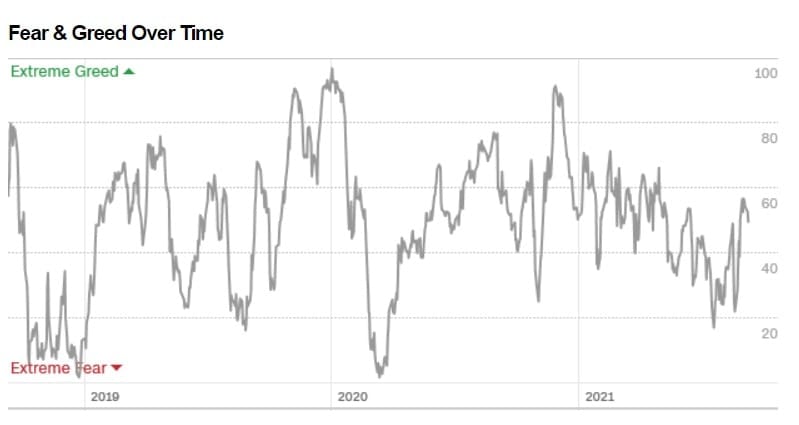

- What is the outlook of stocks as the fear and greed index declined to the fear zone? We highlight the key levels to watch next

The fear and greed index tilted towards the fear zone as investors waited for the latest European Central Bank (ECB) decision and US initial jobless claims numbers. This trend happened as the Dow Jones, S&P 500, and Nasdaq 100 indices tumbled. The same situation is happening in Europe, where the DAX index, FTSE 100, and CAC 40 indices declined.

Fear and greed index retreats

A sense of fear is returning to the market as investors wait for the ECB decision. The central bank is expected to leave its main interest rates unchanged as it tries ro to support the recovery. The main mover for European – and to some extent American – stocks will be its statement on quantitative easing (QE) policies. Stocks will likely fall if the bank signals that it will soon start tapering its asset purchases.

Stocks will also react to the latest American initial jobless claims numbers. The data is expected to show that initial claims dropped from 340k to 335k. These numbers will be notable since the US published weak nonfarm payrolls data last week. And yesterday, the Labor Department released the relatively strong vacancies numbers.

Still, there is a sense in which the global economy is slowing down. For example, data by the Royal Institute of Chartered Surveyors (RICs) showed that the number of homes bought in the UK declined for the second straight month in August.

Turning to the fear and greed index, we see that junk bond demand and put and call options have all moved to the extreme greed zone. At the same time, the stock price breadth and strengths have moved to the extreme fear zone. The safe-haven demand has moved to the fear level. So, what next for stocks?

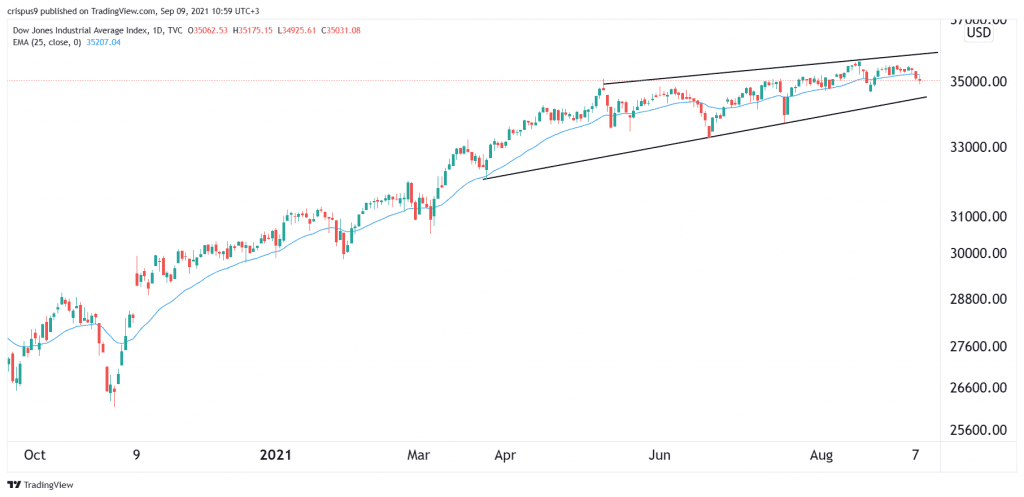

Dow Jones analysis

For this report, let’s focus on the Dow Jones. The daily chart shows that the index is hovering near its all-time high. Still, we see that it has lost its bullish momentum. Also, as I noted before, it has formed a rising wedge pattern.

Therefore, there is a likelihood that the index will continue sliding in the near term as investors take profit and they wait for the Fed decision later this month. Still, in the longer term, the stock will likely maintain its bullish trend since corporate growth will be faster than what analysts expect.