The Nikkei 225 index has been under pressure in the past few days as Japan’s governments implement measures against the new Omicron variant. The index has fallen in the past four consecutive days and is trading at the lowest level since October. It is trading at ¥28,412, which is about 7.45% below the highest level this year.

Japan stocks are falling as the market reflects on the new measures the government is taking against Omicron. In a statement, the government announced that it was increasing its alert level to the highest level.

This happened even as the government locked its airspace. No foreigners will be allowed to the country in the next few weeks as it assesses the situation. This means that the country will struggle to stage a strong recovery going forward.

Nissan Motor Corp was among the worst performers in the Nikkei 225. The stock dropped by more than 2% as the company launched a $17 billion plan for electric vehicles. Other laggards in the index were Mitsubishi Motor, Yamaha, and Sumitomo Electric. On the other hand, the top performers in the Nikkei index were Nikon, Chiyoda Corp, and Olympus.

Nikkei 225 forecast

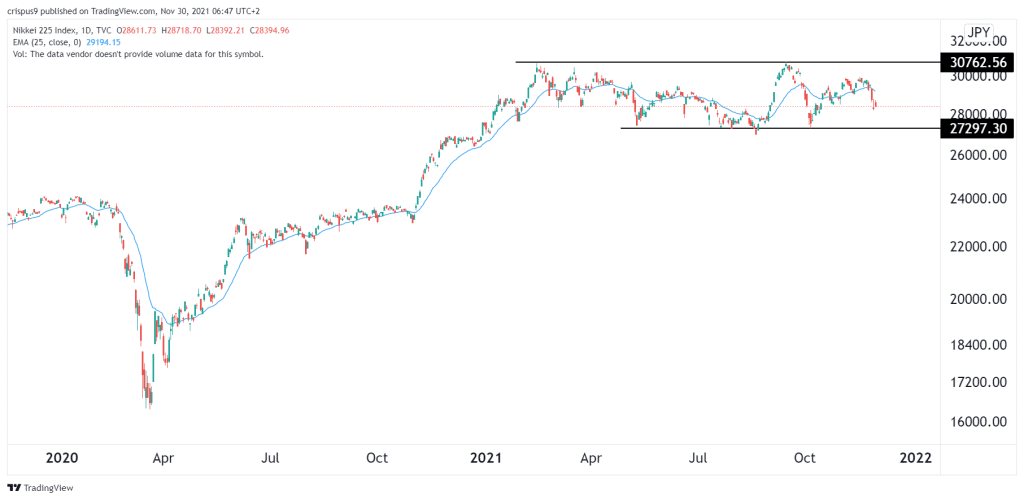

The daily chart shows that the Nikkei 225 index has been in a tight range in the past few months. The index has struggled moving above the key resistance at more than ¥30,700. It has also found some support at ¥27,297. This price is slightly below the 25-day moving average.

Therefore, with volume retreating, there is a likelihood that the index will continue falling as bears target the key support at ¥28,000. On the flip side, a move above the key resistance at ¥29,000 will invalidate this view.