The Lloyds share price is trading lower for the second in three sessions. Investors appear concerned about the impact of rising inflation on the bank’s customers, many of whom are prioritizing food and energy expenses over the bank’s subscription services. Investors are also worried about the impact of bad loans on the bank’s portfolio, even as Chief Financial Officer William Chalmers says that impairment due to bad loans is expected to rise this year.

Last week, the bank reported a Q1 2022 pretax profit of 1.6 billion pounds, which beat the market expectation of 1.4 billion pounds despite representing a fall from the 1.9 billion pounds it earned from the same quarter a year before.

So far, the Lloyds share price has not shown the response expected to the stellar earnings and bullish guidance. However, bullish expectations remain intact as the UK inflation is expected to hit 9% by the end of 2022, much higher than the current levels of 6.2%. This projection is driving bets of further rate tightening by the Bank of England, which benefits the bank’s money instrument investments. Furthermore, Lloyds Banking Group’s real estate investments of 2021 are expected to pay off handsomely in 2022 as house prices and rents attain record highs.

The Bank of England meets next week and is expected to raise rates for the 4th time.

Lloyds Share Price Outlook

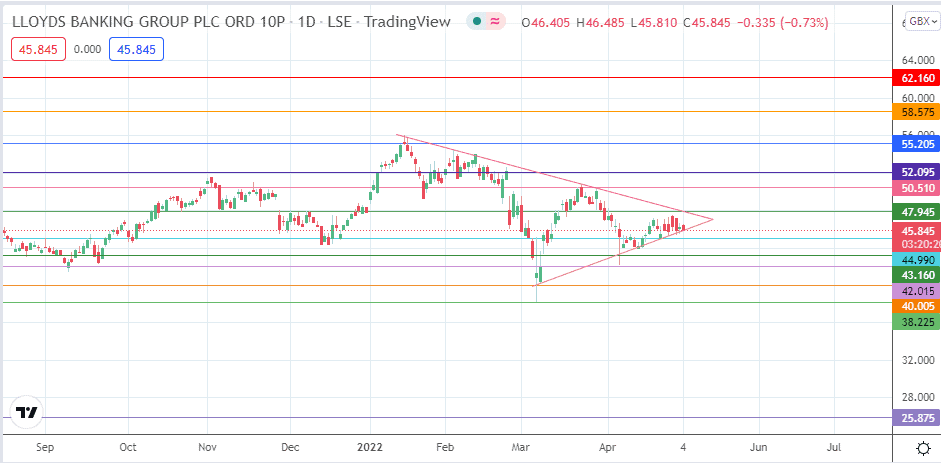

The evolving symmetrical triangle faces a test of the integrity of its lower border by the active daily candle. A breakdown of this border must also degrade the 44.99 support level (3 March and 25 April low) to make a case for a measured move that targets the 40.00 psychological support (5 March 2021 low and 8 March 2022 low). Finally, this measured move must take out pivots at 43.16 (19 July 2021 low and 8 March 2022 low) and 42.015 to become a reality.

On the flip side, the bulls must initiate more momentum to force a bounce on the triangle’s lower border, targeting a breach of 47.945 (29 July 2021/7 December 2021 highs) to achieve an upside break of the pattern.

This also opens the door for a measured move that targets 58.575 (3 February 2020 high). This move must uncap barriers at 50.51 (29 October 2021 high and 29 March 2022 high) and 52.09 (6 January and 22 February highs). The 55.20 resistance must also give way to allow the measured move to come to fruition.

Lloyds: Daily Chart