The Hang Seng is not finding any love as technology stocks tumble. HSI is trading at H20,630, which is about 8.5% below the highest level this month. It has underperformed other leading global indices like the Dow Jones and German DAX. Also, it has fallen by over 34% from its highest point on February 18th last year.

Hong Kong stocks are going through a difficult period as the Covid-19 pandemic coincides with tougher regulations by the Chinese government. In addition, China has announced major shutdowns in Shanghai and other cities in the past few weeks as part of its Covid-zero strategy. As a result, there are concerns that the slowing economy will impact demand for most Hang Seng companies.

At the same time, there is the challenge of the technology sector that has been tightly regulated. Last week, regulators announced that they were banning live streaming of unauthorised video games. As a result, the NetEase share price has been among the worst performers in the Hang Seng index. China is also not slowing down its criticism of other tech companies like Alibaba and JD.com.

WuXi Biologics was the worst-performing Hang Seng constituent on Thursday as its stock crashed by 8%. Other laggards were tech stocks like Alibaba, Meituan, Xiaomi, Tencent, and Alibaba Health Information. On the other hand, the best performers in the index were HSBC, CLP Holdings, Power Assets, Wharf Real Estate, and Citic Pacific, among others.

Hang Seng forecast

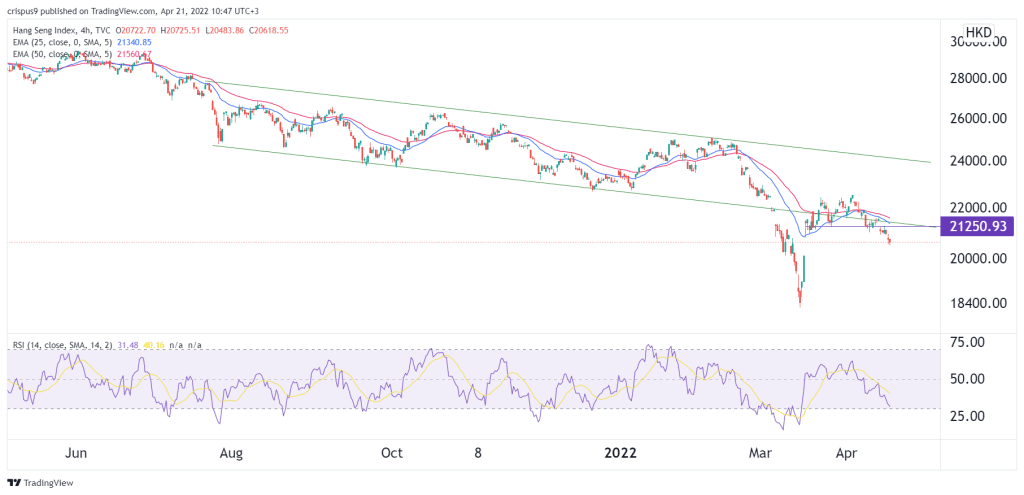

The Hang Seng index has been in a bearish trend in the past few days. As a result, it has moved below the lower side of the descending channel, which is shown in green. The index has also moved slightly below the 25-day moving average. It has also dropped below the important level at $21,250, which is the chin of the double-top pattern. The Relative Strength Index (RSI) is also facing lower.

Therefore, the path of the least resistance for the Hang Seng is lower, with the next key support level being at $20,000. A move above $21,250 will cancel the bearish view.