Reliance Industries share price has continued to underperform the markets in July, dropping by 6 per cent. However, yesterday’s trading session saw a reversal of the long-term bearish trend, with prices rising by a percentage point. Today’s session has also continued with the bullish trend, and the markets are looking likely to close with a price gain of 0.5 per cent.

Why has Reliance Industries’ share price struggled?

Reliance Industries has grown to be one of India’s largest multinational conglomerates. The company, which deals with energy, natural gas, retail, telecommunications, mass media, and textiles, has found itself in a tough spot in the current economic climate, including inflation and an underperforming Indian rupee against the dollar.

As a leader in the energy sector, Reliance Industries has also come under pressure with the current global shortage in oil. The rising cost of gas around the world has also seen the company struggling, and its cost of operations going up.

According to a recent report analysed by Reuters, investors have also become cautious with their investments following a slew of terrible inflation data. The result has been translated into the markets, where we have seen shares across the National Stock Exchange of India continue to fall. Among these affected companies has been Reliance Industries, whose data shows it has dropped by 6 per cent since the month started.

Reliance Industries Share Price Analysis

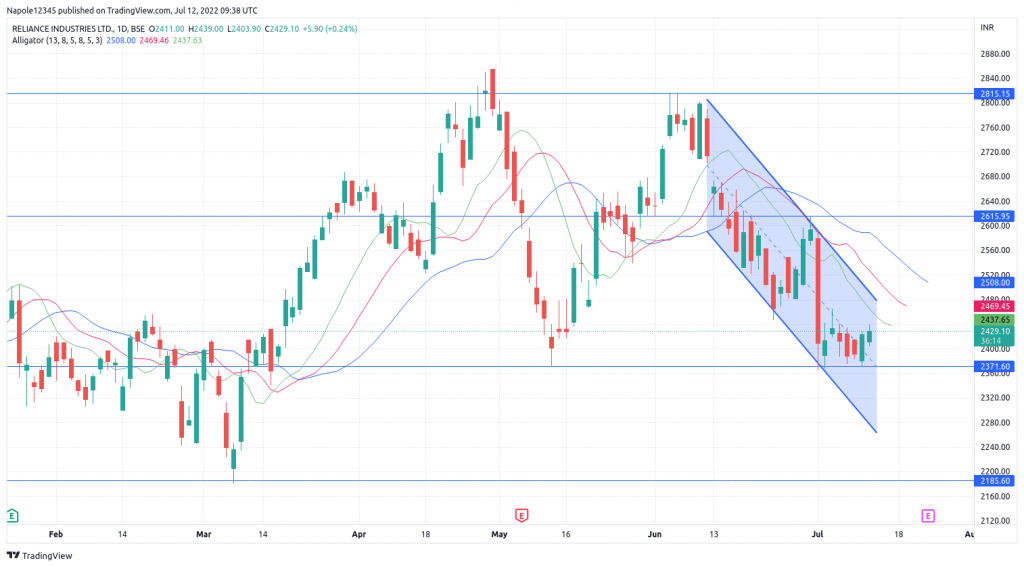

Looking at the chart below, Reliance Industries has continued to trend downwards for the past three months. Part of the reason why we have seen share prices continue to drop has been due to unpleasant inflation data and an Indian rupee that is at its all-time low against the dollar.

If these conditions do not change, I am expecting Reliance Industries’ share prices to continue dropping. There is a high likelihood that we will see the share price drop to trade below the 2,300 price level.

My bearish analysis will only be invalidated if India manages to control its inflation, and currency and bring the cost of living to pre-pandemic levels. If that is achieved, I expect Reliance Industries to resume the bullish trend.

Reliance Industries Daily Chart