The EURUSD is up for the third straight day as traders reflect on the optimism by Christine Lagarde, the ECB president. The pair is trading at 1.1835, up from this week’s low of 1.1750.

In a statement yesterday, the European Central Bank (ECB) decided to leave interest rates and quantitative easing policies unchanged as most analysts were expecting. Furthermore, the bloc’s economy seems to be in a good place, with manufacturing and services PMIs bouncing back.

In her decision yesterday, the bank said that its policies, together with fiscal policies by governments had helped the region recover. As such, it committed to continue with easing policies until inflation rises and unemployment falls.

The EURUSD pair ignored the ongoing risks between the Eurozone and the United Kingdom. That is after the eighth round of talks between the two countries ended without a deal. Also, the two sides are on a collision path because of a bill by the UK that will intentionally break international law. In a statement yesterday, the EU said that it would sue to end the deadlock. It also received support from Nancy Pelosi, who ruled out a deal with the UK if it breaks international law.

Perhaps, the EURUSD is not reacting to the news because of the business dynamics between the two sides. While the UK sells more than 45% of its goods to the EU, the latter sells less than 5%. As such, the EU can afford a no-deal agreement. Also, there is a possibility that the EU will benefit more once companies in the UK moves to EU countries.

In a statement, analysts at ING said that they expect the EURUSD to continue rising, potentially to 1.2500. They wrote:

“With strong bearish dollar dynamics in place, it will be a very tough task for the ECB to tame the EUR/USD upside – which we expect to continue into next year and the pair to reach and potentially breach the 1.25 level in 2021.”

Those at Danske are also bullish on the EURUSD. They wrote:

“Thus, risks appear tilted to the upside in EUR/USD and next week’s Fed meeting will likely provide a test of 1.20 in spot.”

EURUSD technical outlook

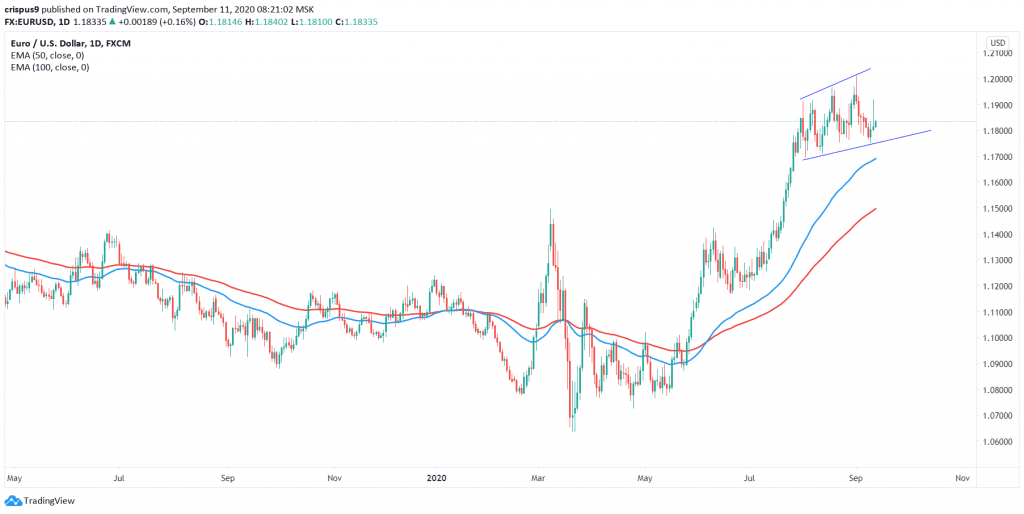

The EURUSD is trading at 1.1835, which is higher than this week’s low of 1.1752. On the daily chart, the price is above the lower support line that is shown in blue. It is also above the 50-day and 100-day exponential moving averages (EMA). This sends a signal that bulls remain in charge and that the price is likely to continue rising as they attempt to test the upper side of the channel at 1.2000.

On the flip side, a move below the lower line of the support will mean that there are still more buyers who will be keen to push the price lower.

Do you want to be an excellent trader? Register for our free forex trading course and one-on-one coaching by traders with decades of experience in the industry.

Don’t miss a beat! Follow us on Telegram and Twitter.

EURUSD technical chart

More content

- Download our latest quarterly market outlook for our longer-term trade ideas.

- Follow Crispus on Twitter.

- Do you enjoy reading our updates? Become a member today and access all restricted content. It is free to join.