YES Bank shares rose for the third trading session in a row on Tuesday, gaining 2.38% to trade at Rs. 27.80 at press time. The bank’s recent impressive performances have stimulated the demand for its shares ahead of the release of its earnings report on Friday, April 26th. YESBANK has gained 5.81% in the last three sessions and the upside is likely to continue for much of the week, as most investors expect the bank to report improved earnings. Barring bad news from in the market, the positive sentiment around the earnings report is likely to support the upside for the rest of the week.

On April 21, YES Bank revealed in an exchange filing that that it had received Rs 1,422.58 crore in allotment of shares to CA Basque. The amount came from the allotment of 1.28 billion equity shares, each of which had a face value of Rs 2. The allotment has raised the total issued paid up shares to Rs 6,009 from Rs 5,753 crore.

Additional support for the bank’s stock came in the form of income-tax computational statements that calculated a refund of Rs 284.21 crore, including interest of Rs 113.44 crore, for the assessment years 2011–2012 to 2013–14. Furthermore, as per the revised listing rules, the portion of the aforementioned return that needs to be recorded in the bank’s profit and loss statement exceeds the materiality requirement. This will be reflected in its books.

Technical analysis

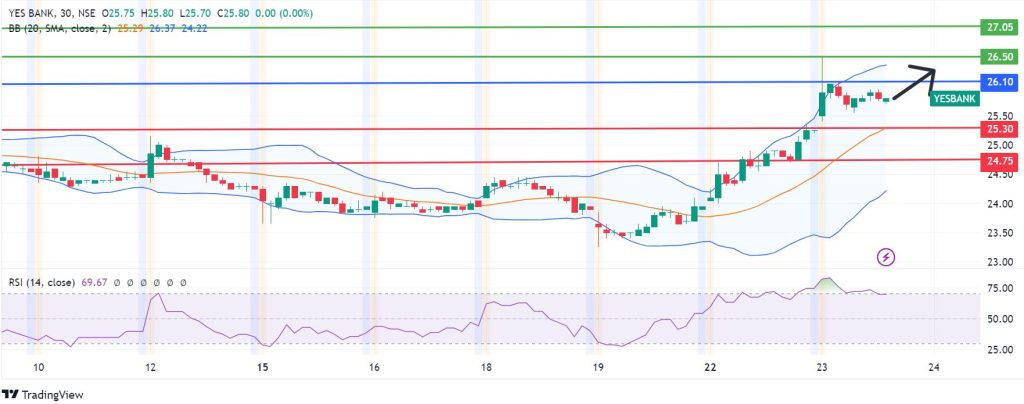

YESBANK shares have an upward momentum, as shown by the strong RSI reading. The buyers are likely to remain in control if they keep the share price above the 26.10 pivot mark. That will favour them to breach the resistance at 26.50 and potentially test 27.05 in extension. Conversely, a move below 26.10 will favour the sellers to be in control, with control coming at 25.30. A continuation of control by the sellers could break the support, enabling them to build the momentum to target a lower support at 24.75.