- The GBP/USD price is loitering near the lowest level since December last year after the latest UK jobs numbers

The GBP/USD price is loitering near the lowest level since December last year after the latest UK jobs numbers and ahead of the upcoming inflation data. The GBP to USD is trading at 1.3200, which is about 7.25% below the highest level this year.

The Office of National Statistics (ONS), the UK unemployment rate declined to 4.2% in October this year. This was the lowest level since the pandemic started. At the same time, the average earnings without bonus rose to 4.3% and 4.9% with bonuses. The number of claimant count increased by more than 49k in November as the Covid-19 cases rose.

The next key catalyst for the GBP/USD pair will be the latest inflation numbers that will come out on Wednesday. The data is expected to show that the country’s inflation jumped sharply in November. These numbers will come on the same day that the Federal Reserve will deliver its interest rate decision. The Bank of England (BOE) is expected to sound a bit cautious as the number of Covid cases rise.

GBP/USD forecast

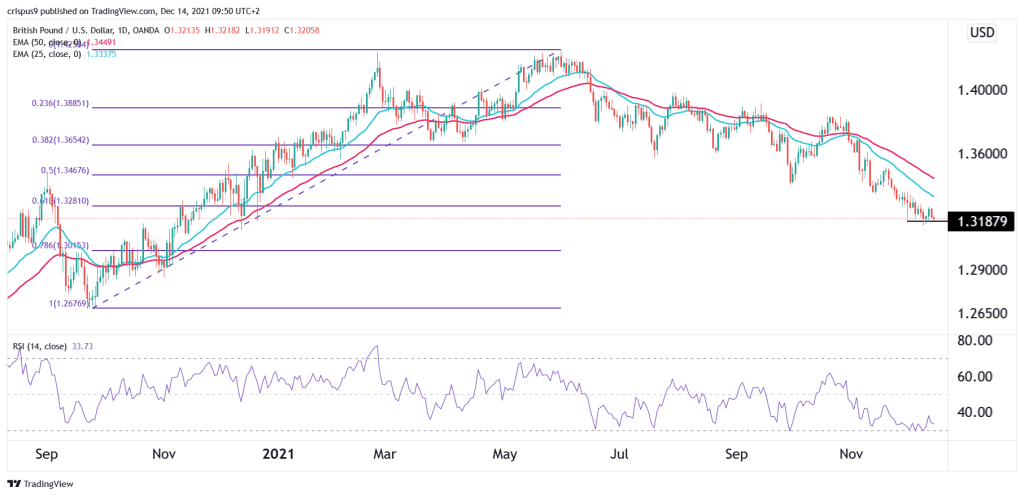

The daily chart shows that the GBPUSD pair has been in a deep decline in the past few months. The pair has managed to move below the 61.8% Fibonacci retracement level. It has also moved below the 25-day and 50-day moving averages. The MACD has also been in a deep dive in the past few weeks.

Therefore, the path of the least resistance for the pair is lower as the divergence between the Fed and Bank of England widens. This could see it retest the key support at 1.3100. This view will be invalidated if the price rises to 1.3280.