- Japanese conglomerate Softbank has been outed as the whale that has been buying huge options contracts in the Nasdaq 100.

Japanese conglomerate Softbank has been outed over the weekend as the “Nasdaq whale” that has been buying huge option contracts in tech stocks. Call options in companies such as Apple have seen extremely bullish activity as the rally in tech stocks has powered higher.

Softbank is headquartered in Tokyo and owns stakes in many technology, energy, and financial companies. It also runs Vision Fund, which is largest tech-focused venture capital fund in the world with $100 billion in capital. The company has been at the centre of controversy with the demise of WeWork, a company that focused on the business model of shared office space. The company’s plans for an IPO failed, seeing an 89% drop in its valuation.

The story of the Nasdaq whale has been breaking on several financial outlets and is based on Softbank buying up big stakes in companies such as Tesla and Apple. The company then jumped on the current bullish momentum in tech stocks to buy up large sums in call option contracts, which drove prices higher in the stocks, and supposedly brought large profits of $4bn for the firm. The news hasn’t impressed investors with the company’s share price down 7% in today’s trading. Investors will be concerned that the company is engaged in speculative activities.

The story is a concern for the current valuation for companies such as Apple and Tesla, which have rallied hard in the last months. Much of this buying has been by retail investors, who were also piling into stock options and the unmasking of the Nasdaq whale could end up being a story that marks the top in another tech stock bubble.

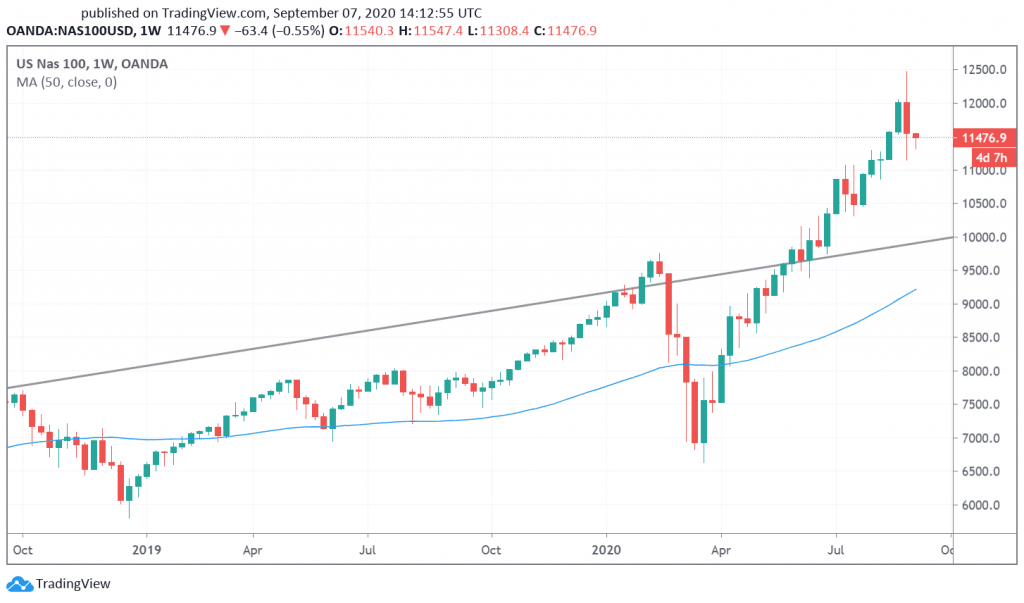

Nasdaq 100 Technical Outlook

Last week’s sell-off in the Nasdaq 100 has seen the price create a bearish engulfing bar, bringing the risk of further losses in the index. There is support at 10,500 but the channel breakout occurred at 10,000 and this is the likely target for a deeper correction with the 50 moving average at 9000. The rally from the March lows has been extremely steep and a pullback would give the price action a healthier technical formation. 12,500 is the resistance for the upside.