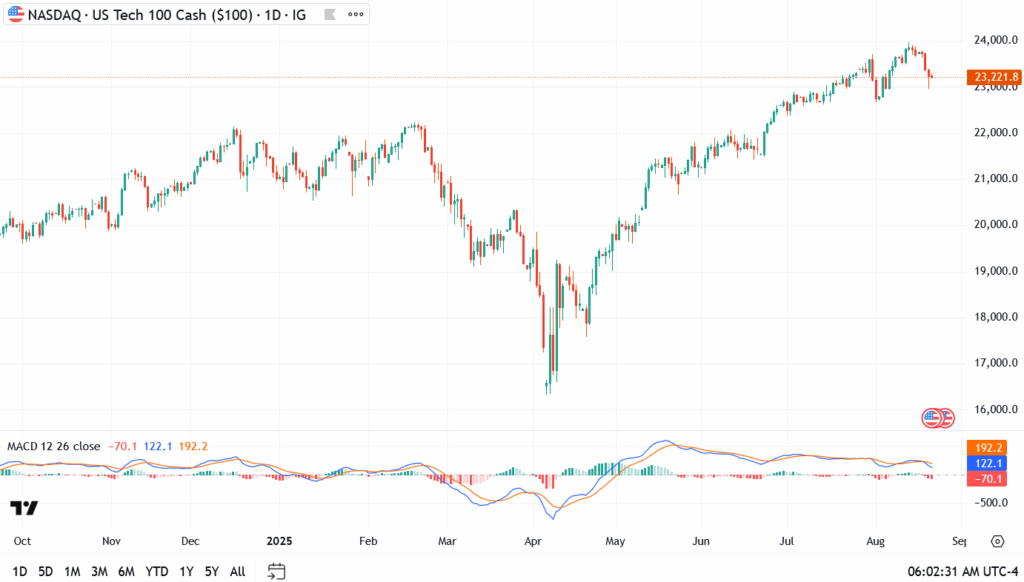

The Nasdaq 100 is pointing lower in Thursday’s pre-market, trading near 23,221 after brushing record levels last week. Tech’s run has been relentless, but momentum cooled as traders digested the Fed’s latest minutes and Intel’s bruising selloff. Futures show buyers still defending the 23,200 line, though the tone is more cautious after the streak of gains.

Why Is the Nasdaq Under Pressure This Morning?

Traders are still digesting the Federal Reserve’s July meeting minutes, released late Wednesday. The notes showed a divided committee: some members argued inflation is easing quickly enough to justify rate cuts, while others warned the risk of sticky prices remains. That split rattled expectations for a September cut, sending Treasury yields higher in overnight trade and denting appetite for richly valued tech stocks.

The weakness was compounded by Intel’s 7% slide after hours. The chipmaker’s soft guidance cast fresh doubt on its turnaround, sparking selling across the semiconductor space. Microsoft and Apple futures held steadier, but the Nasdaq 100 as a whole felt the weight. After weeks of clean momentum, the index is finally facing turbulence with macro and micro headwinds hitting at once.

Nasdaq 100 Technical Analysis

- Current level: 23,221

- Pivot level: 23,200

- Resistance: 23,500, then 23,800

- Support: 23,000, then 22,500; deeper shelf at 21,800

The index is sitting on its pivot. A push through 23,500 would put last week’s 23,800 peak back on deck. Slip under 23,200, though, and the market will likely press 23,000 fast. MACD momentum has cooled, signaling consolidation more than collapse.

In other Nasdaq news,

Windtree Therapeutics Shares Plunge After Nasdaq Delisting

Windtree Therapeutics was crushed on Wednesday, diving 77% after the company confirmed it would be kicked off the Nasdaq. The stock had been clinging to compliance for months, failing to keep its head above the $1 minimum bid rule. Now the delisting ends its stint on a major board and pushes it onto the over-the-counter market, a downgrade that drains liquidity and strips away the institutional spotlight. Traders who once leaned on the turnaround story were left holding the bag as the stock collapsed to new lows.

The collapse underscores how unforgiving the biotech trade has become. Windtree’s pipeline had already faced questions over funding and clinical momentum, and without the credibility of a Nasdaq listing, its ability to attract new capital looks even weaker. In a market that is still rewarding large, cash-rich pharma players, small-cap names with compliance issues are being punished without mercy. For traders, Windtree is now the latest cautionary tale, compliance failures and weak balance sheets can erase shareholder value far faster than science or strategy ever will.

Nasdaq 100 Outlook: Dip or Start of a Slide?

For bulls, the mission this morning is clear: hold 23,200 into the cash open and turn futures momentum back toward 23,500. A push through that ceiling would steady nerves and put last week’s 23,800 high back on the table. With the Fed minutes still echoing and yields ticking up, it won’t be easy, but dip buyers are watching that level closely.

For bears, patience is the play. A sustained break below 23,200 in today’s session would flip the bias, inviting momentum sellers to press for 23,000 and, if pressure builds, 22,500. That zone lines up with the broader August breakout, meaning a failure there risks turning a routine pullback into a trend test. Traders don’t need to chase every tick here, the chart is about to show whether this is just digestion, or the start of something heavier.