- Why is the market down today? Explore the key factors driving the latest U.S. stock and crypto sell-off and investor sentiment.

“Why is the market down today?” is the question dominating trading desks, financial newsrooms and social-media feeds whenever the S&P 500, Nasdaq or Dow suddenly turn red. A sharp pullback often sparks anxiety, especially for newer investors who haven’t lived through major swings. But market declines rarely happen for a single reason. They’re usually the result of a combination of economic data, interest-rate expectations, earnings sentiment, geopolitical disruptions and shifts in investor psychology.

This guide breaks down the main drivers behind today’s U.S. market drop, why volatility has intensified, and how investors can respond without making emotional decisions.

Understanding How the U.S. Stock Market Moves

Before unpacking today’s decline, it helps to understand how American markets operate. Wall Street functions as a real-time barometer of business conditions. Companies list shares on exchanges like the NYSE and Nasdaq to raise capital, while investors buy and sell based on expectations of future earnings and economic growth.

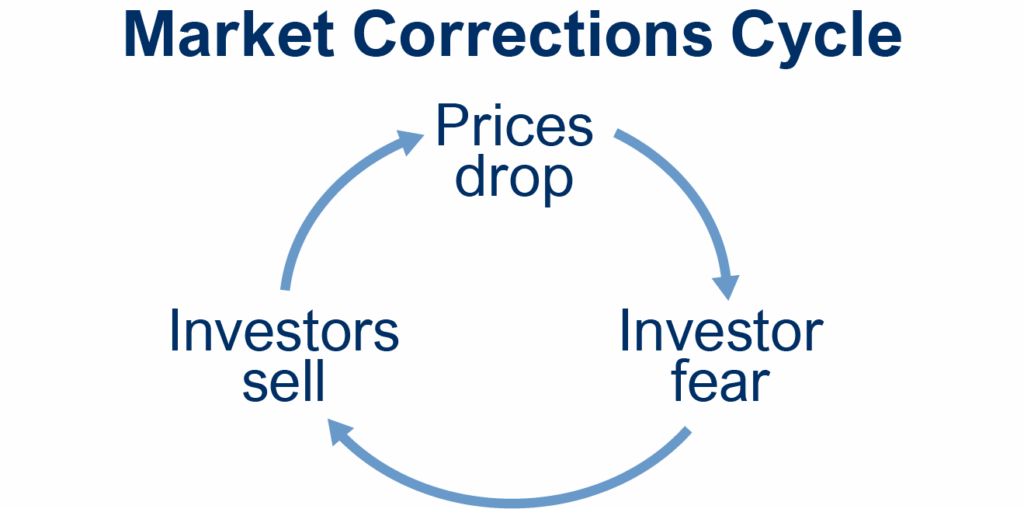

Prices move every second through supply and demand. When optimism rises, buyers outnumber sellers. When fear creeps in, selling accelerates. That basic dynamic is simple, but the forces shaping sentiment are complex. Everything from inflation readings to Federal Reserve speeches can spark dramatic market swings.

Morningstar’s 2024 “Mind the Gap” study found that investors often underperform the market during volatile periods because emotional reactions cause poorly timed buying and selling. This behavior becomes more pronounced when market headlines turn negative.

Why Do Market Prices Drop? Key U.S. Market Pressures Today

Below are the main catalysts that usually trigger broad declines across the Dow Jones, S&P 500, Nasdaq 100 and major crypto assets.

Sticky Inflation and Rising Treasury Yields

Inflation remains one of the most powerful market movers. When consumer prices run hotter than expected, traders anticipate that the Federal Reserve may delay rate cuts or even consider tightening again.

Higher interest rates push Treasury yields up, making bonds more attractive relative to stocks. This often leads to rotation out of risk assets.

The NY Fed noted that yield spikes tend to increase equity volatility as investors reassess valuations. When 10-year yields climb, tech stocks and growth sectors, which rely heavily on future earnings, usually feel the biggest impact

Weak Earnings or Soft Forward Guidance

Corporate earnings season often dictates the tone of the U.S. market. Even when companies beat expectations, cautious forward guidance can spark a sell-off. Wall Street reacts strongly when major players like Apple, Tesla, Microsoft or Nvidia warn of slowing demand, margin pressure or supply-chain disruptions.

In periods where multiple large-cap companies downgrade their outlooks, the entire market tends to feel the heat.

Geopolitical Risks and Global Market Stress

The U.S. market doesn’t move in isolation. Global tensions, whether related to trade disputes, energy supply shocks, military conflicts or economic sanctions, can trigger risk-off sentiment.

A Deloitte global-risk survey noted that geopolitical instability ranks among the top catalysts for institutional volatility spikes. When European or Asian markets tumble overnight, U.S. futures typically follow.

Crypto Market Correlations Add Another Layer

Over the past three years, Bitcoin, Ethereum and major altcoins have become increasingly correlated with the Nasdaq and high-growth stocks. When equities drop, crypto often amplifies the move.

During the sharp tech sell-offs in 2022 and 2023, studies showed synchronized drawdowns across digital assets as liquidity tightened. This correlation remains important, especially when large leverage flush-outs occur during market stress.

Algorithmic Trading and Faster Market Reactions

Another factor often overlooked is the speed at which markets react. Algorithmic funds and automated strategies can intensify sell-offs during volatile sessions. When technical levels break, such as the S&P 500’s 50-day or 200-day moving average, selling programs often accelerate momentum.

This doesn’t mean fundamentals changed. It simply reflects a faster feedback loop.

Retail Sentiment and Emotional Selling

Retail traders now play a major role in day-to-day market swings, especially in heavily watched tech names, crypto tokens and meme-style stocks. Panic selling tends to accelerate during fast intraday drops, where emotion overrides strategy and short-term fear amplifies volatility.

Research highlighted by Verified Investing notes that during periods of stress, investors often shift into loss-avoidance mode and fall into herding behavior, following what others are doing rather than relying on independent analysis. This psychological pattern can deepen temporary declines and make market shocks spread faster across assets.

How Investors Can Navigate a Down Market Without Panic

Market drops aren’t new. Pullbacks, corrections and crashes have been part of the markets since the begining of time. But, term returns remain resilient.

Here are some real-world strategies tips i will give to help stay calm and invest smarter during a sell-off.

- Stay Calm and Avoid Emotional Decisions – Reacting impulsively often locks in losses.

- Assess the Cause, Not Just the Price Move – A decline driven by rates or macro data is very different from one caused by systemic risk. Understanding the “why” behind the move helps shape smarter decisions.

- Stick to Your Strategy – If your plan is long-term, temporary volatility shouldn’t derail it. The S&P 500 has recovered from every downturn in history and continued to make new highs.

- Look for Opportunistic Entries – Market dips frequently offer discounted entry points into strong companies. Investors who used past pullbacks to accumulate quality stocks benefited significantly in later rallies.

Bitcoin’s Major Pullbacks and Comebacks

Bitcoin has a history of deep drawdowns followed by strong recoveries. The 2013–2014 crash after Mt. Gox, the 2017–2018 crypto winter, and the 2021–2022 liquidity-driven sell-off all saw declines of more than 70 percent, yet each cycle eventually produced new all-time highs.

These patterns support a broader market truth. Sharp corrections in risk assets, whether in stocks or crypto, rarely signal the end of long-term growth when underlying adoption and macro conditions improve.

2008 Financial Crisis

The collapse of Lehman Brothers triggered a global sell-off that sent U.S. indices to multi-year lows. Despite the panic, those same indices went on to deliver one of the strongest and longest bull markets in modern history.

2020 COVID Crash

Markets fell into a bear market at record speed as lockdowns froze economic activity. What followed was equally historic. Coordinated stimulus and a rapid shift in investor expectations drove a V-shaped recovery that took major indices to fresh highs within months.

Across all these episodes, the pattern is consistent. Sharp fear-driven declines are often followed by strong recoveries once policy, liquidity, and sentiment reset. That doesn’t make downturns comfortable, but it does provide important context whenever today’s market screens turn red.

Conclusion: Market Drops Are Normal, Your Reaction Matters Most

If the market is down today, it doesn’t automatically signal disaster. Stocks move in cycles. Economic data, shifting Fed expectations, global tensions and investor psychology all play a part in daily volatility.

The strongest investors focus on context, discipline and long-term positioning rather than headlines. Market declines are uncomfortable, but with a clear plan and steady mindset, they can also become opportunities.

The market is down today because investors are reacting to fresh U.S. economic data showing sticky inflation, rising Treasury yields, and renewed risk-off sentiment across global equities and cryptocurrencies.

The market dropped due to caution ahead of the US Federal Reserve meeting, continued FII outflows, and a weakening rupee, which together pressured sentiment and triggered broad-based selling.

Profit booking in small and midcaps, rising Japanese bond yields creating volatility concerns, and uncertainty around the India–US trade deal contributed to sharp intraday declines.

U.S. markets slipped as investors turned cautious ahead of the Federal Reserve’s final policy meeting of the year, with traders reassessing rate-cut expectations and reducing risk exposure.

Yes. FedWatch data shows traders pricing in an 88 percent probability of a rate cut, but policymakers remain divided, which keeps short-term market sentiment fragile.