The EUR/USD had a bearish breakout yesterday as traders waited for a speech by Jerome Powell. It then pared back some of these losses after he delivered a dovish statement. The EURUSD is now trading at 1.2140, which is slightly higher than yesterday’s low of 1.2112.

What happened: Unlike some of his peers, Jerome Powell delivered a relatively dovish statement. He warned that the US economy was not out of the woods yet and that the situation would remain like that for a longer period.

In other statements, Raphael Bostic and Richard Kaplan said that the Fed would possibly start hiking rates earlier than expected. Also, Joe Biden unveiled a $1.9 trillion stimulus package that was relatively smaller than what other analysts were expecting.

What’s ahead: The EUR/USD will today react to the US retail sales numbers that will come out in the afternoon session. Economists expect the data to show that the overall sales dropped in December due to the lockdowns. They see the headline and core retail sales falling by 0.2% and 0.1%, respectively. The pair will also react to the US PPI, capacity utilisation, and industrial production data.

EUR/USD forecast

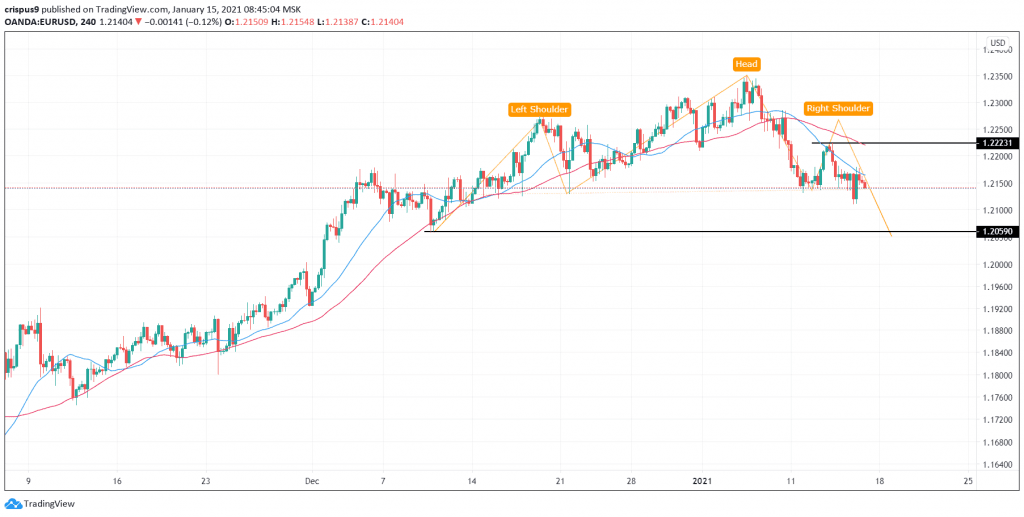

On the four-hour chart, we see that the EUR/USD pair has formed a head and shoulders pattern. This is usually a bearish pattern. It also remains below the previous support of 1.2150 and the short and longer-term moving averages.

Therefore, the pair will most likely move in the direction of yesterday’s bearish breakout. If this happens, the next level to watch will be the support at 1.2060. However, a move above the resistance at 1.2223 will invalidate this trend.

Don’t miss a beat! Follow us on Telegram and Twitter.

EURUSD technical chart

More content

- Download our latest quarterly market outlook for our longer-term trade ideas.

- Follow Crispus on Twitter.

- Do you enjoy reading our updates? Become a member today and access all restricted content. It is free to join.