Crude oil price on the Brent benchmark extended gains for the 2nd day in a row after Saudi Arabia executed a surprise cut in its crude oil output.

Crude oil prices hit the highest levels in eleven months, as Saudi Arabia implemented a voluntary production curb. The Brent crude benchmark climbed 5.46% on Tuesday and added 0.64% on Wednesday to send crude oil prices back into a bull run.

However, crude oil price is off intraday highs, as OPEC announced a rise in oil output in December 2020 by 280,000 barrels, following the inclusion of Libya’s restored supply and the increased supply from the UAE. Compliance with the OPEC + output cut stood at 99% in December, which was 3 points lower than the November compliance level.

The EIA Crude Oil Inventories report is due for release in less than an hour, but this could be overshadowed by the Saudi move, as well as the FOMC minutes to be released later in the day.

Technical Levels to Watch

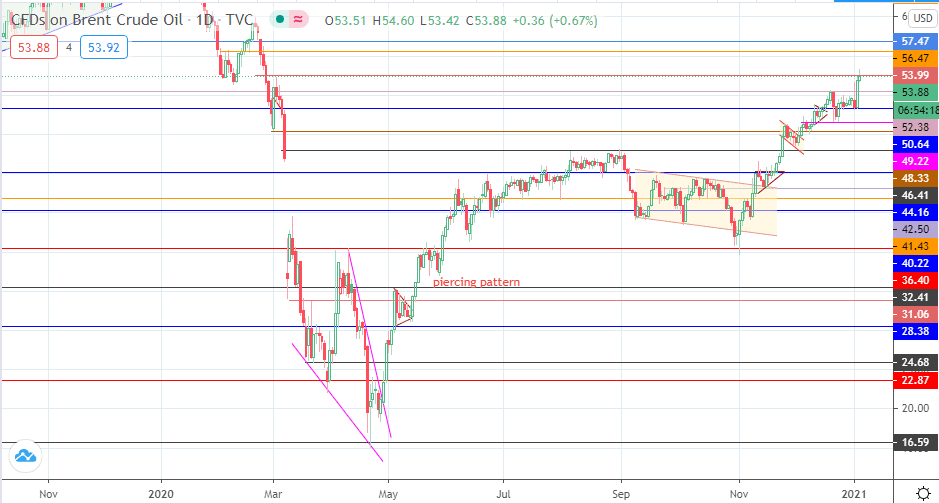

The ascent of crude oil price is still short of the 53.99 price mark set on 3 March 2020, and which constitutes the immediate resistance. This price level was violated intraday, but the intraday pullback has temporarily checked attempts at a breakout.

A break above this level is necessary for the price to push towards the 6 February 2020 highs at 56.47. 57.47 is also in the picture as a potential upside target.

On the flip side, failure to break the 53.99 resistance could prompt a pullback to the 52.38 support, with 50.64 and 49.22 lining up as additional targets to the south.

Don’t miss a beat! Follow us on Telegram and Twitter.

Brent Crude Oil Price; Daily Chart

More content

- Download our latest quarterly market outlook for our longer-term trade ideas.

- Follow Eno on Twitter.

- Do you enjoy reading our updates? Become a member today and access all restricted content. It is free to join.