The Hang Seng index has been in a strong downward trend in the past few weeks as concerns about the Chinese economy continue. The HSI index was trading at $20,000, which was about 35% below the highest level in 2021. It has fallen by about 11% from its highest point this year

China housing concerns

The Hang Seng index has struggled in the past few months as concerns about the Chinese housing market continue. The crisis escalated last year with the financial challenges that faced Evergrande, the second-biggest developer in the country. Other developers, including Hang Seng’s Country Garden, have all come under intense pressure.

The housing crisis escalated this week after China regulators instructed China Bond Insurance to provide offshore bond issuance by a few property developers. Some of the companies in this guarantee are Longfor Group and CIFI Holdings. As a result, shares of companies in the property sector like Country Garden surged after the announcement although challenges in the sector remains.

The Hang Seng index is also struggling as the number of Covid-19 cases in key cities soar to a three-month high. Some of the top cities affected are Hainan and Tibet. The country reported over 2,000 new infections for the fourth straight day. As such, there is a likelihood that the economy will continue struggling in the coming months.

Housing stocks were the best-performing stocks in Hang Seng. Country Garde, Longfor Properties, China Resources Land, and China Overseas jumped by more than 10%. On the other hand, Haidilao, China Resources Beer, CNOOC, and Xiaomi were the worst performers in the Hang Seng index.

Hang Seng index forecast

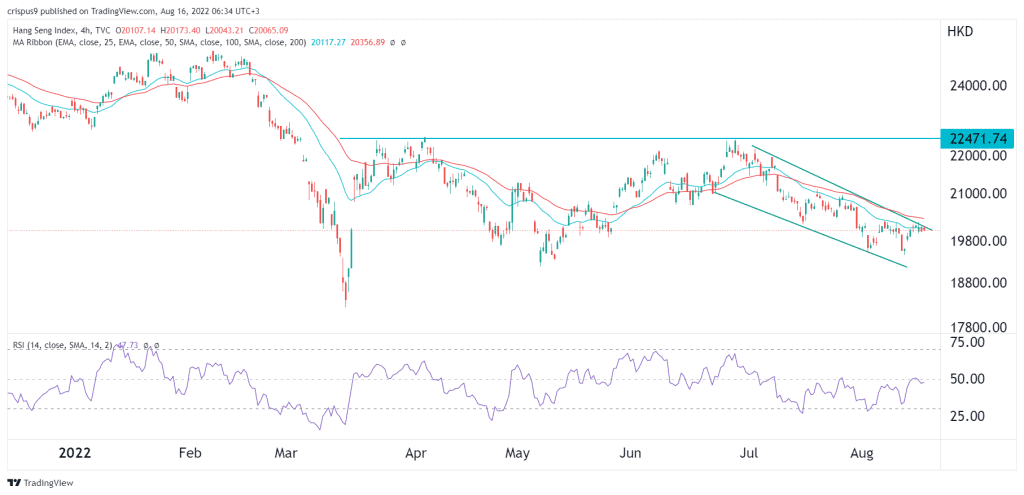

The four-hour chart shows that the Hang Seng index found a strong resistance point at $22,471, which was the highest point since March. The index then moved slightly below the 25-day and 50-day moving averages while the Relative Strength Index (RSI) moved to the neutral point at 50. The price is along the upper side of the descending channel.

Therefore, the index will likely continue falling as sellers target the lower side of the channel at $19,320. A move above the resistance level at $20,400 will invalidate the bearish view. This estimate is in line with the highly effective InvestingCube S&R indicator.