Silver (XAG/USD) price prediction is one of the hardest nuts to crack due to extreme volatility this year. After losing about 10.5% of its value between December 2023 and February 2024, the commodity rose steadily in March, gaining 10.13%. Silver price has gained 17.7% in 2024, higher than its richer cousin, gold, which has risen by 14.64%. As of this writing, silver has eased lower to trade at $28.06 per ounce after hitting new three-year highs of $29.79 on April 12th.

The ongoing bullish sentiment in precious metals is fueled by safe haven appeal amidst geopolitical tensions in the Middle East between Israel and Iran and the Russia-Ukraine war. Furthermore, high inflation in the US is a key factor, with precious metals typically seen as a hedge against inflationary pressures. As a result, the outlook for Silver price in 2024 remains bullish.

What Is Silver?

Silver belongs to a category of metals that are considered very precious due to its wide range of uses and its preference as a store of value. For thousands of years, human civilizations have used Gold and Silver as primary means to exchange and store value. Furthermore, silver is used in several industrial processes. As a result, Silver price has always remained tied to economic activity worldwide.

The XAG/USD keeps track of the price of Silver in terms of the United States dollar. Therefore, the pair generally shows an inverse correlation to the strength or weakness of the greenback.

Silver Price Latest News

Silver currently trades near its YTD highs of $29.79, and the current risk sentiment is likely to encourage more purchases. The US headline inflation reading for March 2024 came in at 3.5%, YoY, up from February’s 3.2%. That was significantly above the Fed’s target of 2%. With the jobs market remaining strong, the Fed is retain the current 5.25%-5.50% interest rates beyond June, and this could bring headwinds to silver from US Treasury yields.

Silver Price May Continue To Rally In 2024

According to the Silver Institute, the demand for silver is expected to reach 1.2 billion ounces, the second-highest on record. This will likely support a price hike, potentially going towards the $30 per ounce territory. Notably, the commodity hasn’t been able to reach that mark since its 2013 meltdown.

While Fed interest rate policy is expected to play a part in determining the commodity’s price, much will also depend on industrial demand. The outlook for the global economy is generally positive. In its latest forecast, the IMF projected a “slow but steady” global economic growth, with real GDP growth revised upwards in April by 0.1% to 3.2%.

Furthermore, China reported a better-than-expected GDP growth of 5.3% in Q1 of 2024, beating the forecast 4.8%. The country expects the economy to grow by about 5% in 2024. The world’s second-largest economy also recently reported a growth in industrial activity for the first time in six months. These statistics are good news for silver prices as they could translate to increased demand and higher prices, thanks to silver’s use as both a luxury and industrial metal.

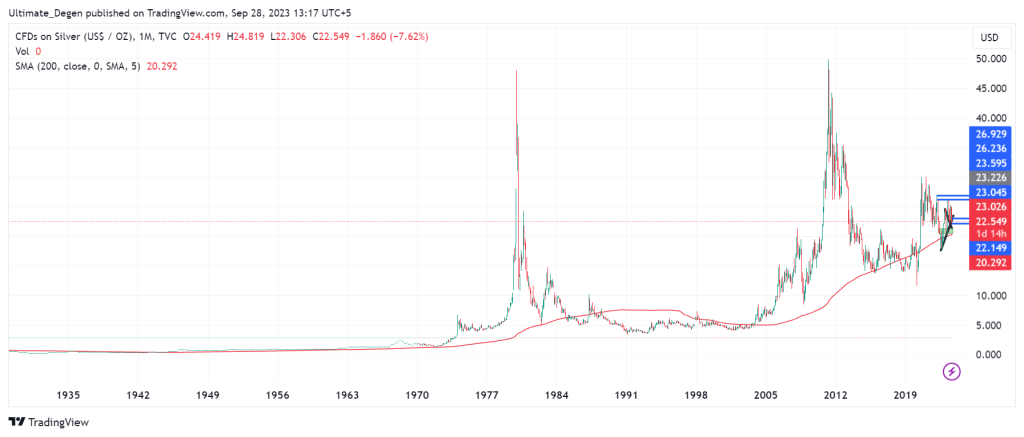

Silver Price Chart History

The following price chart shows the Silver price history since 1930s.

The following XAG/USD chart reveals that Silver prices per ounce have generally been strong since September last year. The price bottomed out at around $20.68 in October 2023, but rose strongly in November, followed by a loss of 10.6% between December 2023 and February 2024. Through the ups and downs during that period, the price of Silver has risen by 36.21%.

Silver Price Prediction And Latest Analysis

The following XAG/USD chart reveals that Silver price per ounce has been on the upward trajectory for the most part in 2024, as shown on the ascending channel. However, the price faces resistance at the $30.0 psychological level. A move past that level could open up a pathway to take a shot at the ATH price of $49.

The commodity’s 50-MA is well above the 200-MA, signaling a strong bullish market. However, for the upside to be sustained, it is important that the buyers keep the price above the $27.14 pivot mark. Otherwise, as slip to the $25.25-22.99 support levels is would still be possible.

I predicted this drop in precious metal prices in my last Silver price forecast. I also regularly update the price targets on my Twitter, where you are welcome to follow me.

Silver Price Prediction 2025

Due to the high inflation and increased interest rates, analysts are predicting the US economy will enter a recession later in 2023. If this really happens, then the Silver and Gold price may increase as they are the preferred store of value across the world. A simple pitchfork analysis gives us a silver price forecast for 2025 between $34 and $50.

Silver Price Prediction 2030

A lot can happen in the world till 2030. Considering the current state of the global economy and the inflation across the world, I’d be surprised if Silver doesn’t make a new all-time high within the next seven years. Therefore, XAG/USD may break above its 2011 all-time high of $50. However, close attention must still be given to the changing global macroeconomic scenario.

Silver Price Prediction 2040

While the Silver price prediction 2040 is anybody’s guess, we can still consider a few different scenarios. If the US dollar remains the global reserve currency within the next two decades, Silver can comfortably trade above $50 by 2040. Technical analysis also gives a price range of $78-$138.

Where To Buy Silver?

You can buy silver on brokers like IG, TD Ameritrade, Interactive Brokers, Capital.com, Exness, etc. These brokers allow you to trade the XAG/USD pair by adding very little margin. However, you must learn risk management before taking leveraged positions on any asset.

How To Trade Silver?

Nowadays, there are various ways to gain exposure to the volatility in precious metals. Holding silver physically involves additional costs. Therefore, the best way is to invest in Silver CFDs or futures contracts via an online broker like eToro, Exness, TD Ameritrade, etc.

What is The Spot Price Of Silver?

As the name suggests, Silver spot price is the price of the bullion coins for immediate delivery. The current spot price is $24.75, but it is very volatile as it trades almost 24 hrs across the world wherever the markets are open. The biggest trading volume comes from US, UK, Japan, Hong Kong etc.

Concluding Remarks

Investing in precious metals like Gold and Silver is always worth considering as they are a time-tested store of values with plenty of uses across the modern industry. However, the biggest factor is to evaluate your investment objectives and the time horizon. If you don’t want exponential returns and simply want to hedge against inflation, Gold and Silver could be one of the great options.