Dow Jones futures are in the red once more and the market is showing real concern at this level. Last week’s rout in the Dow and Nasdaq highlighted the lack of liquidity on the downside and dip buyers could find themselves in trouble in the weeks ahead.

The only economic release of note this week is the core CPI inflation on Friday, but the market is ripe for profit-taking after seeing big gains from the mid-March panic selling. The big driver of stock market gains has been in the large tech stocks, with the Dow Jones lagging behind in the early stages. The recent story regarding Softbank’s buying of call options in momentum stocks has many traders concerned that the most recent gains in stock indices are based on speculative activity.

In the United States, there are now only two months until the election and we have to consider the potential for profit-taking by foreign investors. U.S. ETF flows have seen 10 billion of inflows in the last week and this brings the year to date figure to almost $300 billion for the year. This figure doesn’t account for the big retail flows on platforms such as Robinhood. With all of the retail investment we have seen, the market is running out of buyers as professionals question the valuations and that leaves the market ripe for a sell-off.

The markets have been complacent since the mid-March lows but coronavirus cases are rising in Europe so we cannot rule out the potential for further lockdowns as the flu season gathers pace in September and October. Stock investors should count their blessings and take some profits at these levels. The downside risks far outweigh the upside potential at present.

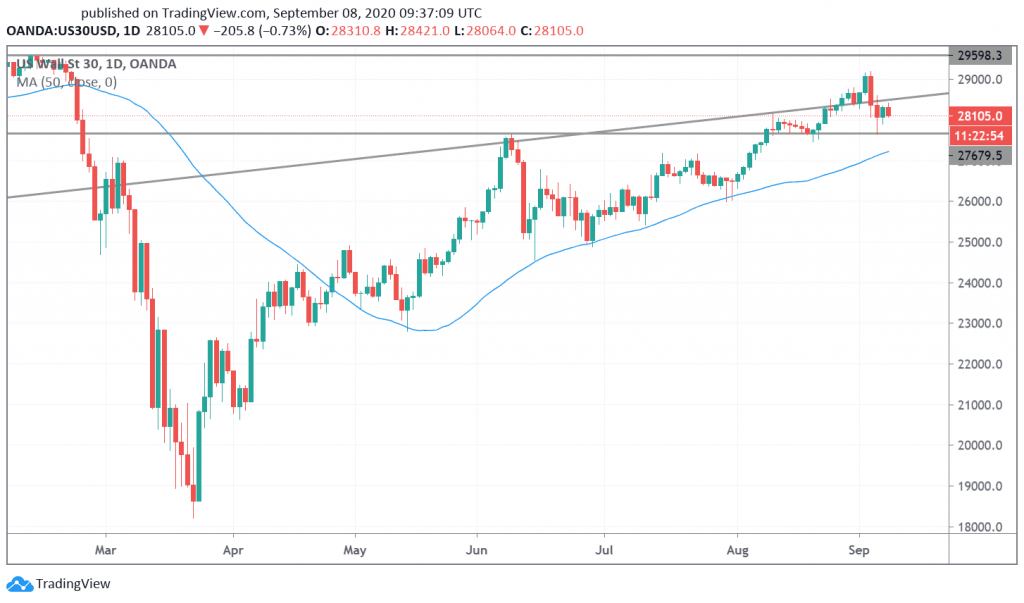

Dow Jones Technical Outlook

Futures on the Dow Jones index are 200 points lower and the index is moving lower from key resistance at the uptrend line which proved stubborn in March and June. First support comes in at 27,700 and below that level opens up a move to 26,000. 29K is the resistance level and stop losses should be placed above. The Investing Cube team is available for one-to-one coaching in the markets. Details are available here.

Don’t miss a beat! Follow us on Telegram and Twitter.

Dow Jones Daily Chart

More content

- Download our latest quarterly market outlook for our longer-term trade ideas.

- Follow Kevin on Twitter.

- Do you enjoy reading our updates? Become a member today and access all restricted content. It is free to join.