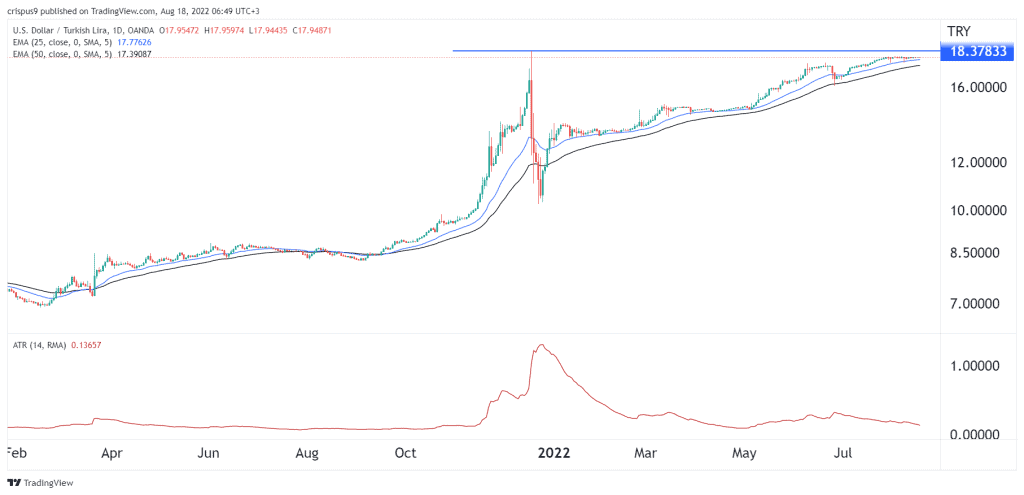

The USD/TRY price has moved sideways in the past few days. USD to TRY exchange rate was trading at 17.94 on Thursday, which was lower than the all-time high of 18.37. It has jumped by more than 70% this year, meaning that Lira is the worst-performing currency in the emerging market. The GBP/TRY and EUR/TRY have also rallied.

CBRT meeting ahead

The USD/TRY price will be in the spotlight on Thursday as the Central Bank of the Republic of Turkey (CBRT) concludes its meeting. Analysts believe that the CBRT will maintain its relatively dovish tone and leave interest rates unchanged at 14%.

The bank has become an outlier among global central banks by having a dovish tone even as inflation surges. Recent data shows that the country’s inflation has surged to almost 80%, making life terribly hard for everyone in the country.

At the same time, the policy actions by the CBRT have not helped to slow the Turkish lira crash. For example, the bank recently unveiled measures to slow loan growth momentum in the country. It also introduced state-backed accounts that shield savers from lira weakness.

Analysts believe that the CBRT could help to boost the lira without a rate hike. For example, the bank could hint that it will start hiking rates later this year or in 2023. In a note., an analyst at Bloomberg said:

“The bank sees this approach as a mediating move between the economic fundamentals warranting a hike and the political leadership calling for a cut. In reality, it is leaving inflation untamed and the currency unsupported.”

USD/TRY forecast

The daily chart shows that the USD to TRY exchange rate has made a strong recovery in the past few months and is sitting close to its all-time high. The pair is being supported by the 25-day and 50-day moving averages. The Average True Range (ATR), which is a good measure of volatility, declined to the lowest level in months.

Therefore, the pair will likely continue consolidating after the CBRT decision. A more dovish CBRT will see the coin rise to the all-time high of 18.37.