The VET/USDT pair is marginally higher for the second day in a row, even as the pair seeks to buck the negative VeChain price predictions that have pervaded the space due to the recent slump in price. On Wednesday, the Binance exchange announced the addition of several new cryptos as part of the first batch of digital currencies included in the Bridge 2.0 solution.

VeChain is one of nine listed currencies, with ApeCoin, The Sandbox, JasmyCoin, and Dogelon all making the list. This listing means that users can now bridge these nine tokens from the Ethereum blockchain to the Binance Smart Chain (BSC). Unfortunately, this development is yet to produce a bullish response on the VET/USDT charts.

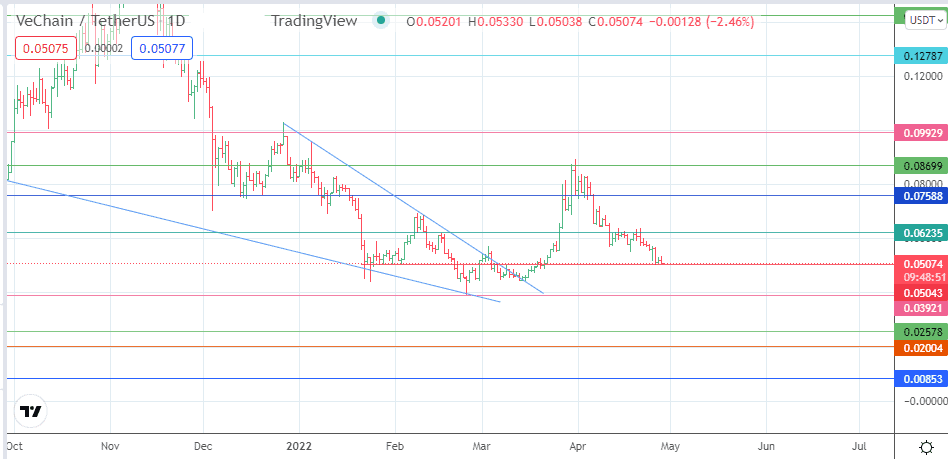

What are the possible scenarios as far as the VeChain price prediction is concerned? On the technical side of things, the breakout move that followed the conclusion of the falling wedge pattern only served as a rally that brought in a new selling opportunity at 0.08699. The decline that has followed the rejection at that price mark has met support at the 0.05138 price mark.

VeChain Price Prediction

Unless sufficient bullish momentum enters the VET/USDT pair to spur an additional upside push, the 0.05043 support will remain under pressure. On the other hand, if this support collapses under the weight of bearish momentum, the door towards 0.03921 (24 February low) swings wide open.

If the decline continues below the low of 24 February, 0.02578 (26 January 2021 low) becomes the next potential harvest point for the bears. After that, 0.02004 (10 January 2021 low) and 0.00853 (4 November 2020 low) round off potential southbound targets for the bears.

On the flip side, if further bullish momentum comes in at present levels, we could see a bounce that targets the 0.06235 resistance (16 February and 16 April highs). An additional advance brings 0.07588 (18 January and 6 April highs) into the mix before the 30 March high at 0.08699 becomes a viable northbound target.

VET/USDT: Daily Chart

Follow Eno on Twitter.