A recent report by Coinbase indicates chainlink’s price is not matched by its recent growth in the total value secured (TVS). The report painted a picture of chainlink being heavily undervalued in the market, a disparity termed as an issue by David Duong, Coinbase’s head of institutional research.

According to the research, chainlink’s TVS has grown by more than 800 percent since early 2021. This seen the amount held as TVS grow from $7 billion in early 2021 to the current value of $58 billion. On the other hand, the chainlink price (LINK/USD) has only grown by about 30 percent to a market capitalization of $6.7 billion.

Duong pointed out some of the issues that will stunt the growth of the cryptocurrency if not addressed. These issues included market saturation that may limit the platform’s future growth prospects, potential dilution of LINK’s circulating supply, and an imbalance of dApp demand, node operator fees, and operating costs.

Chainlink Price Prediction

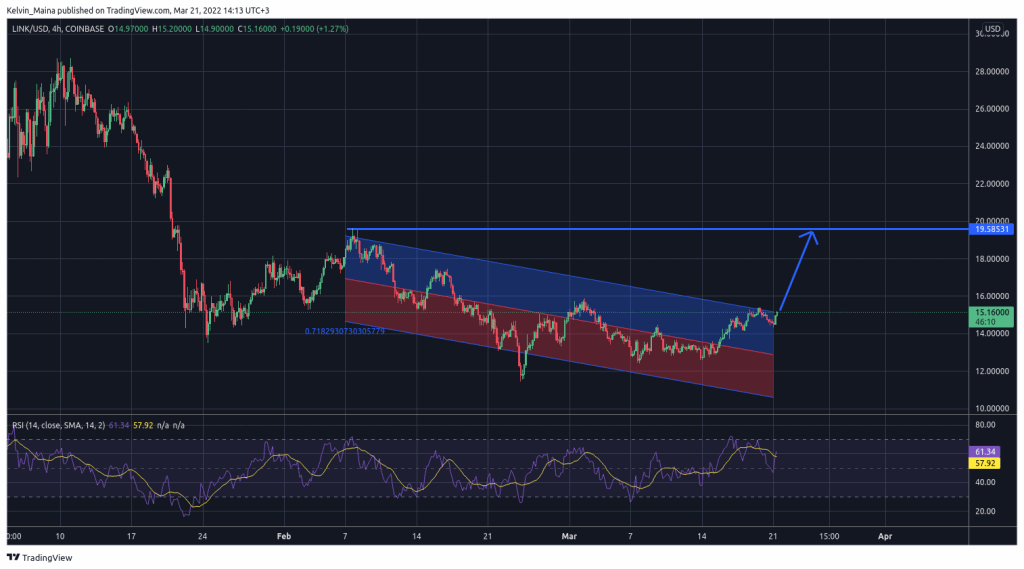

The report by Coinbase about the possibility that chainlink may be undervalued seems to be accurate, looking at its 4-hour chart. The prices have been trading within a descending channel since February 7. Just recently, the chainlink price has touched the channel’s upper trendline and has successfully broken to the upside. This means that there is a high likelihood that the current breakout is a trend reversal. If that is the case, my Chainlink price prediction is that it will be trading at the resistance level of $19 in the coming days.

The RSI indicator also shows signs that chainlink prices are likely to continue. It also confirms that the current bullish move may be a trend reversal. However, if the prices reverse and start trading within the descending channel, my trade analysis will be invalidated. It will also mean that the current breakout from the descending channel is fake and the prices are still on a long-term bearish move.

Chainlink 4-Hour Chart