The Asian session is one of the three prominent forex trading sessions. While most traders focus on the other two trading sessions due to their relatively high volume of forex transactions, there are great trading opportunities in the Asian session, especially if you know what currency pairs to trade.

Usually, it begins at 7:00 PM EST (00:00 GMT) and ends at 4:00 AM EST (09:00 GMT). Although significant financial hubs like Sydney, Hong Kong, and Singapore are included, market activity in the Tokyo financial markets is the main driver of this session.

| Feature | Details |

|---|

| Trading Hours | 11:00 PM – 8:00 AM GMT |

| Key Markets | Tokyo, Sydney, Singapore |

| Most Active Currencies | JPY (Japanese Yen), AUD (Australian Dollar), NZD (New Zealand Dollar) |

| Volatility Level | Generally low to moderate |

| Market Behavior | Price action tends to be range-bound unless major news breaks |

| Liquidity | Highest for Asia-Pacific currencies during this session |

| Best For | Scalping, short-term trades in JPY, AUD, NZD pairs |

| Impact on Other Sessions | Sets early sentiment and levels for London and New York openings |

| News Drivers | Economic releases from Japan, Australia, China, and New Zealand |

| Challenges | Limited momentum, risk of false breakouts, lower volume in non-Asian pairs |

Top Forex Pairs to Trade in the Asian Session

You are not confined to sluggish markets and limited possibilities if you trade during the Asian session. In actuality, several currency pairs, particularly those associated with the top economies in the region, perform exceptionally well during these hours. Here are the best pairs to watch if you’re involved in the Tokyo, Sydney, or Singapore Open:

USD/JPY

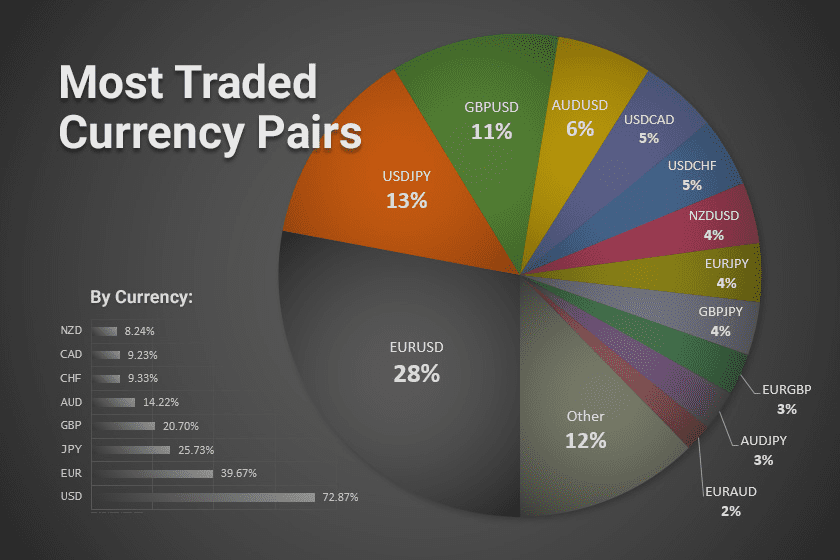

The yen is one of the most traded currencies in the world. Since Japan’s economy often makes headlines, USD/JPY typically sees clear price action and consistent volume. Traders who favor smaller spreads and technical setups love it.

AUD/USD

The AUD/USD often reacts to regional news, notably data releases from China, because of Australia’s significant involvement in commodities and trade in Asia. The pair is known for its smoother moves during Asian hours, which makes it a great option for short-term and swing traders.

NZD/USD

The New Zealand dollar still sees increased activity during this session. Its movements are influenced by dairy prices, RBNZ decisions, and broader risk sentiment in Asia-Pacific markets.

EUR/JPY

This cross pair combines European and Asian influences, making it more volatile than USD/JPY. It responds to both Japanese and European developments, and its price action during the Asian session can offer great intraday opportunities.

GBP/JPY

This pair is known for big price swings and strong momentum, even when the market is quiet. It tends to move more than most other pairs during the Asian session. That can mean more trading opportunities, but also higher risk, so it’s better suited for experienced traders who are comfortable handling fast moves. Risk management is key when trading this one in the Asian session.

While EUR/USD and GBP/USD are still tradable during the Asian session, they typically gain more momentum once London opens. If you’re focused on early activity and lower spreads, it’s the Asia-Pacific currencies that tend to offer the most reliable setups at this time.