The Tesco share price is holding steady close to its all-time high as investors react to the recent strategies to boost its price. The TSCO stock is trading at 270p, which is a few points below its all-time high of 276p. The shares have risen by more than 48% this year.

What next for Tesco?

Tesco surprised investors last week when it boosted its profit outlook as the retail industry continues to face significant challenges. The company announced that its profit in the first half of the year jumped by about 16.6%. It also upgraded its profit forecast for the year to be between £2.5 and £2.6 billion.

It also announced that Tesco Bank had turned a profit for the first time in a while. At the same time, the company announced a £500 million share buyback as the management attempted to boost its share price that has lagged peers like Sainsbury and Morrisons.

The Tesco share price is also reacting to the latest GDP data from the UK. The numbers show that the country’s economy rebounded by 0.4% in August after contracting by 0.1% in the previous month. It rose bt 6.9% on a year-on-year basis, a sign that the economy is moving to its pre-pandemic levels. This is important for Tesco because of its role as the biggest supermarket in the UK.

Still, the company faces significant challenges ahead. For one, there are emerging Brexit issues that could lead to supply shortages. In a statement on Tuesday, Lord David Frost, the Brexit minister warned that the EU was making a “historic misjudgement” if it failed to rewrite the Brexit rules on Northern Ireland. If Brexit risks remain, the company could face supply shortages and higher import costs.

Tesco share price forecast

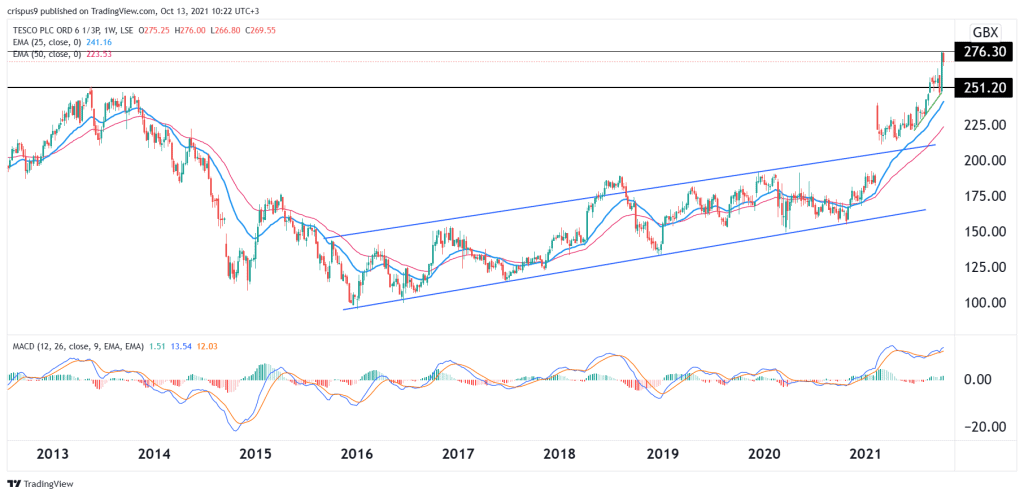

The weekly chart shows that the Tesco share price has been in a major bullish trend in the past years. Indeed, the share price has risen from 94p in December 2015 to the current 276p. Along the way, the stock moved above the important resistance at 250p, which was the highest level in May 2013. The shares also rose above the ascending channel shown in blue. It also rose above the 25 and 50-week moving averages.

Therefore, the stock will likely keep rising in the near term as bulls target the next key resistance at 300p. However, a pullback to about 251p cannot be ruled out as the stock forms a break and retest pattern.