Nio (NYSE: NIO) stock price was on a steep downtrend in January 2024, losing -38.04% of its value. It traded sideways for most of February, gaining +2.31% in February, but has lost 2.36% since the beginning of March. currently in the midst of a major correction. The Chinese EV company’s stock has plunged -188.5% from its August 2023 highs.

Technical analysis reveals that NIO stock is consolidating at a very critical level. There are signals of bottom formation which suggest the current price could be a good long term buying opportunity. The stock price currently trades below its $6.26 IPO opening price, and will need to head above $6.50 to build upside momentum in the short term.

Tesla vs NIO

Nio and other EV companies have struggled in the past few months for several reasons. First, there are concerns that the EV industry is getting crowded. There are hundreds of companies in the industry, like Li Auto, BYD, and Xpeng, that are building electric vehicles. As such, investors are worrying about demand in the industry since Nio manufactures premium cars.

Second, there are concerns about Nio pricing power now that well-known brands have started lowering their prices. This means that Nio could be forced to follow the trend in the coming months, which will hit its margins.

In fact, NIO has already started to offer incentives to its customers. However, these incentives have more to do with phasing out the first-generation stock than competing with its rivals in price cuts. The company intends to make the complete transition to its second-generation platform NT 2.0, by accelerating the sales of its old stock.

Nio Stock Latest News

The company appointed Nicholas Paul Collins and Eddy Georges Skaf to its Company’s board of directors on February 7, 2024. Furthermore, Mr. James Gordon Mitchell tendered his resignation as a director of the Company on the very same day. In late December, the company got a $2.2 billion equity investment from Abu Dhabi-based investment vehicle, CYVN. That was in addition to the $734.5 million investment by the same firm in July 2024.

In one of the most recent developments, NiO Inc. has appointed a new independent director in the company’s board of directors. Professor Yonggang Wen has joined the board of directors with effect from 13 November 2023.

In other news, the Chinese EV maker has stepped into the smartphone market with the recent launch of its NIO phone. The phone targets the owners of NIO EVs while providing them with features like automatic parking and other remote functions. The EV-centric phone has a lot of similarities to the Google Pixel 2.

The EU investigation into the subsidized Chinese EV companies has given a major blow to the NIO stock. According to the President of the European Commission, Ursula von der Leyen, the regional counterparts are unable to compete with the subsidized Chinese EVs.

NIO Inc. Reports Delivery Numbers

Nio’s deliveries in the fourth quarter of 2023 stood at 50,045 vehicles, beating its projected estimates of between 47,000-49,000. This figure was part of the 160,038 vehicles delivered in 2023 in total, contributing to an overall increase of 30.7% year-over-year.

The company also started 2024 on the right footing, seeing its January deliveries grow by 18.2% year-over-year to stand at 10,055 vehicles. However, that figure declined to 8,132 units in February. Overall, the company aims to deliver between 31,000-33,000 units in the first quarter of 2024.

NIO to add another 1,000 swap stations in 2024

NIO achieved a milestone of completing 30 million battery swaps in China in October 2023. Furthermore, it met its target of building 1,000 new power swap stations in China in 2023 and expects to match that figure in 2024. The company currently has an average of a station for every 150km in China, According to the recently released report, the company swapped 10 million batteries at its swapping stations between April and October 2023.

As per the latest NIO stock news, the company is accelerating the development of its network of battery swap stations. This is expected to increase the revenue of the Chinese EV maker significantly. The company has rolled out around 10 of its next-generation battery swap stations in China. These charging stations could be ideal for long-distance travelers while also boosting the company’s revenue.

NIO Keeps Expanding In The West

Nio (NYSE: NIO) is also expanding its business in Europe. It has already opened a battery swap station in Germany, where it expects to gain market share. The company has also launched two swap stations in Norway, one of the biggest EV countries in the industry. The company has established more than 10 NIO battery swap stations in the EU.

Also, the company plans to launch its cheaper brands known as Firfly and Alps in Europe sooner than previously expected. As per the company president, Firefly will be launched in Europe by 2025.

The EV company currently has 39 power swap stations in Europe, 11 of which are in Germany. By 2025, Nio hopes to have over 4,000 battery swap stations globally, with over 1,000 overseas.The vast majority of the stations (2, 375) are currently in China, and that figure is expected to hit 3,310 by the end of 2024.

However, the latest data shows that EV sales in Europe are finally stalling after a 47% increase in the first nine months of 2023. This can be attributed to the economic slowdown due to inflation and high interest rates.

NIO vs Tesla Price War

The EV price war which was initiated by Tesla due to falling sales, are now weighing on the profits of the whole industry. As a result, the recent NIO earnings report reveals that the Chinese EV company’s losses are expanding. In fact, the company recently had to layoff 10% of its workforce.

The company could, however, get some upthrust when it launches its much-touted 4th-generation supercharger in April 2024. The battery’s power can go as high as 640 kW, and its maximum output is 765 Amps and 1,000 Volts. The fourth-generation power stations will increase the capacity of services per station from 408 to 480 per day.

It is worth mentioning here that NIO is only one of the few electric vehicle manufacturers betting big on battery-swapping technology. Tesla CEO Elon Musk has already discarded the idea after some consideration. Nevertheless, NIO still remains optimistic about the future of the technology and intends to expand its battery-swap network globally.

Will Nio stock go up?

There are several factors that could drag the Nio stock price lower in the coming months. First, competition in the EV industry is growing rapidly recently. Nio is now competing with more than 400 EV companies in China. Some of the top competitors are BYD, Li Auto, and XPeng. This means that, ultimately, the company’s growth will slip in the coming months.

Further, from a technical perspective, the stock has been in a strong sell-off in the past few months. It also managed to crash below the important support level at $11.71, which was the lowest level in May this year. Therefore, it seems like there is a bearish momentum, which will make it difficult for the stock to bounce back any time soon.

Recently, Audi defeated NIO in court over the naming of its vehicles. The court in Munich gave a verdict that the NIO vehicle names were too similar to those of Audi. These names included NIO SUVs ES6 and ES8, which were too similar to Audi’s names for the S6 and S8 models.

Nio Stock Price Prediction & Technical Analysis

You can see that the NASDAQ: NIO chart is accumulating below its $8.50 support, which was the previous range low. Due to bullish divergences on RSI and MFI indicators, more downside seems unlikely. Nevertheless, the most critical level on the chart remains the $7 level, which has been acting as a support for the last couple of months. A breakdown below this level will be ctastrophic.

Due to this reason, it is critical to manage your risk if you intend to buy at the current levels. A better idea would be to dollar cost average.

Nio stock price forecast for 2024

Last quarter, NIO saw its vehicle sales revenue jump of 1.6% in the fourth quarter of 2023, to $2.17 billion. Other sales brought in $234.4 million, up by 24%. Full-year revenue stood at $7.8 billion in 2023. Furthermore, gross profit rose 100% year-on-year to $180.2 million. The rise in revenue was attributed to increased deliveries, signaling that the company’s performance could improve if it meets its deliveries targets.

However, NIO still tails Tesla when it comes to profitability. The company’s net loss stood at $756 million in the fourth quarter of 2023. The full-year net loss increased by 43.5% to $2.91 billion. Furthermore, the company missed analysts’ EPS projections by 17%.

Analysts have mixed feelings about the Nio stock price. Data compiled by Marketbeat shows that the average target for the stock is $22, which is substantially higher than the current $9.99. In the near term, NIO is likely to struggle to break even. However, Tesla has proven that EV manufacturers can return good profit once they establish a stable enough and wide enough market base. Equally important is the ability to meet customer orders.

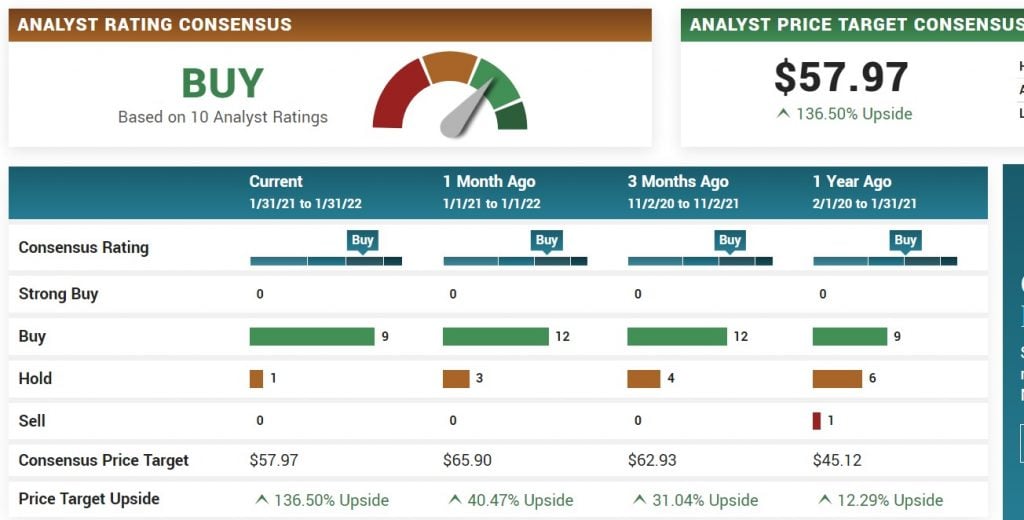

Some of the analysts bullish on the Nio stock price are from China Renaissance, Mizuho, Jeffries, Deutsche Bank, and UBS. Most of these analysts have a buy or hold rating on the stock.

Another broader look by most analysts shows that most of them are bullish on the stock. In addition, data compiled by Tipranks shows that the target for the stock is $16, which is also higher than the current level.

Meanwhile, according to Long Forecast, the Nio stock price will remain in a tight range in the next few months. They expect the shares to be below $8 at the end of 2023.

Nio stock forecast 2025

It is difficult to predict how a stock will perform in about three years, as history has shown us. The situation is more volatile for Nio because it is a Chinese company that could probably be delisted in the United States.

All factors constant, there is a possibility that the Nio share price will do well by 2025 as electric vehicles go mainstream. As you already know, many countries such as those in Europe and even China have made plans for phasing out combustion engine vehicles.

By 2025, Nio will have perfected its manufacturing process and expanded its business to other countries. According to Long Forecast, the stock will be trading at about $55 in January 2025. If you want to test, you can check the ATFX trading demo account.

Nio analysts forecasts

Nio stock forecast 2030

Generally, I am a bit bullish on the Nio stock price in the long term because of the company’s rapid growth. Therefore, I believe that the stock will be substantially higher than where it is today. However, based on its historic performance, we can’t rule out a situation where the stock rises three times by 2030 to over $70. As Tesla has proven, this is a possible scenario.

Nio stock price history

As shown below, the Nio share price has had a roller-coaster as a public company. The company went public in 2018, and its stock price collapsed to an all-time low of $1.20. At the time, there were concerns about the company’s existence as a going concern.

It then started a spectacular rally in November 2019 as the firm geared towards the launch of its products. Since then, it jumped by more than 5,400% and reached an all-time high of $65. Today, the stock is about 65% below its all-time high.

Nio share price history

Is Nio a good buy and hold stock?

While Nio is a good company, it is also highly risky. Being a Chinese company, there are concerns about the accuracy of its financial results. In the past, we have seen Chinese companies publish inaccurate numbers.

Another concern is that the company could be delisted in the US. If this happens, many American investors will be left carrying the bag. Also, there are concerns about rising competition in the EV industry as companies like BYD, Xpeng, Geely, and Zeekr take market share.

Nio stock short interest

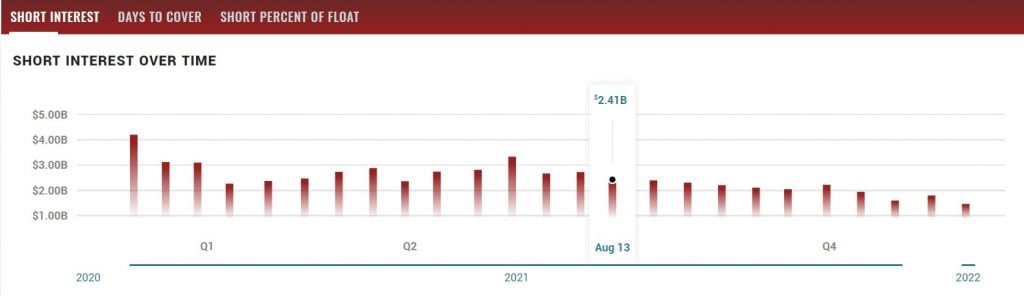

Short interest refers to the number of shares held by short-sellers. These are people who bet that a stock will go down. After the Wall Street Bets situation, we have seen the short interest of many companies decline. The current Nio short interest stands at just $1.5 billion, which is the lowest level in more than a year. At its peak, the value of shares held by short-sellers was worth over $4 billion.

Nio short-interest

How many cars has Nio sold?

Nio is a relatively young company that is in the process of ramping up its production. Nio has sold over 238k cars, which is a remarkable number for a company of its age. Analysts expect that it will sell over 500k cars per year in the next five years.

Is the Nio stock overvalued?

Like most EV stocks, Nio is currently overvalued. Besides, this is a loss-making company that makes less than $4 billion in annual revenue that is being valued at almost $35 billion. The company has a price-to-sales ratio of 5.89, making it overvalued. However, this overvaluation can be justified if the company maintains its growth.

Summary

The Nio stock price has done well over the years. In this article, we have explained why it has performed like that. We have also identified potential risks that the company is currently facing.