- The Barclays share price is trading higher and could top 160p as the bank invests in a crypto trading platform.

The Barclays share price is trading higher this Tuesday amid the company’s new crypto-related investment. As a result, Barclays finds itself in the top 10 gainers on the FTSE 100 index this Tuesday. The trigger for the upside move is the bank’s participation in a $70m funding round for a new cryptocurrency trading platform. The platform is owned by Elwood Technologies and founded by Alan Howard, a UK hedge fund billionaire.

Elwood Technologies is an established provider of portfolio management services for digital assets. Its product line is tailored for institutional investors. The Financial Times reports that the funding round is the first time Elwood Technologies will seek external financing for its projects. The funding round has raised the company’s valuation to $500m. Other investors include Commerzbank, Goldman Sachs and Galaxy Digital.

The investment by Barclays bank extends its foray into the world of digital assets. This move is coming as the company seeks to emerge from a chaotic period. It suspended market-making in its US divisions over a clerical error that led to steep losses in its bond trading desks. It is also planning to refile statements in the US by month-end in preparation for the much-anticipated $1.2billion share buy-back program.

The recovery in the Barclays share price would make it three days in a row that the stock is closing on the upside if Tuesday’s 2.79% spike is maintained.

Barclays Share Price Outlook

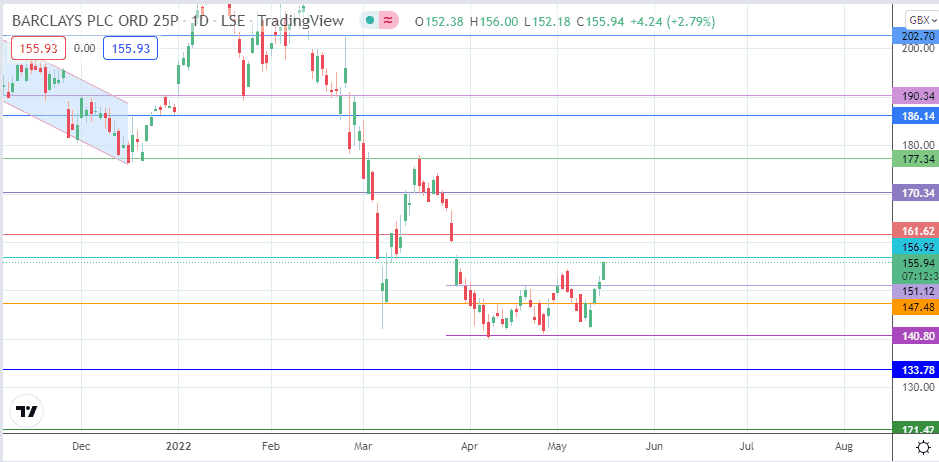

Tuesday’s uptick sends the price action clear of the support at 151.12 and puts the stock on course to challenge the resistance at 156.92. If this resistance is broken, the 9 March high at 161.62 becomes the next natural target for the bulls. Likewise, 170.34 (14/24 March highs) and 177.34 (17 March high) automatically become new harvest points for the bulls if the advance transcends the barrier at 161.62.

On the other hand, rejection at 156.92 stalls the advance, with a pullback also creating an opportunity for a retest of 151.12 as a new support. If the bulls fail to defend this support, 147.48 becomes an additional target to the south (8 March and 13 May lows). Likewise, 140.80 (7 April low) and 133.78 (2 December 2020 low) will form additional southbound targets if the bottom falls out from below the bulls defending 147.48.

Barclays: Daily Chart