The Stellar Lumens Price has retreated around 13% from Saturdays $0.4309 high, ending lower in the last two days. Stellar (XLM/USD) is trading at $0.374 (-1.33%), up +34.2% in October, and +770% year-to-date. Stellar Lumens’ current market cap of $8.9 billion makes it the 22nd most valuable cryptocurrency, behind Polygon (MATIC/USD).

This morning, Bitcoin is trading at $64k, within 1.5% of equalling its all-time high. However, altcoins are not responding to BTC’s rally as they did earlier in the year. XLM has gained around 47% over the last three weeks, although it will need to improve by 110% to reach the multi-year high of $0.8045 set in May. Coming into the weekend, XLM rode a wave of optimism after Stellar inked several high profile deals. The Canadian Central bank recently announced they are working with Stellar to develop their Central Bank Digital Currency (CBDC).

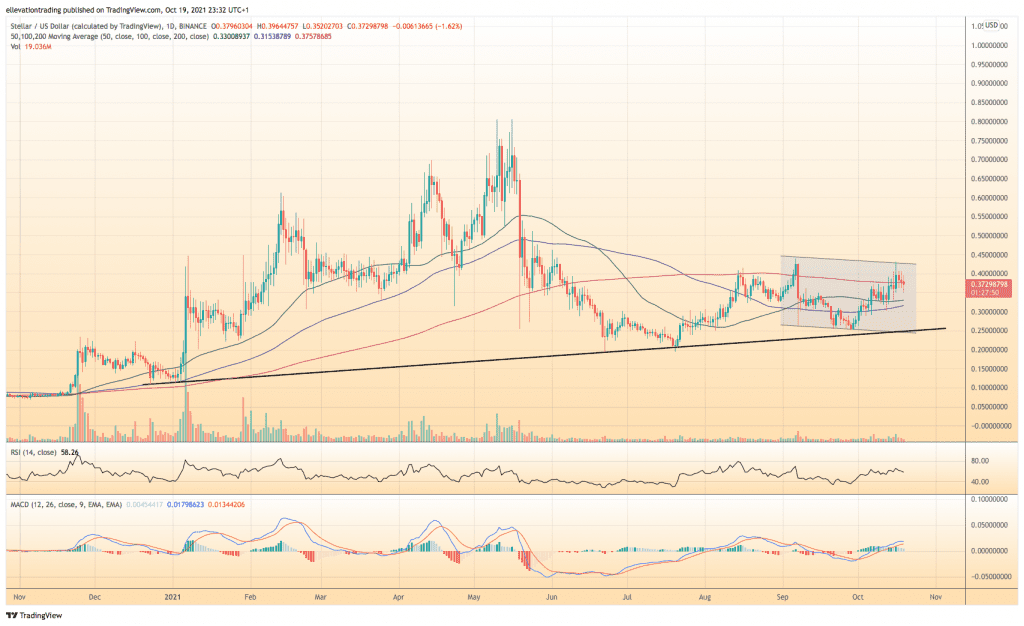

XLM Price Forecast

The daily chart shows the Stella Lumens price surged above the 200-day moving average (DMA) at $0.3758 on Saturday and extended towards the September high of $0.4393. However, XLM fell short and topped out at $0.4309, subsequently leaving an ominous double-top pattern on the chart. As a result, Stellar has fallen below the significant 200-DMA, which could trigger further weakness.

Below the market, the 50-DMA at $0.3301 and the 100 at $0.3154 are the first support levels. Following the moving averages comes the long term trend line at $0.2500. However, considering the Stellar networks recent announcement, I expect buyers to emerge on any weakness. Therefore, I am optimistic about XLM and expect it to clear the September high soon. However, the bullish view relies on the price staying above the 100-day moving average. On that basis, a close below $0.3154 invalidates this thesis.

Stellar Lumens Price Chart (Daily)

For more market insights, follow Elliott on Twitter.