Ardana is Cardano’s DeFi platform, providing the best-priced solution for stablecoin-to-stablecoin trading. Ardana chose Cardano as its home chain because of its proof-of-stake platform with proven innovations that provide top security and sustainability for its platforms. Cardano is one of the top blockchains, having evolved significantly from the limitations of Bitcoin and similar chains. Ardana contributes to Cardano by providing their dUSD stablecoin, the only collateralized, decentralized, and soft-pegged stablecoin on Cardano. The Ardana DEX enables a high capital efficiency of 50-100x and creates opportunities for liquidity providers to collect low-risk income from platform fees.

With its stablecoin features, its DANA token, the expanding Danaswap hub, and a growing number of critical chain-to-chain bridges, Ardana have a lot to offer. So, where does it line up as a DEX? Let’s take a closer look as we dive deep into the Ardana platform.

Ardana Team and Philosophy

Ardana is a relative newcomer to the DeFi industry. Still, it was built quickly after a long period of historical and economic research identified the structure needed for a high-impact platform. Ardana was created in early 2021 by CEO Ryan Matovu, along with a capable team of crypto natives and TradFi experts with a pedigree from central banks and Wall Street. The team saw that DeFi was making radical changes to the larger financial industry, but gaps in the services would limit DeFi from reaching its potential. They saw that exchanges, lending and borrowing protocols, stablecoins, and other DeFi services were critical for a balanced foundation and a way to link TradFi with DeFi.

They also saw that the L1’s largely determined the shape and structure of a DEX due to the scalability, fee structure, and compatibility with other chains. The team researched and selected Cardano as their home because they saw it becoming a top ecosystem for DeFi, and it had a strong need for a DeFi hub that would rival the success of ETH/Matic/BSC and SOL/AVAX. Because stability is such a critical element, Ardana developed a strong Stablecoin, along with the Stable-asset-set exchange, a cornerstone of their offering.

After reaching out to Cardano developers and determining where they could create the most impact, the Ardana team realized that a fairly priced, scalable foreign exchange was necessary. To accomplish this, they needed a significant liquidity floor, which they built up through vault lending. To ensure currency values were close to the real price, they constructed Danaswap, a stablecoin decentralized exchange.

Ardana Key Features

Stablecoin

The key to Ardana’s strong foundation is its stablecoin, dUSD. The coin is backed by the US dollar and is a decentralized, on-chain, asset-backed stablecoin. Users can buy, sell, and mint dUSD throughout the Cardano ecosystem, opening many opportunities for the rising number of platforms building on the chain. The dUSD is backed directly by collateralized assets deposited by users, such as ADA tokens. A key feature of the stablecoin is that instead of converting ADA into a stablecoin, users can deposit their ADA into one of Ardana’s vaults. They receive a proportion of the value back as a minted dUSD loan. When the dUSD is returned to the platform, the user receives back their ADA with small fees for the loan transaction. This process jumpstarts the economic growth for Cardano by facilitating lending and borrowing in a way that best benefits the users.

DANA Token

The Ardana token (DANA) was created to successfully govern and guide the platform. It serves two key purposes:

- DANA allows for holders to propose and vote on changes to the ecosystem as it evolves.

- Stakers are rewarded with access to a share of the Ardana fees.

DANA is a native asset on Cardano, and users can acquire the token through an open market or one of Ardana’s liquidity mining programs.

Key Metrics:

- Ticker: $DANA

- Total supply: 125,000,000

- Initial market cap: $3,412,500

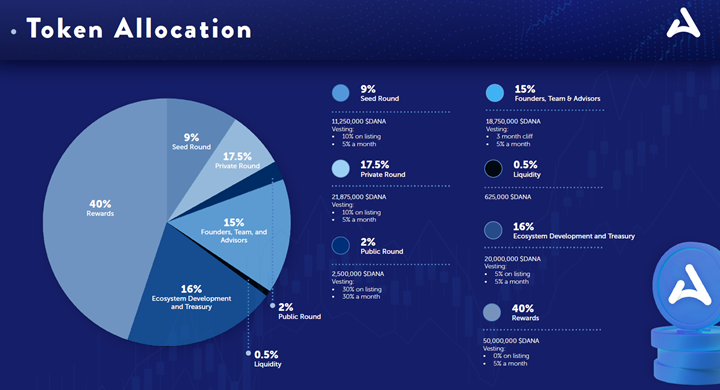

Token allocation is as follows:

- Liquidity Mining Rewards: 40%

- Token Sale: 28.5%

- Founders, Team, Advisors: 15%

- Ecosystem Development and Treasury: 11.5%

- Exchange Liquidity: 5%

Source: https://ardana.org/

Danaswap

The platform’s Automated Market Maker (AMM) is called Danaswap, and it serves as a decentralized exchange for stable, multi-asset pools built within the Cardano ecosystem. Taking a page from Ethereum, the Ardano team quickly realized that for Cardano’s DeFi markets to grow and succeed, they needed a tool to ensure capital-efficient cross-liquidity between stable pairs. The platform has developed an invariant curve formula to ensure maximum stability and efficiency that can create 50-100x capital efficiency. Users enjoy very low slippage as they can swap between stable assets such as wrapped Bitcoin and stablecoins. The fees from market-making are rewarded in part to those who deposit assets into the Danaswap pools.

A key part of Danaswap is creating an efficient, no-barrier, decentralized foreign exchange. As they are developed, this allows swapping between various international stablecoins, including dUSD, dGBP, dEUR, and more. The global foreign exchange market is estimated at $6.6 trillion, and this massive volume is despite the large exchange/transaction fees and barriers that come with centralized infrastructure. If Ardana can cultivate the growth needed for mass adoption, this could upset the bank-controlled foreign exchange balance.

Multi-Chain Bridges

One of the most recent and exciting developments for the platform is its partnerships developing with other L1 chains. Ardana has solidified agreements with several key chains, including Elrond ($EGLD) and NEAR (NEAR).

Ardana is working to build the bridge infrastructure between the Cardano ecosystem and Elrond, allowing for free-flowing asset transfer between the chains. Elrond is a high-throughput Layer 1 blockchain, and the partnership will open the doors to many opportunities for residents of both ecosystems.

The NEAR protocol partners with other key blockchains, including Ethereum and Polkadot. By bridging Cardano and NEAR, Ardana will allow access to many other key blockchains and their markets, exponentially growing options and opportunities for its users.

Looking Ahead: 2022 and Beyond

While Cardano is not the largest blockchain in the industry, it has a lot to offer. With Ardana providing critical infrastructure, DeFi services, and a Stablecoin foundation, it unlocks the potential for mass-market growth and adoption. Furthermore, by bridging even beyond the Cardano ecosystem into other top L1 blockchains, with plans to bridge, Ardana may be one of today’s top ecosystem growth facilitators.