Exxon Mobil’s Q2 2019 earnings per share and revenues topped the earnings forecasts by analysts. Exxon Mobile posted earnings of 73 cents per share, which was far greater than the 68 cents that was predicted by analysts. Furthermore, revenues rose to $69.091 billion, versus the consensus figure of $65.77 billion.

Earnings were boosted by a tax benefit the company received in Alberta. Revenues were boosted by upbeat performance in its upstream division, with a 90% increase in its Permian Basin oil fields. Total production in its upstream operations was up 7% to 3.9million barrels per day.

The performance of the company’s upstream operations more than made up for the underwhelming performance of the downstream and chemicals divisions of the company. Revenues from the downstream and chemicals operations fell to $451million and $188 million respectively.

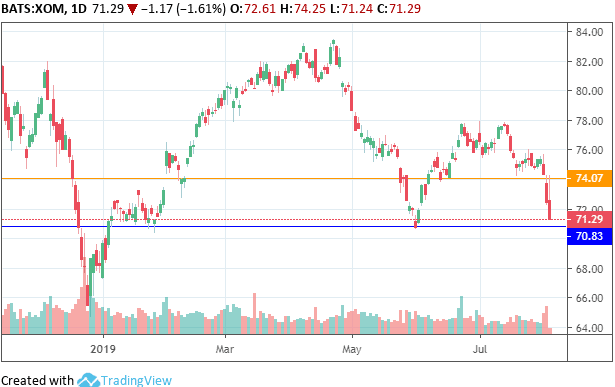

Exxon Mobil Opens Lower

Crude oil prices fell 7% on Thursday and have only posted a mild recovery in Friday trading. This has affected the prices of oil company stocks, many of which are trading lower. The US markets are also lower after new trade tariffs were imposed on Chinese products. Exxon is currently testing the S1 pivot support at 70.83 (January and May 2019 lows), having broken the S1 pivot support price of 71.67.

Market sentiment is bearish. However, if support at 70.83 is able to hold, some price recovery to the 71.67 price level may occur. A downside breach of 70.83 opens the door to 69.67 in the near term.Don’t miss a beat! Follow us on Twitter.

Download our latest quarterly market outlook for our longer-term trade ideas.

Do you enjoy reading our updates? Become a member today and access all restricted content. It is free to join.