Barclays share price has come under intense pressure in the past few weeks amid concerns about the UK economy and investment banking. The stock is trading at 151p, which is significantly lower than last month’s high of 173p.

Why BARC is struggling

Barclays is a global bank that has several divisions including consumer and business lending and investment banking. For example, its Barclaycard has a strong market share in the UK. Therefore, the company is facing numerous challenges.

First, there is the fact that the UK economy is staring at the worst economic crisis in decades. Recent data shows that the country’s inflation has surged while consumer confidence has dropped sharply in the past few months. Less confident consumers tend to avoid spending, which will affect the bank’s loan growth.

Second, and most importantly, Barclays is facing the challenge of its investment banking division. This year has become the most challenging year for investment banking as deal-making dries up. According to the Wall Street Journal, the volume of deals announced this year has tumbled by more than 80%. This has hurt companies like Barclays and Goldman Sachs.

Third, Barclays is contending with the performance of the housing market in the UK. The bank, which recently bought Kensington Mortgage, will likely see some challenges as the sector slows down due to the rising home prices.

Bank earnings season ahead

Still, Barclay’s has some positives. First, interest rates have risen, which will lead to a higher net interest margin. Analysts believe that the bank’s Net Interest Margin will rise to about 3%. This assumes that the Bank of England will hike rates to 1.75%.

Second, the British pound has dropped substantially in the past few months and is now trading at the lowest level since 2020. A weak pound is hurting the sterling that the company makes in the UK. However, unlike other banks like Lloyds and Natwest, Barclay’s has a lot of business in the US. As such, since the company reports in pounds, the stronger dollar will likely offset some currency issues.

Another thing that could benefit Barclays is its trading division which could report some growth in the quarter. The next key catalyst for the Barclays share price is the upcoming earnings by American banks like Wells Fargo, JP Morgan, and Citigroup. They will provide more information about the performance of the banking sector.

Barclays share price forecast

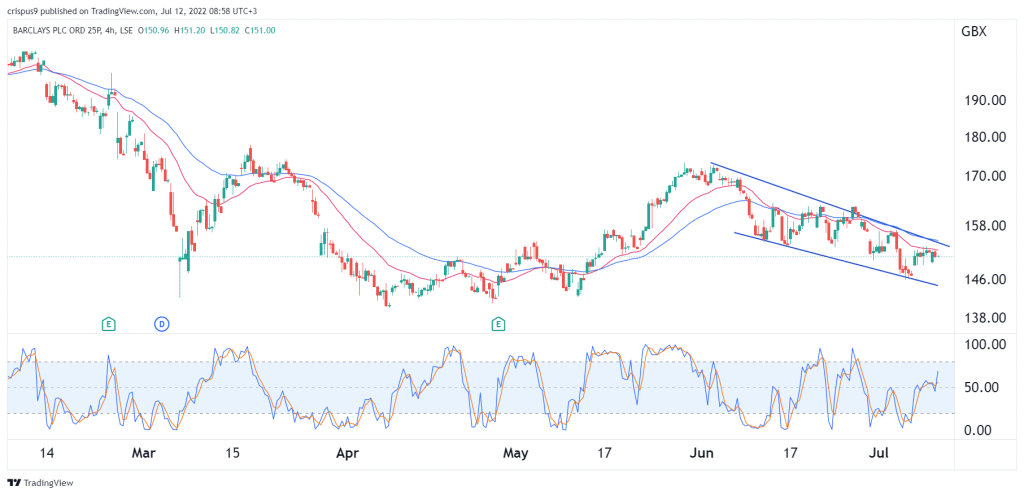

The four-hour chart shows that the BARC share price has been moving downwards in the past few days. Along the way, the stock has formed a bearish channel that is shown in blue. It has also moved below the 25-day and 50-day moving averages while the Stochastic Oscillator has move above the neutral point.

Therefore, I suspect that the shares will continue dropping this week as the bank earnings season kicks off. This could see it test the lower side of the channel at 145p. A move above 153p will invalidate the bearish view