The Royal Dutch Shell share price has struggled in the past few days as investors continue to reflect on the company’s earnings and the new activist investor proposals. The RDSB shares are trading at 1,658p, which is about 8% below the highest level last week.

What next for Shell?

Shell is one of the biggest oil and gas companies in the world. It has a total market capitalization of almost $200 billion and a presence in hundreds of countries. Shell operates across all sectors of the oil and gas industry. It has upstream, midstream, and downstream operations.

Shell’s management has worked relatively hard in the past few years to position the company well. For example, the company decided to sell its Permian Basin operations to ConocoPhilips two months ago. The transaction was valued at more than $9 billion, which was about $7 billion more than what the company paid for a few years ago.

Shell has also sold some of its unprofitable businesses. That has helped it to become a relatively lean company thar has relatively low debt. It has also become a leading player in renewable energy.

Yet, the Shell share price has lagged that of other supermajors like Exxon and Chevron. This is the situation that Dan Loeb, an activist investor who runs Third Point wants to solve. In a report published last week, he said that he hoped that the company will separate into two. One division will focus on renewable energy while the rest will focus on the relatively dirty business.

However, the company and some of its biggest shareholders like Abrdn have opposed the proposal. Still, there is a likelihood that the company will keep doing well in the near term as investors focus on the rising oil and gas prices and dividends.

Shell share price forecast

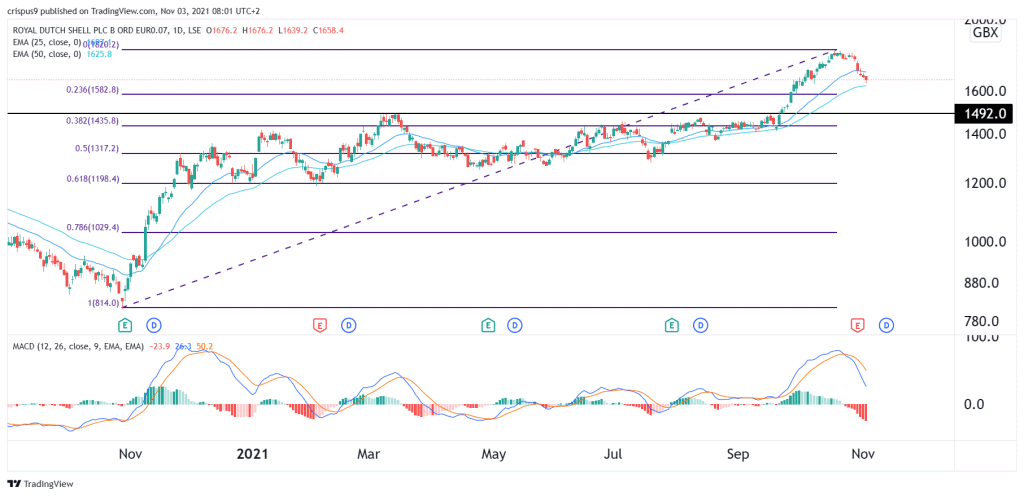

The daily chart shows that the Shell share price has been in a spectacular rally in the past few weeks. This growth saw the stock jumped to a high of 1,820p. The stock has given up some of those gains as the rally takes a breather. It has also moved below the 25-day and 50-day exponential moving averages (EMA). It is also approaching the 23.6% Fibonacci retracement level.

Therefore, for now, I suspect that the stock will keep dropping as bears target the 23.6% retracement level at around 1,600p. I then believe that it will resume the bullish trend and retest its YTD high at 1,820p.