- Indian pharma stocks tumble as Trump slaps 100% tariffs on branded drugs. Sun Pharma, Dr. Reddy’s and Laurus Labs lead the fall.

Pharma Stocks Tumble After Trump’s Tariff Announcement

Indian pharmaceutical stocks came under heavy pressure on Friday after U.S. President Donald Trump announced a 100% tariff on branded and patented pharmaceutical products, effective October 1, 2025.

The Nifty Pharma index dropped nearly 2% to 21,500 intraday. Shares of Laurus Labs plunged over 7%, making it the biggest loser of the session, while Natco Pharma fell 4.61%, Biocon slipped 4.09%, and Zydus Life dropped 3.3%. Among the heavyweights, Dr Reddy’s and Sun Pharma also fell sharply, dragging the sector lower.

Trump’s 100% Tariff Impact on Indian Pharma Stocks

The U.S. is India’s largest export market for pharma. By doubling duties on branded drugs, companies will either need to absorb higher costs, pass them on to customers, or risk losing market share.

100% tariffs will be imposed unless pharmaceutical companies build plants in America.”

Stated Trump

That creates fresh uncertainty for Indian drugmakers, especially those with branded product portfolios in the U.S.

Sun Pharma Shares Down Over 2% After Tariff Shock

Unlike most Indian players who focus primarily on generics, Sun Pharma has meaningful exposure to branded drugs in the U.S. market, which accounted for around 31% of its consolidated revenue in FY25. Its branded portfolio includes Cequa, Winlevi, and Odomozo, among others.

Sun Pharma also operates a manufacturing plant in New Jersey through its subsidiary Ohm Laboratories, meaning the impact of U.S. policy moves is more direct compared to peers. This explains why Sun Pharma’s stock, though down just over 2% by closing, remains one of the most exposed to Trump’s tariff plan.

Sun Pharma Technical Outlook

Sun Pharma shares have been under pressure but are holding near key support zones, making the next few sessions critical.

- Immediate support: ₹1,557.35. If this level breaks, the slide could extend deeper toward ₹1,500.

- First resistance: ₹1,730.65. A close above here would signal buyers regaining control and could open a move higher.

- Major resistance: ₹1,845.85. This is the big ceiling to watch, clearing it would confirm a bullish breakout and potentially restart the uptrend.

In short, Sun Pharma remains range-bound between ₹1,557.35 and ₹1,730.65. Bulls need momentum above ₹1,730.65 to shift the bias back to the upside, while a drop below ₹1,557.35 would tilt the outlook bearish.

Dr Reddy’s Stock Falls Over 3% on U.S. Tariff Concerns

Dr Reddy’s Laboratories, one of India’s largest drug exporters, ended the session down more than 3% as investors weighed the fallout from Trump’s 100% tariff on branded medicines. While the company’s U.S. portfolio is still heavily tilted toward generics, it does market select branded and specialty drugs in the U.S., making it vulnerable to higher costs and tighter margins.

In FY25, the North American market contributed nearly 45% of Dr Reddy’s consolidated revenue, underscoring its heavy reliance on the U.S. for growth. Any squeeze on branded product sales or pricing pressure could dent earnings in the near term, keeping the stock under pressure until there is more clarity on policy execution.

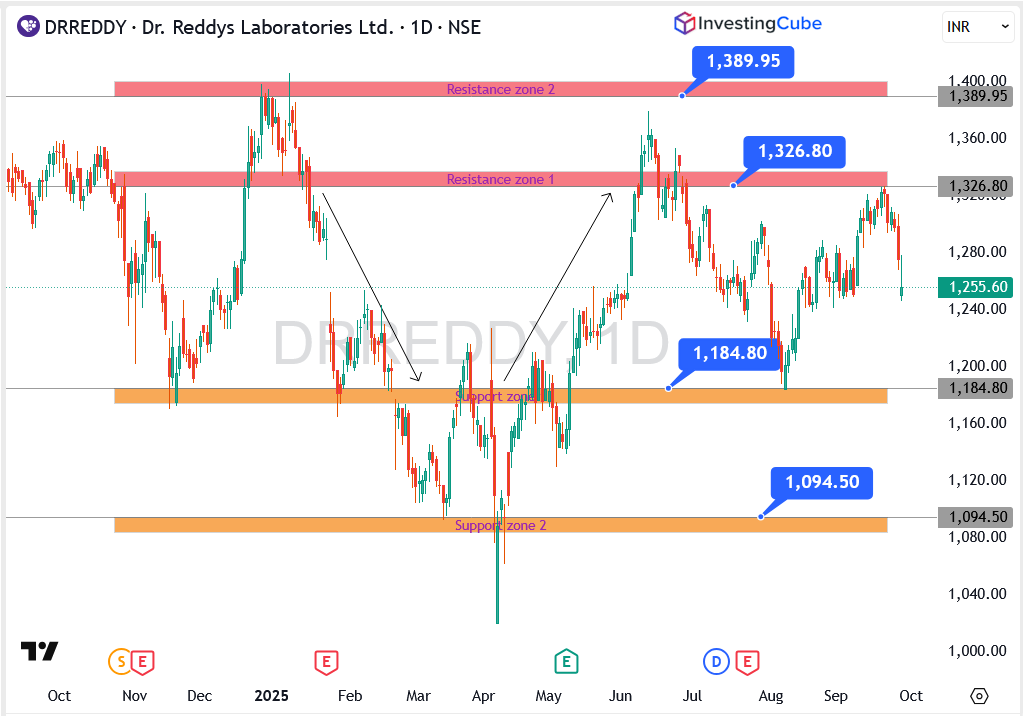

Dr. Reddy’s Laboratories Technical Outlook

Dr. Reddy’s stock is testing key levels after the tariff shock, and the chart shows a clear battle between buyers and sellers.

- Immediate support: ₹1,184.80. A failure to hold this zone could drag the stock lower toward ₹1,094.50.

- First resistance: ₹1,326.80. A breakout here would strengthen momentum and pave the way toward ₹1,389.95.

- Major support: ₹1,094.50. Losing this base would mark a bearish shift and expose further downside risk.

- Upper resistance: ₹1,389.95. This remains the bigger ceiling, a sustained move above could reset the bullish trend.

Overall, the structure is neutral-to-cautious. As long as price stays above ₹1,184.80, recovery attempts are valid, but the real breakout test sits at ₹1,326.80-₹1,389.95.

Will Trump’s 100% Tariff Trigger a Pharma Stock Reset?

The market’s reaction is sharp but not entirely irrational. Profitability in U.S. exports is now under question, and management commentaries over the coming weeks will be critical.

Restructuring production footprints could mitigate risk in the long term, but the near-term hit to earnings looks unavoidable. For investors, this isn’t necessarily a collapse, but a sector reset where only the most efficient players may thrive.

Indian Pharma Stocks FAQs

Indian pharma stocks are under pressure after the U.S. announced a 100% tariff on branded and patented drugs, sparking fears of reduced margins and weaker U.S. exports.

Sun Pharma may face a bigger hit since about 31% of its revenue comes from the U.S. and it sells branded drugs like Cequa and Winlevi. Dr. Reddy’s exposure is smaller, but both could see earnings pressure if tariffs remain.

No. The tariff applies only to branded and patented drugs. Most Indian pharma companies like Cipla, Lupin, and Aurobindo focus mainly on generics.

This article was originally published on InvestingCube.com. Republishing without permission is prohibited.