In today’s trading session, the BT share price is down by a percentage point, resuming a long-term bearish trend after yesterday’s price gain cut a seven-day bearish streak. Today’s drop in the price of the company’s share is not surprising and continues a long-term trend which has seen BT’s value dropping by 7 per cent in August and 13 per cent in July.

Why is BT struggling?

Despite being one of the leading telecommunication companies in the UK, the latest inflation rate in the UK has posed a challenge to BT and resulted in some of its divisions struggling. The company has also faced issues with workers, which have included strikes and demand for a pay rise.

This week, BT workers are expected to start their strike, demanding better working conditions and a pay rise. The move has resulted in many investors becoming concerned about the company’s margins. In fact, most investors agree that increasing pay for the more than 100,000 BT workers is not something the company can afford.

Most investors are also looking at the company’s debt of £12.3 billion and sounding the alarm that it might be a problem in the future. For a company with a market capitalization of about £15, the debt may not pose a serious problem now, but it may cut into dividends paid to investors in the future.

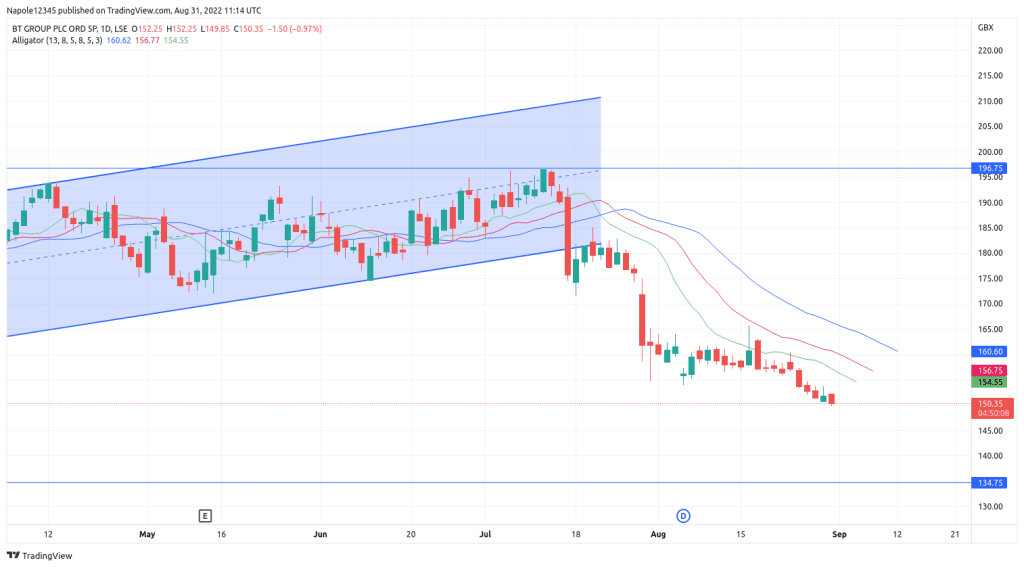

BT Share Price

As seen above, the current decline in BT share price has been due to a myriad of factors, including the workers’ strike that is currently going on, which has seen investors becoming uneasy with their investors.

Therefore, I expect the BT share price to continue dropping for the next few trading sessions. There is a high likelihood that we might see the share price trading below the 145p price level within the next few trading sessions. It is highly likely that in September, the prices may go as low as 140p price level. However, a trade above the 155p price level will invalidate my bearish analysis.

BT Daily Chart