The Beyond Meat share price has been making a slow recovery in the past few days as investors watch the progress of McPlant. The BYND stock is trading at $51.37, about 45% above the lowest level this year. It is still about 78% below its all-time high, while its total market cap has collapsed to about $3 billion. Other alternative meal stocks like Oatly have also tumbled in the past few months.

Is McPlant a bust?

A key catalyst for the Beyond Meat share price has been the recent launch of McPlant, a burger that is being sold in Mcdonald’s. While the stock initially rose after the launch, analysts say its performance has been a bit muted lately. A study of 600 locations by BTIG said that the burger sales were weaker than expected. The report added that the two companies would likely boost their messaging to boost their popularity.

And in a recent call, analysts at Piper Sandler warned that the upside for the product would be limited. The analyst said that there is a likelihood that McDonald’s will decide to take its production in-house after the 3-year contract ends. This will depend on what internal data shows about the burger’s performance. As a result, the firm will continue to incinerate cash in the near term.

Another risk for Beyond Meat is that the cost of doing business is rising as the prices of key commodities and fertilizer jump. A quick look at the company’s inputs shows that their prices have all risen. They include canola oil, potatoes, and sunflower, among others.

Meanwhile, it is still too early to tell whether the Beyond Meat Jerky will be a success. This is a product born out of the partnership between Beyond Meat and PepsiCo. The snack offers traditional beef jerky in original spicey flavours.

At the same time, analysts have been a bit bearish about the BYND stock price. In the past few months, those at Goldman Sachs, Bank of America, Piper Sandler, Cowen, BMO, and Cannacord have all slashed their estimate about the stock.

Beyond Meat share price forecast

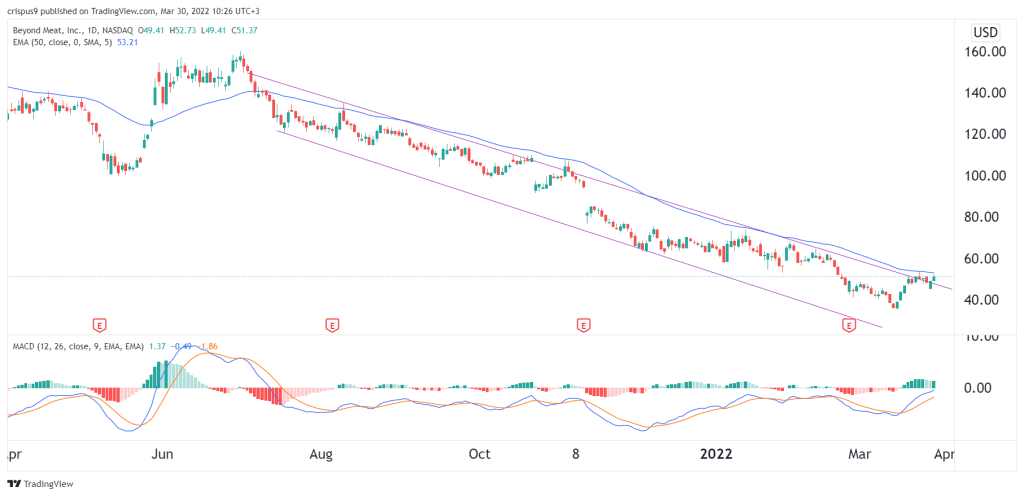

BYND stock price has not been left behind in the recent stock slide in the past few months. The shares formed a descending channel pattern that is shown in purple. This being a widening channel, it sent a sign that the stock will likely have a bullish breakout.

The stock is along the upper side of the channel, and it remains below the 25-day moving average. Therefore, there is a likelihood that the stock will resume the bearish trend in the near term as bears target the next support at around $40.