- Nvidia earnings could shake the Nasdaq 100 as traders await key AI data. Will the chip giant deliver another blowout or spark a pullback?

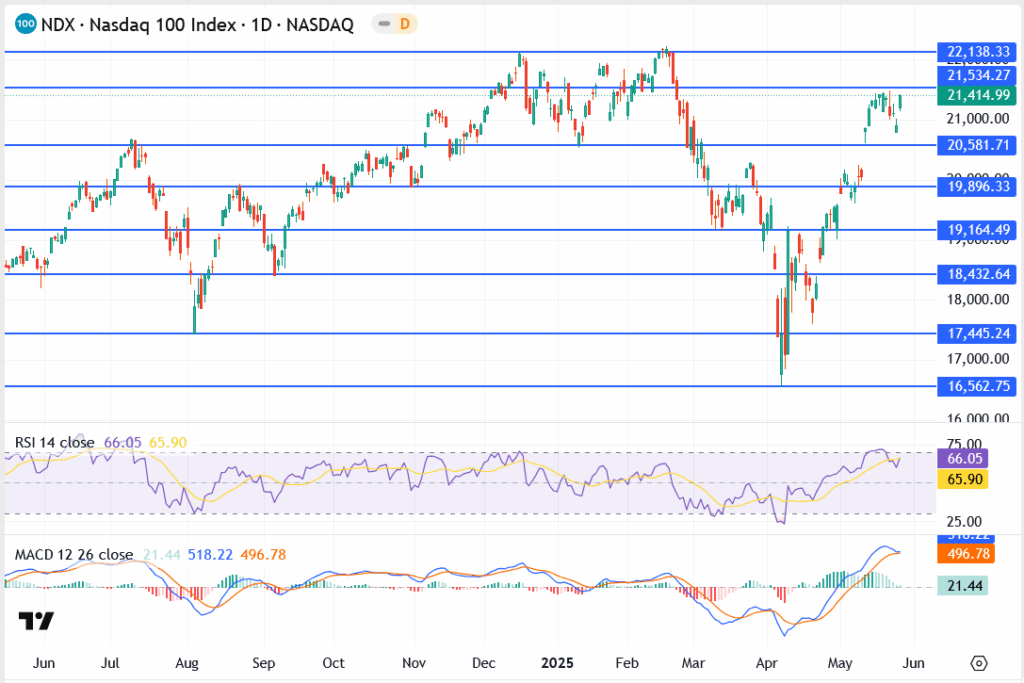

The Nasdaq 100 share price today is showing signs of fatigue after a solid rally in recent weeks, hovering just below the 21,500 level. The Index is trading at 21,414.99 in pre-market trading, with traders cautious ahead of U.S. GDP data and PCE inflation figures due later this week.

Tech stocks continue to do the heavy lifting, but the momentum that drove April’s breakout is starting to slow. With the index trading in a tight range between 21,298 and 21,472, bulls now face a critical test near resistance at 21,534.

Nasdaq 100 Price Outlook and Forecast

The Nasdaq 100 forecast remains cautiously bullish as long as price holds above the 21,000 mark. However, the lack of fresh catalysts and rising caution across risk assets could keep the index range-bound for now.

Resistance Levels:

- 21,534.27 – key ceiling for the week

- 22,138.33 – March high, breakout target

Support Levels:

- 21,000.00 – psychological floor

- 20,581.71 – short-term demand zone

- 19,896.33 – prior breakout point

On the momentum side, RSI is at 66.05, brushing close to overbought, while the MACD is still in positive territory but flattening. The setup reflects hesitation, not reversal, but buyers need a catalyst to break higher.

Top Nasdaq Stocks: Nvidia Reclaims $135, Microsoft Tests Resistance, Apple Still Sideways

The Nasdaq 100’s three heavyweights are showing mixed behavior in pre-market action. Here’s where things stand early on Wednesday:

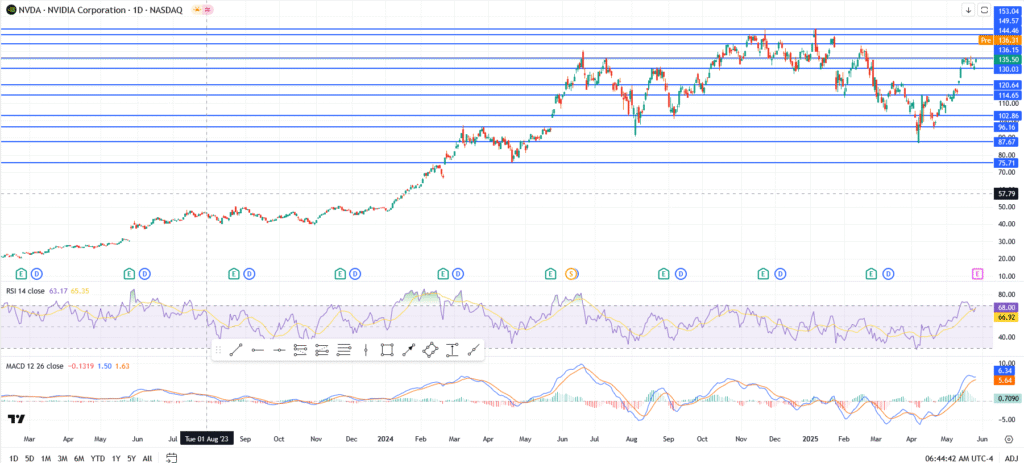

Nvidia (NVDA)

Nvidia is pushing higher again, last seen trading near $135.50, with bulls eyeing that resistance zone at $136.31.

- RSI is cooling slightly at 63.17, but still supportive of upside continuation

- MACD remains bullish, with the signal line holding positive

- If $136.31 breaks, the next big test sits at $144.46. A rejection, though, could drag the stock back toward $130.03, the last pivot support

So far, the setup leans bullish, but traders should watch closely for exhaustion near the top of this range.

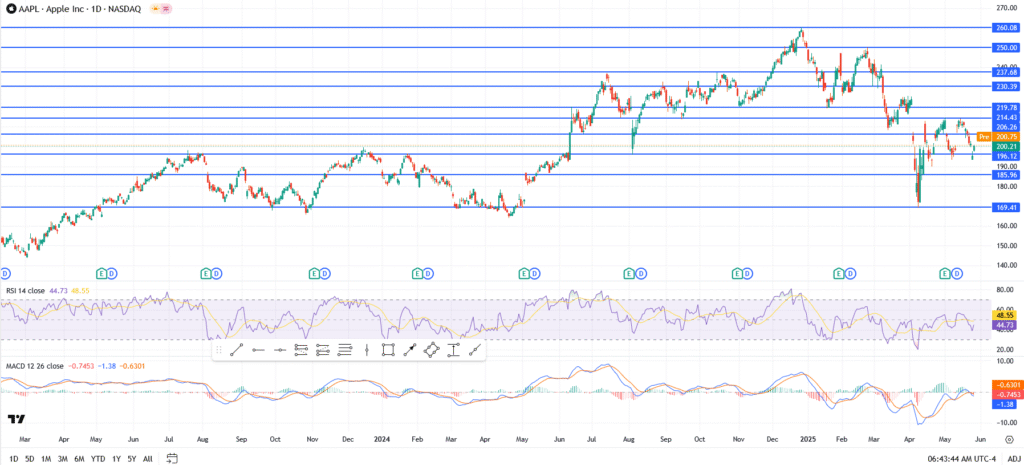

Apple (AAPL)

Apple is showing less energy than its peers, still hovering around $200.21, down from recent highs.

- RSI is weaker at 44.73, signalling indecision or mild bearish drift

- MACD is flat-to-negative, with no real directional impulse

- Key levels to watch: Support at $196.12, and resistance at $206.26

Unless momentum improves, Apple may remain stuck in sideways action, possibly a wait-and-see ahead of summer product events.

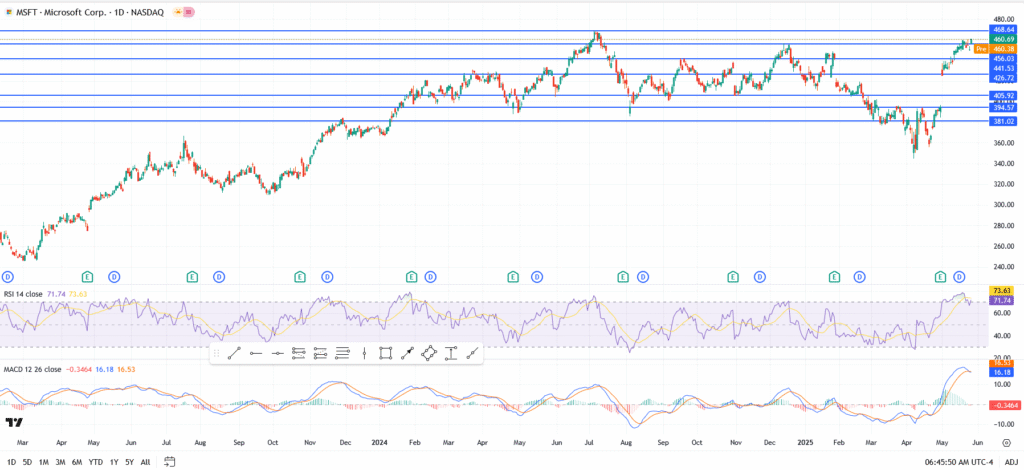

Microsoft (MSFT)

Microsoft is flirting with resistance again, trading near $460.38 in pre-market hours.

- RSI is elevated at 71.74, bordering on overbought territory

- MACD remains firmly bullish, though a bit extended

- Support sits at $456.03, with the next resistance up at $468.64

The trend is still with the bulls, but short-term traders may start locking in gains if $460–$468 proves too sticky.