New concerns that the US may be forced into freeing up some strategic reserves to reduce local energy derivatives prices are forcing crude oil prices lower for the 4th straight day. Brent crude oil is trading 0.94% lower this Monday.

There is also talk in the market that the Organization of Petroleum Exporting Countries (OPEC) is pumping more than the 400K barrels per day target that was set as the increased quota for November.

The US crude oil stocks data made available to the markets last week by the Energy Information Administration showed a considerable increase in the US strategic oil reserves. This excess crude could give the President Biden-led administration enough room to release some of it into the market to cool off domestic price pressures. Senate Majority leader Chuck Schumer has lent his support towards this policy direction, also calling for the US to wean itself off fossil fuels for good.

Crude Oil Price Outlook

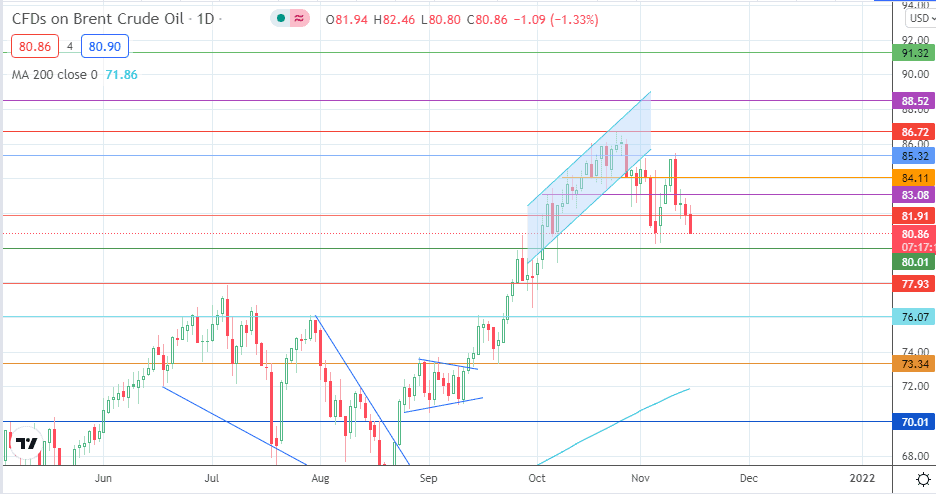

Monday’s drop has broken below the 81.91 price support and looks set to target the 80.00 psychological support level. If this pivot is taken out, a continuation of the correction towards the 77.93 price mark could be on the cards.

On the flip side, there is only room for a rebound if the bulls can defend the psychological support at 80.00. To re-establish the uptrend, this rebound would need to take out resistance barriers at 83.08 (5 October/5 November highs), 84.11 and 86.72. Resumption of the uptrend will also open the door towards new targets at 88.52 and potentially 91.32.

Brent Crude: Daily Chart

Follow Eno on Twitter.