Danger signs are emerging in the housing market in the US and other rich countries as interest rates rise. Recent data show that new and existing home sales are falling as buyers remain cautious. The same trend has happened in other assets. Cryptocurrency prices have lost more than a trillion dollars while stocks suffered a major meltdown. In this next housing crash prediction, we will look at when it happens.

Are we in a housing bubble?

Housing prices have skyrocketed in the past few years as buyers get more addicted to low-interest rates. In the UK, the average price of a home has surged to an all-time high of £278,000. In the US, the average house price has jumped to an all-time high of $429,000, significantly higher than before the pandemic started. The same trend is seen in other countries like Australia and New Zealand.

There are several reasons why house prices have surged. First, interest rates have remained at record lows for a long time, which has made the cost of borrowing significantly cheaper. Second, the cost of building materials like lumber have surged in the past few months.

Third, the pandemic led to more demand for second homes, especially in the United States. Fourth, during the pandemic, governments in the US and other countries offered trillions in stimulus. Most of these funds flowed to the housing sector. Additionally, many people saved a lot during the lockdowns.

Next housing crash prediction

There are signs that the next housing crash could happen soon. First, mortgage rates have surged to a decade high of 5.9%, and there are signs that they will rise to over 7% by the end of the year. Therefore, with inflation also surging, there is a likelihood that demand for housing will be a bit cool.

Second, pending home sales have crashed in the past five months straight. This is a sign that the number of people buying homes has declined. Third, there are concerns that the number of people who can buy these homes will keep falling. For example, the average salary in the US is about $64,000. This means that a person would need to save their salaries for over six years to afford an average home.

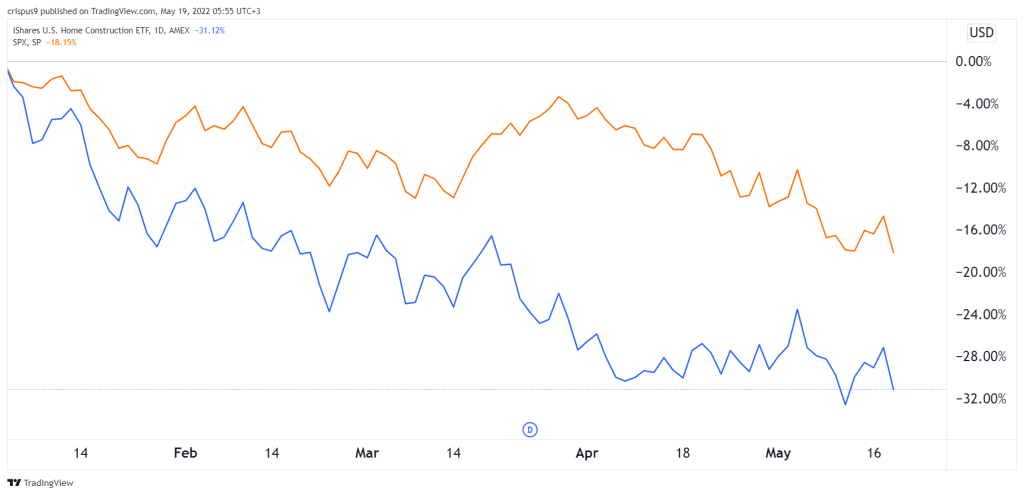

Third, other assets have also declined sharply recently. For example, stocks have all nosedived, meaning that most 401 (k) people have gotten poorer. Cryptocurrencies have also declined sharply. Therefore, the next key sector to fall could be housing. This explains why many home builders shares have plummeted. In an interview on Wednesday, billionaire Jeremy Grantham warned the following about the next housing crash.

Finally, there are signs that housing prices are slowing, which usually happens before a crash. For example, the average house price rose by 9.3% in March in the UK. This was a slowdown from the previous month’s 11.3%. This is in line with what I predicted recently. As shown below, the iShares home builder ETF has underperformed the S&P 500 index.