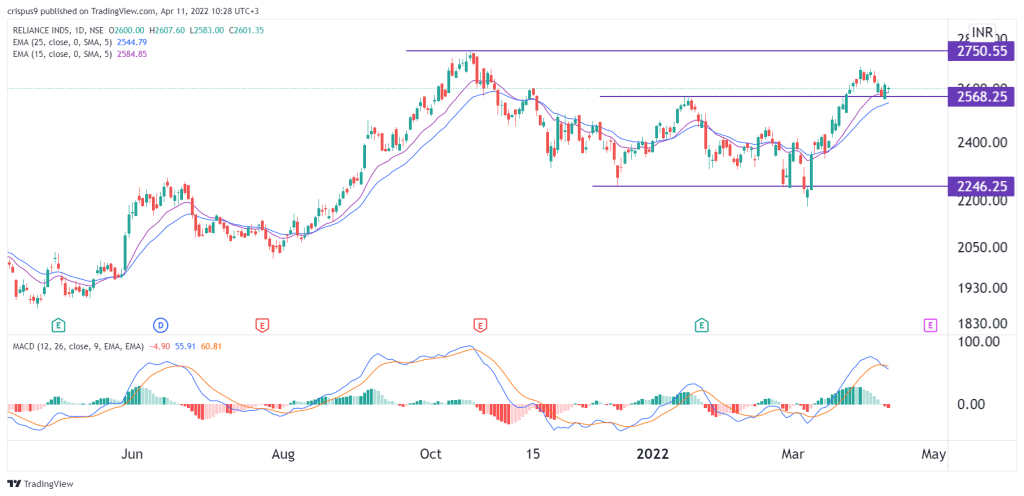

The daily chart shows that the Reliance Industries stock price has been in a strong bullish trend in the past few weeks. The shares have managed to move above the important resistance level at 2,568, which was the highest level on January 18th. The stock has also done what is known as a break and retest pattern by coming back to this support level. A break and retest is usually a bullish sign. In addition, it remains above the 25-day and 50-day moving averages.

Therefore, there is a likelihood that the Reliance share price will keep rising as bulls target the all-time high of 2,750. On the other hand, a drop below 2,450 will invalidate the bullish view.