The US dollar index (DXY) is in a strong upward trend today as traders react to the strong economic data from the United States. Last week, data from the country revealed that the country’s economy was in a strong recovery even as it battles the new wave of the virus. The dollar has gained by 0.15% against the Swiss franc (USDCHF), 0.12% against the Swedish krona (USDSEK), and 0.15% against the British pound (GBPUSD).

In addition to the strong data from the US, the dollar index is rising as tensions between the US and China emerge. In an interview conducted overnight, President Trump said that he would consider decoupling from China if re-elected. That would be a huge deal considering how interconnected trade between the two countries is. This statement followed news that the country was considering banning the biggest Chinese chip company. And in a statement earlier today, China accused the US of bullying as it launched its new data initiative.

Later today, the dollar index will react to the GDP data from Europe. Analysts expect the final reading of the data will show that the bloc’s economy contracted by 15% in the second quarter.

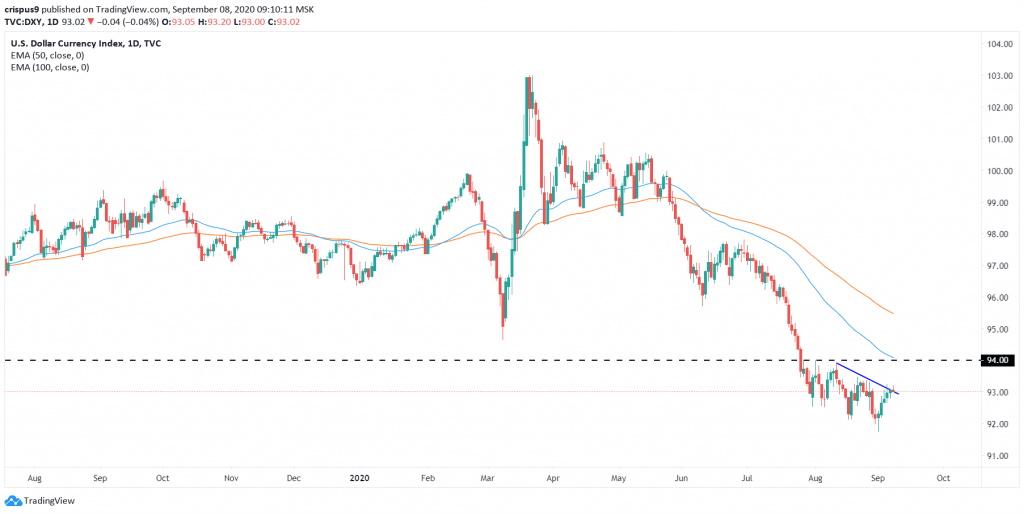

The daily chart shows that the US dollar index has gained in the past six consecutive days. It is trading at $93.00, which is slightly above the descending resistance that is shown in blue. The price remains below the 50-day and 100-day exponential moving averages. Therefore, there is a likelihood that the index will continue rising as bears now target the next resistance level at $94.00.

Elsewhere, Asian stocks rallied today as traders seemed to move on after the sharp contraction experienced last week. In Japan, the Nikkei 225 has jumped by 0.80% while in China, the Hang Seng and Shanghai Composite index have gained by 0.46% and 0.85%, respectively.

The same story is happening in Europe, where futures tied to the DAX index, FTSE 100 and Stoxx 50 are up by 0.18%, 0.47%, and 0.40%, respectively. The likely catalyst for European stocks performance is the upcoming GDP data and the ECB interest rate decision. Analysts expect that the bank will leave interest rates unchanged but possibly hint at more stimulus in the future.

In the United States, futures tied to the Dow Jones, S&P 500, and Nasdaq 100 are up by more than 1%, 0.76%, and 0.05%, respectively. This rally is possibly because of a new deal between Democrats and Republicans that will let the country avoid a shutdown. It is also because of increased demand by investors who are returning from their summer vacations.

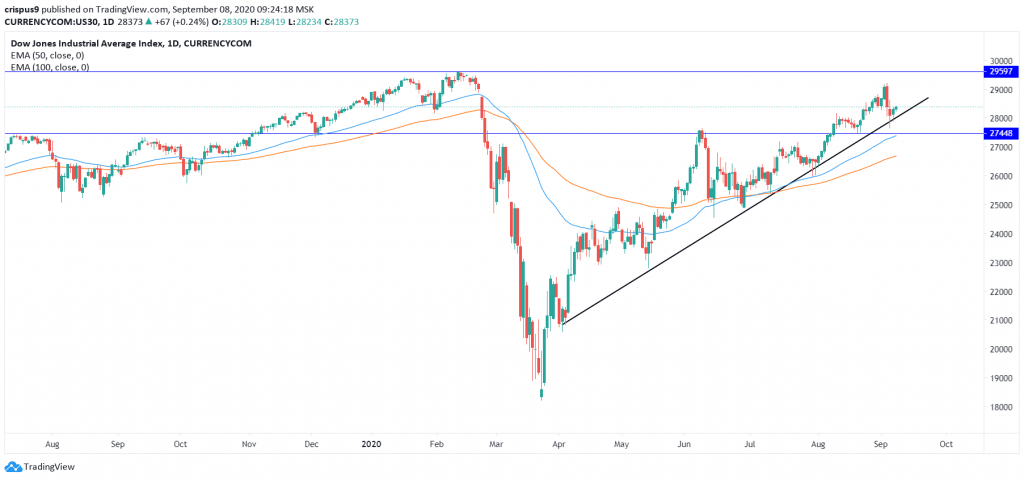

The daily chart shows that the Dow Jones futures are up for the second consecutive day. Interestingly, the price has failed to move below the ascending trendline that is shown in black. It remains above the 50-day and 25-day moving averages, meaning that a reversal has not yet happened. Therefore, the price is likely to continue rising as bulls aim for the resistance at $29,000.

Don’t miss a beat! Follow us on Telegram and Twitter.

Dow Jones Daily Chart

More content

- Download our latest quarterly market outlook for our longer-term trade ideas.

- Follow Crispus on Twitter.

- Do you enjoy reading our updates? Become a member today and access all restricted content. It is free to join.