- USDJPY volatility expected on July 16 as traders await release of US Retail Sales & Core Retail Sales results. Markets expecting a dip in retail purchases.

Are Americans still buying at retail outlets as much as they used to? This question will be answered when the Retail Sales and Core Retail Sales reports hit the market. Both sets of data are expected to have good impact in the market. For this release, the USDJPY will be the currency in focus.

Background

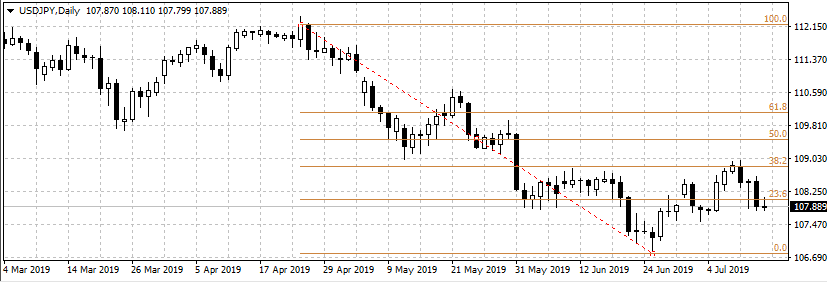

The US Dollar lost ground significantly after US Fed Chair Powell’s dovish stance in his testimony before the US Congress. It continues to have a bearish bias, even though it has recovered some ground in Monday’s trading sessions. The greenback will have another test of its resolve when the retail sales results are released at 8.30am EST on Tuesday July 16.

Interpreting the Data

Analysts are expecting the retail sales figure and its core component to come in at 0.1% each, which is worse than for the previous month (0.5%). To trade this news item, we are looking for:

- A no-conflict situation.

- Deviation of at least 0.4% between the actual and consensus figures.

A no-conflict situation means that both the Retail Sales figure and its core component must move in the same direction: either they BOTH surprise to the upside, or to the downside. At the very least, one figure should match consensus while the other component deviates from the consensus figure.

Worse than expected readings would be USD negative, while readings that exceed the consensus will be USD positive. The tradable deviation would be 0.4% (i.e. -0.3% and below to sell, and 0.5% and above to buy).

Exact trade play would depend on the figures, since we need both sets of data to move in the same direction.

Watch out for the speech at the G7 Presidency meeting from the US Fed Chairman Jerome Powell at 1.30pm EST and the CNBC appearance of FOMC member Charles Evans at 3pm EST.Don’t miss a beat! Follow us on Twitter.

Download our latest quarterly market outlook for our longer-term trade ideas.