- In this next housing crash prediction, we explain whether the property bubble will continue in the coming months of 2022.

The housing market has done well during the Covid-19 pandemic as demand for homes has outstripped supply and the cost of building material has jumped. As a result, there are concerns about whether this housing bubble or whether there will be a slowdown. In this next housing crash prediction, we will explain why home prices have jumped and whether there will be a repeat of what happened in 2008/9.

Global home prices have risen

Data published by most countries show that home prices have jumped sharply since the pandemic. In Australia, the Australian Bureau of Statistics data showed that home prices jumped by 5% in the third quarter and by 21% in 2021. As a result, the mean home price in the country has jumped to a record A$863,500.

In New Zealand, home prices by more than a quarter to over $900k, according to data by CoreLogic. The same trend is happening in the UK, where home prices rose by over 21,000 pounds in 2021.

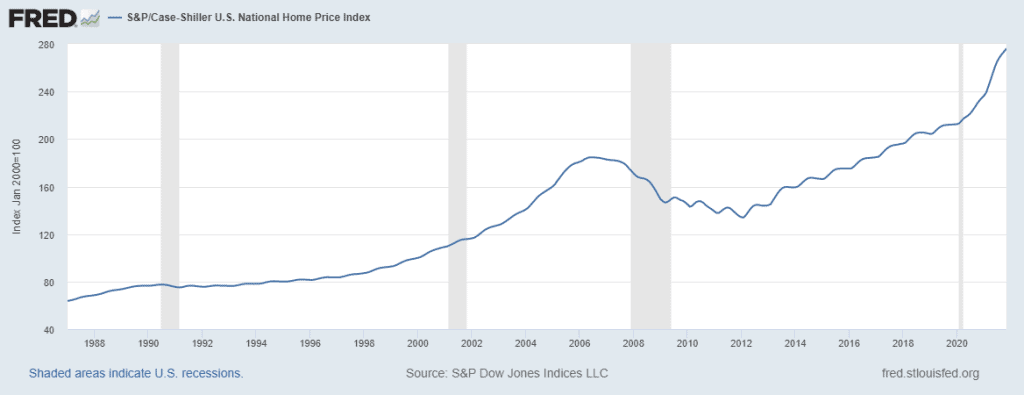

In the US, the closely watched Case-Shiller index has been in a strong bullish trend, as you can see in the chart below. The average home price in the US soared by 16.9% in 2021, bringing the average price to $381k.

The same trend happened in most developed countries like Japan, Switzerland, and Germany. Therefore, whenever there is such a big move, there are always fears that prices will tumble. This is what we will seek to explain in this next housing crash prediction.

Housing bubble: Why housing prices have soared

There are several reasons why home prices have soared in the past few years. First, there is the issue of supply. In most countries, governments announced lockdowns to slow the spread of the virus. As a result, many people who work in the property market reduced their output, leading to lower inventories.

Second, the pandemic led to higher demand for homes because of the savings that people generated when staying at home. As a result, most of them were able to save money to afford their deposits. That was not possible to achieve before the pandemic started.

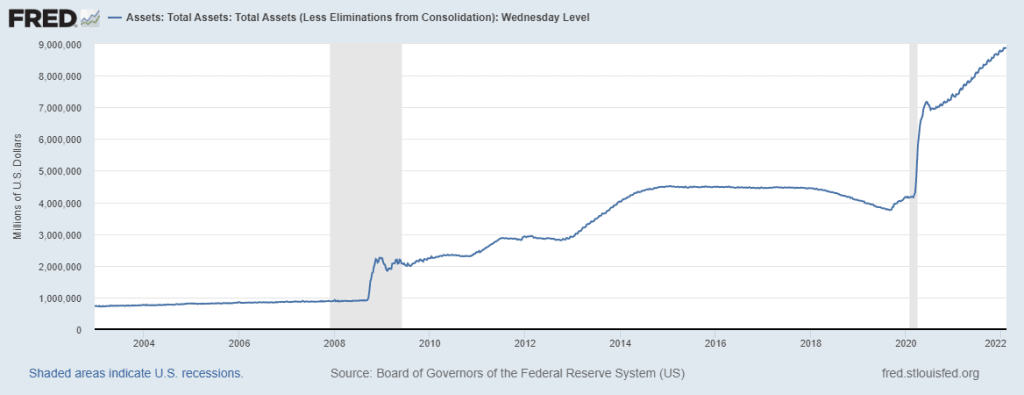

Third, home prices jumped because of decisions by central banks. For example, the Federal Reserve brought interest rates to a record low and announced its biggest balance sheet expansion on record. As a result, with low-interest rates, people could afford mortgages. The same trend happened among other central banks like the European Central Bank, Bank of England, and the Reserve Bank of Australia.

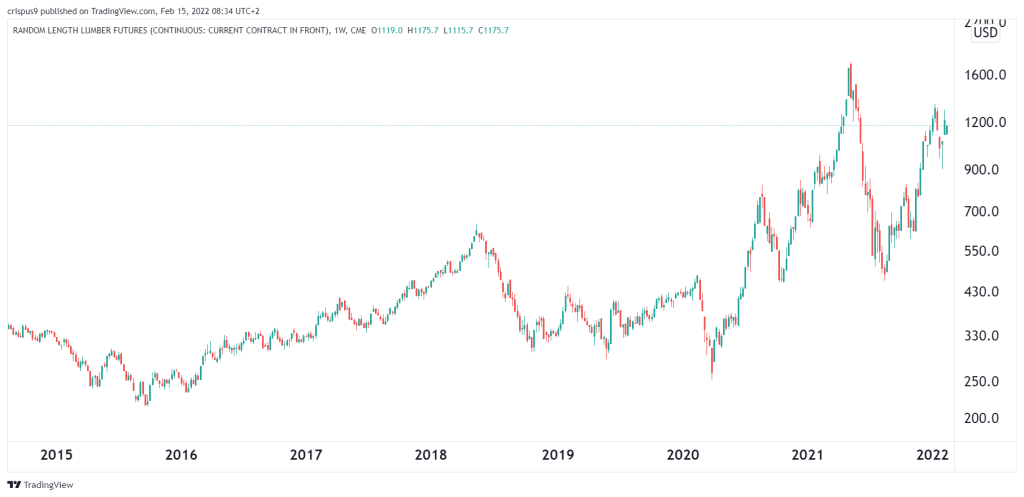

Fourth, the cost of the building rose during the pandemic. As shown below, the cost of lumber soared during the pandemic. Other building materials like cement and paint have also risen. Workers are also being paid more money partly because of the restrictions of migrants.

There are other reasons why housing prices have risen during the pandemic. For example, the robust performance of the stock and cryptocurrency market has led to more wealth. Most of these new wealthy people have channelled their wealth to the property market.

Risks to the housing market

To develop a good housing crash prediction, we need to look at some of the risks posing to the property market in 2022.

The biggest is that central banks have started hinting that they will turn hawkish this year. For example, the BOE has already delivered a 50 basis point rate hike in the past few months in the UK. Moreover, the bank has hinted that more hikes are on their way.

Similarly, the Fed has started slashing its quantitative easing (QE) purchases and hinted that it would deliver about three hikes this year. The ECB, RBA, and RBN are also expected to start tightening.

Therefore, rates will lead to slower demand for home prices in the most developed world as rates rise. As a result, home sellers will likely start and continue lowering their home prices.

Another reason why many experts are making their home price crash predictions is because many people have been priced out of the housing market. As a result, as prices jump, there will be a likelihood that prices will start slowing.

Meanwhile, there are risks that the Chinese housing market will continue its crash in 2022. As you recall, the housing market in the country went through jitters as the Evergrande crisis started. Other housing giants like Kaisa, Shimao, and Fortune Land have all moved into distress. China home prices have also declined recently. Therefore, if the trend continues, we could see ripple effects in other countries.

Next housing crash prediction 2022

To understand whether the housing bubble will burst in 2022, we need to understand why prices declined sharply in 2008.

The main cause was that many banks offered sub-prime mortgages to people who could not afford to make payments. As a result, as the Fed started hiking interest rates, the number of defaults soared, leading to a collapse.

However, market conditions are now significantly different from those in 2008. For ]

one, American giants like JP Morgan, Goldman Sachs, and Wells Fargo have changed their business model such that they are no longer exposed to the sector as they used to be. Instead, these companies are now focusing on other areas like institutional banking.

Another reason why a housing crash will likely not happen is that while mortgage debt has soared in the past few years, its share of the economy has been dropping, as shown below.

Finally, while inflation has soared, there is a likelihood that the Fed will hike interest rates at a gradual pace in a bid to prevent shocks in the market.

Summary: Will the housing bubble burst in 2022?

In this article, we have looked at some of the reasons why home prices have soared in most countries like the US and UK. We have also explained some of the risks that the home market faces in 2022. In general, we expect that home prices will slow down in 2022. However, we cannot characterize this as a housing crash.