- Apple shares slid 2% after unveiling the ultra-thin iPhone Air at its 2025 launch event. Can Wall Street excitement match consumer buzz?

Apple Unveils Its Thinnest iPhone Yet

Apple’s latest product showcase was designed to wow. The company introduced the iPhone 17 line-up and a new flagship, the iPhone Air, its thinnest phone ever at just 5.6 mm. Up until now, the Air name was reserved for MacBooks and iPads, but Apple just decided phones deserve the slim treatment too. The device is lighter, sleeker, and packed with AI-driven features that slot neatly into Apple’s ecosystem.

The event also brought updates to the Apple Watch Series 11, Ultra 3, SE 3, and AirPods Pro 3, reinforcing Apple’s dominance across wearables and accessories. The hardware rollout drew plenty of consumer buzz, but financial markets were less impressed.

Market Reaction: Shares Ease Post-Unveiling

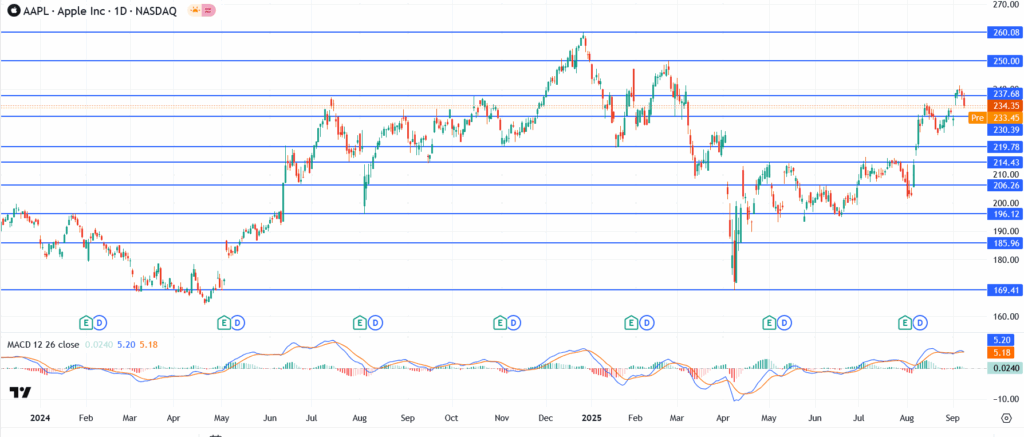

Apple stock (NASDAQ: AAPL) fell in pre-market trading immediately after the launch, down nearly 2% from Tuesday’s close. The slip leaves shares hovering around $233, off from last week’s peak above $237. The market reaction is typical of Apple unveilings: investors cheer the design and ecosystem upgrades, but traders quickly focus on whether the new models will drive margins and volumes in a competitive global smartphone market.

Analysts also flagged Apple’s continued reliance on premium pricing. At $999 in the US and nearly ₹1.2 lakh in India, the iPhone Air is firmly positioned for the high-end buyer. That strategy keeps margins intact but raises questions about growth in emerging markets.

Apple Share Price Chart Analysis

- Current price: $233.45

- Immediate support: $230.39

- Secondary support: $219.78

- Resistance zone: $237.68, last week’s high

Trade entry: Short-term traders may eye pullbacks into the $230 zone as a potential entry, provided support holds. A break below that level, however, would tilt risk toward $220.

Apple Stock Outlook

The launch reinforces Apple’s ability to generate consumer excitement, but the near-term stock reaction highlights investor caution. Wall Street has seen this pattern before: product unveilings spark headlines, yet the share price often drifts lower once the event premium fades.

For long-term holders, the iPhone Air could strengthen Apple’s brand halo and spur another round of upgrades, particularly in the premium market. But in the short term, the stock looks vulnerable to further consolidation if support at $230 gives way. With Apple still trading near record territory after a strong summer rally, investors may demand clearer signs of sales traction before pushing shares higher.

Apple Stock FAQs After the iPhone 17 Launch

Apple is still one of the most resilient names in big tech. Its balance sheet is clean, the services business keeps growing, and the iPhone upgrade cycle isn’t dead yet. That said, after a massive rally, the easy gains may be behind us. If you’re already sitting on strong profits, trimming a little for diversification makes sense, but for long-term investors, Apple remains a solid core holding.

On paper, yes, Apple’s valuation looks rich. But the market isn’t valuing it like a simple hardware maker. Investors are paying for the recurring cash flows from services, App Store, iCloud, Apple Music, and for the company’s ability to set global design standards. Still, at a 30+ multiple, the bar is high. Any disappointment in iPhone sales or margins could pressure the stock.

It’s true Apple hasn’t made the same flashy AI announcements as Microsoft or Google. But that’s their playbook, they rarely move first. Apple usually waits, then builds something polished that works seamlessly inside the ecosystem. Expect AI to show up more subtly, in the camera, in Siri, in app integration, rather than in headline-grabbing chatbots. The risk is that Wall Street grows impatient if Apple doesn’t show tangible progress soon.