The crude oil price downward trend has continued in the past few days. Brent, the global benchmark, has crashed to the lowest level since October 1. It is trading at $78.60 while the West Texas Intermediate (WTI) is trading at $75.

New wave is a concern

The crude oil price has been under intense pressure lately as investors remain concerned about the rising number of Covid-19 cases in Europe and China.

In the past few days, many European countries like Austria and Netherlands have seen a surge in cases. Austria has gone ahead announced a lockdown and mandated every person to be vaccinated. In Germany, Angela Merkel has warned about the new wave of the pandemic.

At the same time, there are worries of the rising number of hospitalizations in the US among vaccinated people. In a statement last week, Anthony Fauci made the case for more people to receive their vaccine boosters. Therefore, there is a likelihood that the number of cases will keep rising.

Meanwhile, crude oil price has dropped as concerns about reserves has risen. The US, Japan, and China are actively considering releasing their strategic reserves in a bid to lower prices.

Still, there is a likelihood that the ongoing supply constraints will help to support oil prices. OPEC+ will be unlikely to listen to the United States and boost supply. Besides, it is the same US that asked the cartel to limit supplies during the Trump’s administration.

Crude oil price prediction

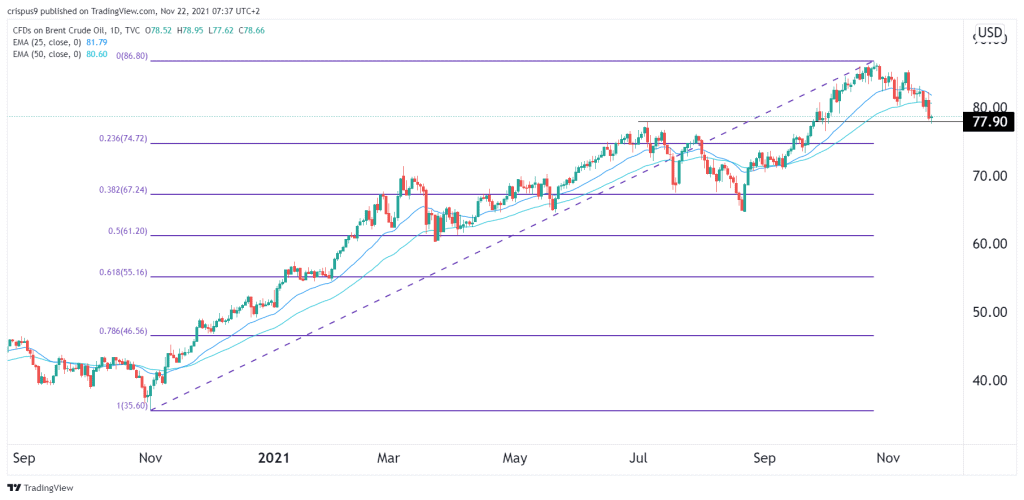

Turning to the daily chart, we see that the crude oil price has been under intense pressure in the past few weeks. This is a notable price action since the price is trading at $78.60, which was also the highest level in July this year. Therefore, this price action seems like a break and retest pattern.

The price is also above the 23.6% Fibonacci retracement level while it has moved below the 25-day and 50-day moving averages. It is also at the correction phase of the Elliot wave pattern. Therefore, there is a possibility that crude oil price will rebound above $80 in the coming days. If this fails to happen, the next key resistance level to watch will be at the 23.6% retracement level at $74.72.