- Boeing incurs loss per share of $0.60.

- Delays in 787 Dreamliner and repair costs of $1billion to blame.

- Boeing share price has traded lower in 11 out of 12 sessions.

The Boeing share price continued on the downward streak on Wednesday after the company reported a loss of $132 million for the 3rd quarter of 2021. There was some improvement over 2020’s disappointing numbers for the same period under review, with the earnings per share of $0.60 beating the $0.14 predicted by analysts. Revenues rose slightly from $14.14 billion in Q3 2020 to $15.28 billion in Q3 2021. This improvement did not improve sentiment on the stock, which continues to be offered on Wednesday.

Losses arose from delays in deliveries of the 787 Dreamliner, considered integral to the company’s attempts to recover from the loss of revenue following the grounding of the entire 787 MAX. With the Boeing share price already facing pressure when the pandemic struck, a collapse of global aviation sent the stock further into the mire.

Inspections and structural repairs of the 787 Dreamliner have led to Boeing incurring $1billion in excess costs. A hundred jets are affected and now sit in inventory. Analysts say it may be another 5-6 months before deliveries resume.

The Boeing share price is down for the 11th session in 12, trading 1.27% lower on the day as of writing.

Boeing Share Price Outlook

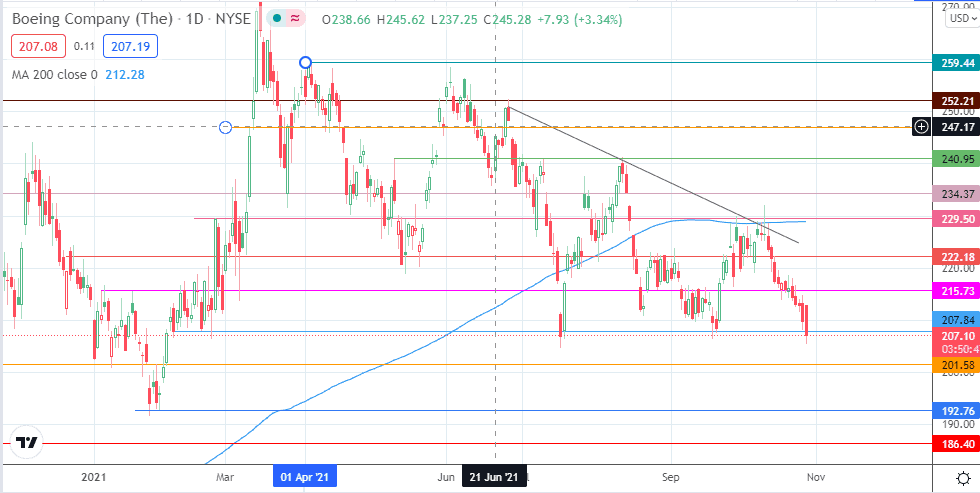

The active daily candle has violated the support at 207.84. A breakdown of this area allows the bears to push towards 201.58. Additional support appears at 192.76, where the price action hit a low on 1 February. 186.40 and 175.92 could become increasingly important barriers to the south if the price decline continues.

On the other hand, the bulls need to initiate a recovery bounce at the present level for a retracement rally to occur. Such a rally brings in 215.73 and 222.18 into the picture as initial upside targets. The 200-day moving average forms a dynamic resistance close to the 29 September high at 229.50. A break of this level also takes out the descending trendline resistance and allows for a recovery towards 234.37 and 240.95.

Boeing: Daily Chart

Follow Eno on Twitter.