The Shell share price popped on Tuesday as crude oil and natural gas prices stabilized, and investors reacted to the latest BP earnings. The stock is trading at 2,216p, close to its year-to-date high of 2,250p. It has risen by more than 44% from its lowest level this year, bringing its total market cap to about 164 billion pounds.

Shell earnings preview

Shell, formerly known as Royal Dutch Shell, will publish its quarterly results on Thursday, and analysts believe that the company did well in Q1. Thanks to the relatively steady crude oil and natural gas prices, this growth will happen. However, the company will take some paper losses in conjunction with its decision to exit the Russian market. On Monday, BP announced a charge of over $20 billion after it terminated its deal with Russia’s Rosneft.

In April, Shell said that exiting the Russian market had already caused it over $5 billion. The figure has likely increased, considering that the statement came in the first week of April. Data compiled by Vara shows that the consensus is that Shell made $4.05 billion in its integrated gas division and $2.8 billion in its upstream operations.

Oil products are expected to have generated $555 million, while its adjusted earnings are expected to be $6.39 billion. Its cash flow from operating activities is expected to be $8.17 billion. It is worth noting that these estimates were based on Brent trading at $79.8 in the quarter and the Henry Hub being at $4.75. Of course, these prices have been higher than that.

Shell share price forecast

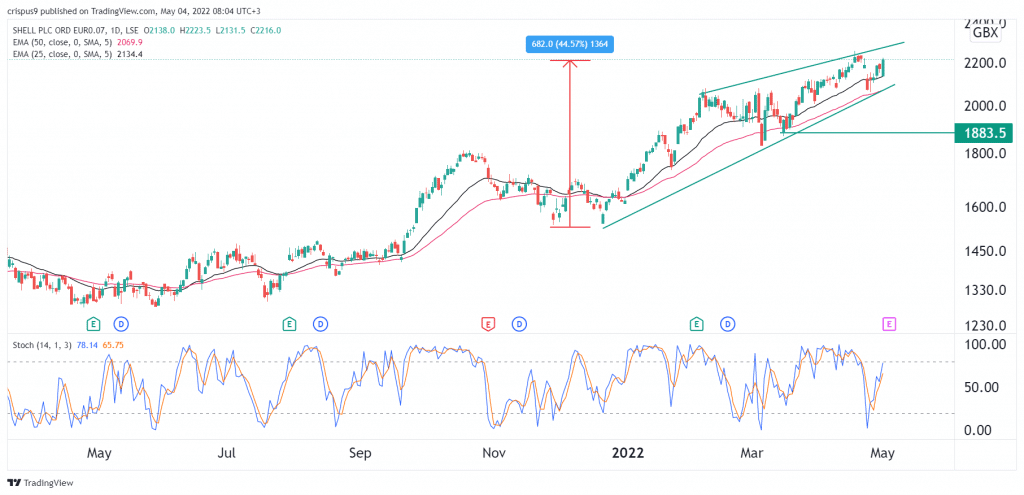

The daily chart shows that the Shell share price has been in a bullish trend in the past few months. The stock has managed to move above the 25-day and 50-day moving averages, while the Stochastic Oscillator has moved close to the overbought level. It has also formed a rising wedge pattern, which is usually a bearish signal.

Therefore, the stock will likely retest the YTD high of 2,250p. In the long-term, however, as the rising wedge matures, there is a likelihood that the shares will likely have a bearish breakout.