The Clover Health share price has been under pressure in the past few weeks as investors position themselves for the upcoming quarterly results. The CLOV stock is trading at $3.08, which is about 54% above the lowest level this week. However, the shares are still 90% below their all-time high. This means that its market cap has crashed from an all-time high of over $6 billion.

What next for CLOV?

Clover was one of the most popular stocks in early 2021 as the meme investing euphoria happened. At the time, the stock managed to move from about $10 to $28. Unfortunately, these gains were short-lived as the company became a penny stock. Other firms that did well during the meme stock era, like ContextLogic, Robinhood, Virgin Galactic, and Palantir, have also had a turbulent period.

The Clover Health share price has also struggled as investors have been concerned about the Medicare changes of the Biden administration. In February this year, the government announced a new program known as ACO Reach, created in the previous administration. The goal was to transform how doctors were paid for caring for Medicare patients.

Analysts believe that these changes will benefit Clover Health and other firms in the industry like VillageMD and Cano Health. Clover said that it would serve over 165,000 people in the program this year in a recent statement. As a result, it expects to make between $2 billion and $2.3 billion in revenue. Therefore, analysts are waiting for more clarity about the program and the upcoming results. However, the consensus is that the firm’s revenue jumped to over $700 million in Q1 while its loss per share fell to 25 cents.

Clover Health share price forecast

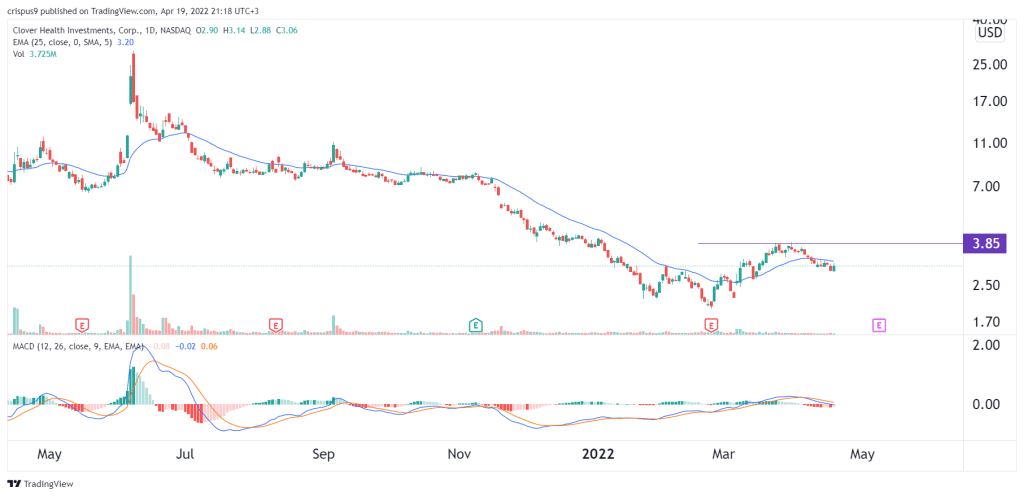

The daily chart shows that the Clover stock price has been moving sideways in the past few days as its volume has dried up. The shares remain close to the 25-day moving average while the MACD dropped below the neutral level. A closer look shows that the stock has formed a small inverted head and shoulders pattern.

Therefore, while it is too early to tell, there is a likelihood that the stock will have a bullish breakout ahead or after earnings. If this happens, the next key resistance level to watch will be at $4.