Indian Rupee (INR) has been on a losing streak against the dollar over the past two weeks, but has largely retained gains made between early December 2023 and early March 2024. The USDINR currency pair has risen recently on sentiment surrounding the Federal Reserve interest rate decision. This has seen the USD/INR pair rise from 82.71 to 83.12 in the first 20 days of March 2024. In addition, the pair is currently above the 200-day SMA. However, that is still about 0.45% from the November 2023 highs of 83.47.

The constant interventions from the Reserve Bank of India have given the Indian rupee much-needed strength in the past few months. This has also kept the US dollar to Indian rupee exchange rate from rising above 83.50.

RBI Interventions Limit Indian Rupee Losses Against the Dollar

USDINR was in a general downtrend on the daily chart between early December 2023 and Early March 2024, as the Indian rupee enjoyed a stellar run against the US dollar. Multiple interventions by the Reserve Bank of India (RBI) helped keeep the rupee stable during a period when the dollar generally gained against major currencies. In October 2023 for example, the RBI’s interventions accounted for 17% of all forex trading value. That said, the Fed’s monetary policy is expected to retain high interest rates through the first half of 2024 as it pursues its target 2% inflation rate. This will continue exerting downward presssure against the rupee.

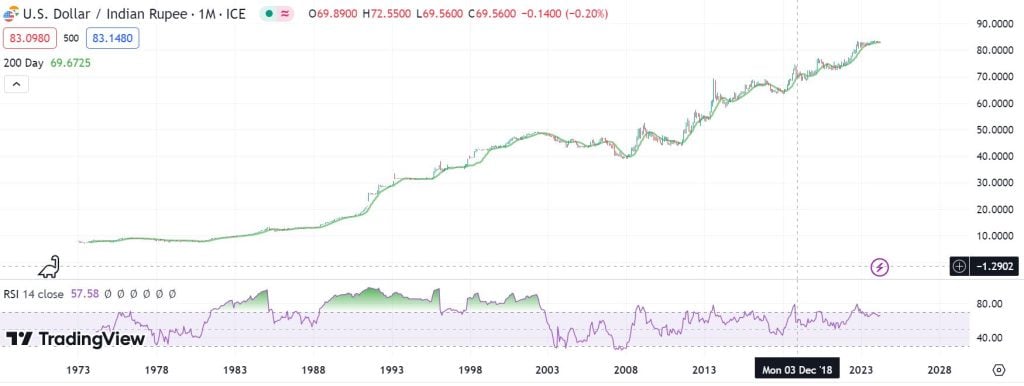

USD/INR Historical Chart

USD to INR trading dates back to 1973 when the pair was floated in the forex market at an opening price of $1 to 7.98 rupees. By late 1983, the currency pair rose past the psychological level of 10 rupees to the US Dollar. Between then and April 2002, it rallied by 376.41% to 48.76 rupees.

After retracing to 39.9 rupees in November 2007, the USD/INR has been on an uptrend since then. The pair surged to an all-time high of 83.47 on November 10th, 2023. Before attaining its all-time highs, the USD/INR tasted the 76.45 price mark in March 2020, just as the coronavirus pandemic was sweeping through the world.

As the US Federal Reserve started to hike rates, Indian Rupee started to slide against the US Dollar. In October 2022, the pair surged to a new all-time high of $0.8328. This ATH was refreshed in 2023 but the pair is really struggling to find strength above

USD/INR Outlook Amid Eleated Oil Prices

The global oil prices remain steady due to the rising tensions in the Middle East. Israel’s rhetoric regarding a ground invasion in Gaza’s Rafah City has further intensified the likelihood of supply disruptions. However, an even greater concern for India lies in the new trajectory the Russia-Ukraine war has taken. Ukraine has intensified its attacks on Russian oil infrastructure in March, and this will likely impact India’s oil import bill.

India defied pressure from the United States and has been importing cheap Russian oil amidst the war. Russia was India’s largest supplier of crude oil in 2023, accountig for 30% of its imports. This contributed substantially to the reduction of India’s oil import bill by 24% year-on-year in December 2023. However, India reported a decline in Russian oil imports in January and February, as stricter Western sanctions weighed in. Therefore, we are likely to see this reflected in the strengthening of the dollar against the rupee if the trend continues

RBI Intervenes To Stabilize USDINR

Since the start of the year, the US Federal Reserve and the Reserve Bank of India (RBI) have both remained hawkish. The increase in interest rates by RBI gave the Indian Rupee much-needed strength in terms of the US dollar. However, in its April 2023 meeting, RBI surprised investors by pausing the rate hikes. This has led to a weakness in Indian Rupee.

Another factor impacting the USD to INR exchange rate is the rising oil prices. Crude oil price has soared to its highest level in the last 10 months. Since oil is one of the biggest imports of India, the country’s import bill has significantly increased. A correction in oil prices may strengthen the Indian rupee against the greenback.

It has also been seen that the Indian central bank starts to intervene whenever the USD/INR pair rises above the 83.3 level. This has kept the exchange rate within a very tight range since the start of 2023. However, the rising strength of the US dollar is still generating strong tailwinds for the pair.

USD/INR Rebounds As Corporates Accumulate USD

After a pullback in USD/INR, there has been an increase in demand for the US dollar by the big corporates and importers of India. The increase in demand is offsetting the slight weakness in the DXY index in the past couple of days. The 83 level will remain a key level to watch in the coming weeks.

What Else Could Impact USDINR?

It has often been seen in the past 8-12 months that the Reserve Bank of India has started to offer dollars whenever there’s an increased selling pressure on the Indian rupee. This approach has kept INR in a tight range against the dollar.

Due to the current geopolitical scenario, many countries are now exploring more options for international trade. As a result, Indian Rupee has also appeared as a viable option for many countries.

More recently, the Reserve Bank of India has given the go-ahead to the banks of 18 nations to trade in Indian Rupee. The move can increase the demand for INR and decrease the selling pressure.

USD/INR Forecast 2024

As of this writing, USDINR is is on the upward trajectory and is above the 200-Day SMA. However, the pair previously faced multiple rejections at 83.35, and this will likely be the resistance level in the mid-term. If the pair gains strength above this crucial level, the USD/INR forecast will become very bullish. However, in that case, the Reserve Bank of India may start to intervene again. Keep your eye on 83.00 pivot in the near term.

Also, the US interest rate policy will play a crucial role in determining the USDINR exchange rate. If the first interest rate cut comes after June, then we are likely to see fewer cuts in 2024, translating to a stronger US dollar.

What will be USD to INR Rate in 2025?

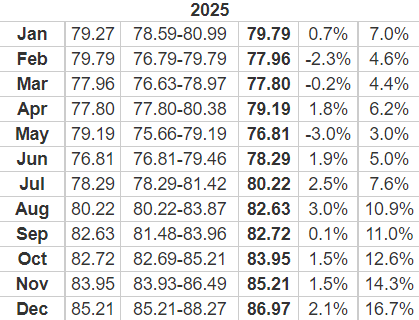

Long Forecast’s USD to INR forecast 2025 suggests the start of the year around 79.79 Rupees. It expects the currency pair to average 80 Rupees by mid-year before rallying further to 86.97 Rupees by the end of the year. The prices can go much higher if the global economy enters a prolonged recession after the ongoing deflationary measures.

It is important to note that the targets for April 2022 have already been met, while the price pattern on the daily chart indicates that there is a high potential for the May 2022 price target of 79.19 to be met in June. As it is, this makes the USD to INR forecast 2025 above quite viable, albeit with some minor differentials. It is crucial to conduct your own individual research.

USD to INR Forecast 2030

A feasible USD to INR forecast for 2030 is informed by the economic health of India and the US, Fed and RBI’s monetary policy, and the demand for the US dollar as a safe haven. Hence, a strong dollar will likely push USD to INR to a new record high, depending on the key drivers.

However, as an emerging market, India’s currency has the potential to strengthen further in the coming years. From that perspective, USD to INR forecast 2030 will be for the pair to remain within a range for several years.

How to trade USDINR

To trade USDINR, one needs to open an account with a reputable forex broker. When researching the best broker, it is helpful to consider their spreads, commissions, and other fees. It is also possible to trade the currency’s derivatives in the form of USDINR futures.